Answered step by step

Verified Expert Solution

Question

1 Approved Answer

write three paragraphs analyzing this companys balance sheet and income statement. please include from the balance sheet * working capital amount *common size balance sheet

write three paragraphs analyzing this companys balance sheet and income statement.

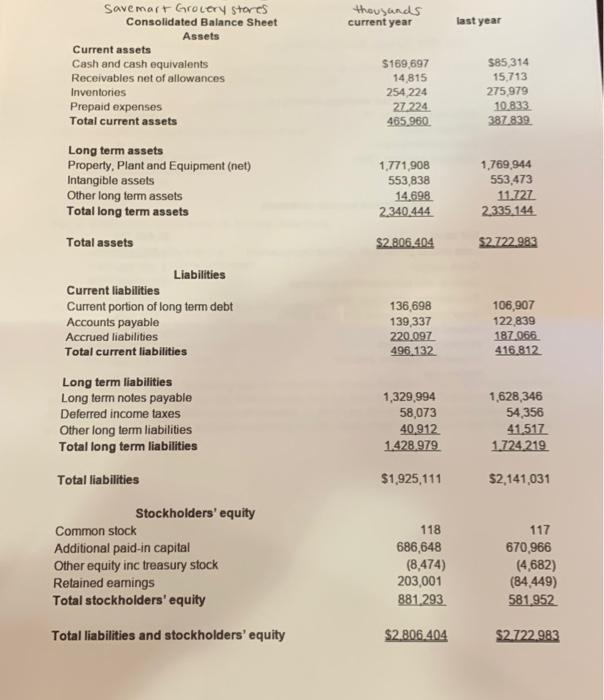

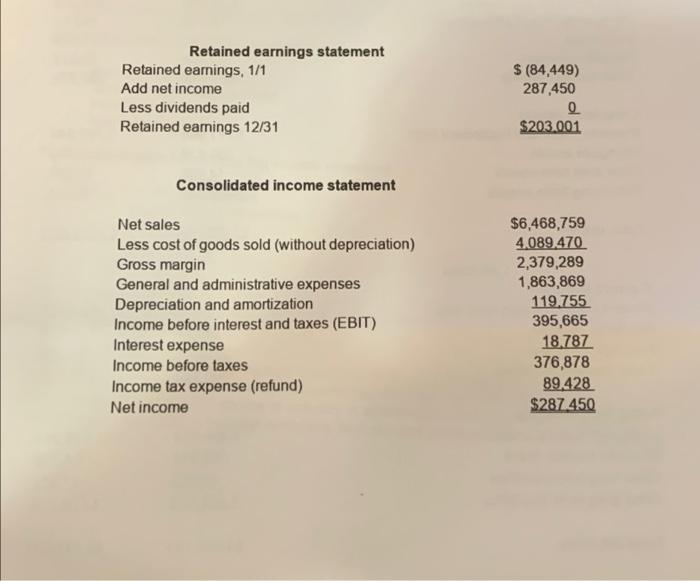

thousands current year last year Savemart Grocery stores Consolidated Balance Sheet Assets Current assets Cash and cash equivalents Receivables net of allowances Inventories Prepaid expenses Total current assets $169 697 14815 254 224 27.224 465.960 585 314 15713 275979 10.833 387 839 Long term assets Property, Plant and Equipment (net) Intangible assets Other long term assets Total long term assets Total assets 1.771,908 553,838 14.698 2.340.444 1,769,944 553,473 11.727 2.335.144 $2.806.404 $2.722.983 136,698 139,337 220.097 496.132 106,907 122,839 187,066 416.812 Liabilities Current liabilities Current portion of long term debt Accounts payable Accrued liabilities Total current liabilities Long term liabilities Long term notes payable Deferred income taxes Other long term liabilities Total long term liabilities 1,329,994 58,073 40.912 1428.979 1,628,346 54,356 41.517 1.724.219 $1,925,111 $2,141,031 Total liabilities Stockholders' equity Common stock Additional paid-in capital Other equity inc treasury stock Retained earnings Total stockholders' equity 118 686,648 (8,474) 203,001 881.293 117 670,966 (4,682) (84.449) 581.952 Total liabilities and stockholders' equity $2.806.404 $2.722.983 Retained earnings statement Retained earnings, 1/1 Add net income Less dividends paid Retained earnings 12/31 $ (84,449) 287.450 0 $203.001 Consolidated income statement Net sales Less cost of goods sold (without depreciation) Gross margin General and administrative expenses Depreciation and amortization Income before interest and taxes (EBIT) Interest expense Income before taxes Income tax expense (refund) Net income $6,468,759 4.089.470 2,379,289 1,863,869 119.755 395,665 18.787 376,878 89.428 $287.450 please include from the balance sheet

* working capital amount

*common size balance sheet

*liquity matrix

*leverage matrix

from the income statement

*additional liquity matrix

*common size income statement

*profitability metrics

both

*cash flow identity

*additional profibility metrics

*asset utilization metrics

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started