Answered step by step

Verified Expert Solution

Question

1 Approved Answer

write in word pls 5. Mr. Jabir and Mr. Shanavas are in partnership, sharing profit and losses in the ratio 3:2. The following Trial Balance

write in word pls

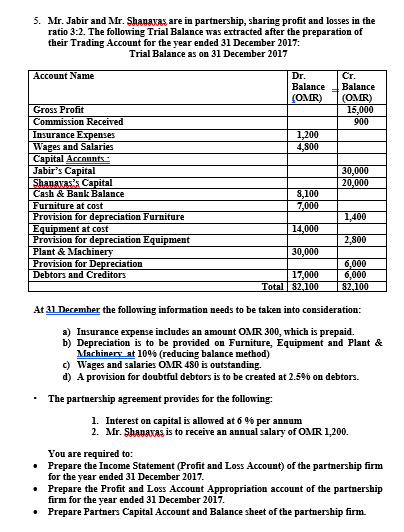

5. Mr. Jabir and Mr. Shanavas are in partnership, sharing profit and losses in the ratio 3:2. The following Trial Balance was extracted after the preparation of their Trading Account for the year ended 31 December 2017: Trial Balance as on 31 December 2017 Account Name Dr. Balance (OMIR) Cr. Balance (OMR) 15,000 900 1,200 4,800 30,000 20,000 Gross Profit Commission Received Insurance Expenses Wages and Salaries Capital Accounts Jabir's Capital Shanaxas's Capital Cash & Bank Balance Furniture at cost Provision for depreciation Furniture Equipment at cost Provision for depreciation Equipment Plant & Machinery Provision for Depreciation Debtors and Creditors 8,100 7,000 1,400 14,000 2,800 30,000 17,000 Total 82,100 6.000 6,000 82,100 At 31 December the following information needs to be taken into consideration: a) Insurance expense includes an amount OMR 300, which is prepaid. b) Depreciation is to be provided on Furniture, Equipment and Plant & Machinery at 10% (reducing balance method) c) Wages and salaries OMR 480 is outstanding. d) A provision for doubtful debtors is to be created at 2.5% on debtors. The partnership agreement provides for the following: 1. Interest on capital is allowed at 6 % per annum 2. Mr. Shanavas is to receive an annual salary of OMR 1,200. You are required to: Prepare the Income Statement (Profit and Loss Account) of the partnership firm for the year ended 31 December 2017. Prepare the Profit and Loss Account Appropriation account of the partnership firm for the year ended 31 December 2017. Prepare Partners Capital Account and Balance sheet of the partnership firm Dr. Cr. Account Tile Account Tile Particulars Profit & Loss Account For the year ended 31 December 2017 Amount (OMR) Amount (OMR) Amount (OMR) Amount (OMR) Dr. Cr. Profit & Loss Appropriation Account For the year ended 31 December 2017 Amount Particulars (OMR) Particulars Amount (OMR)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started