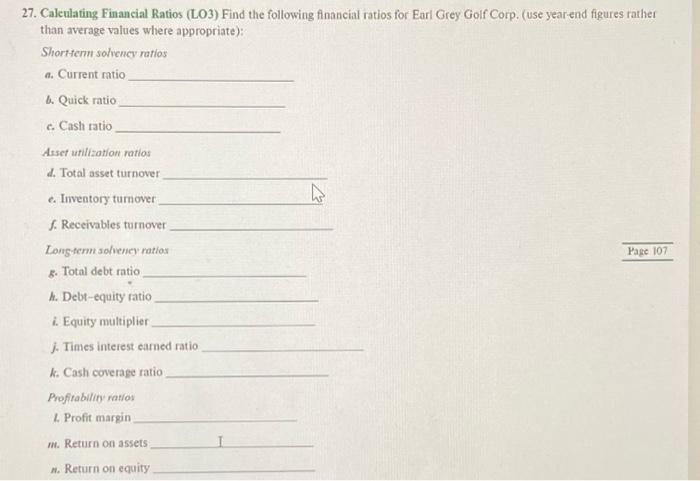

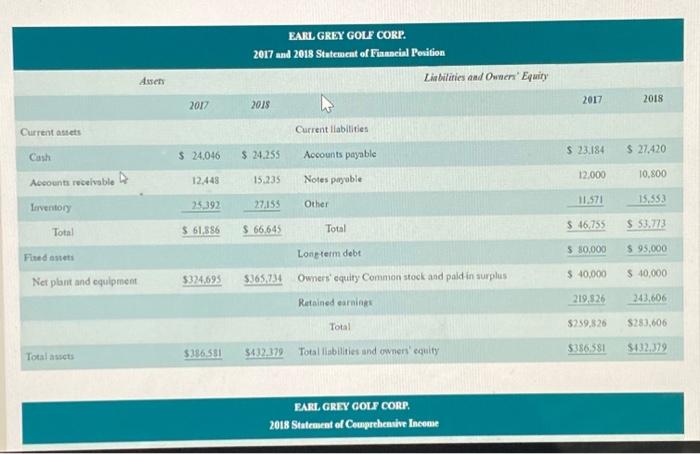

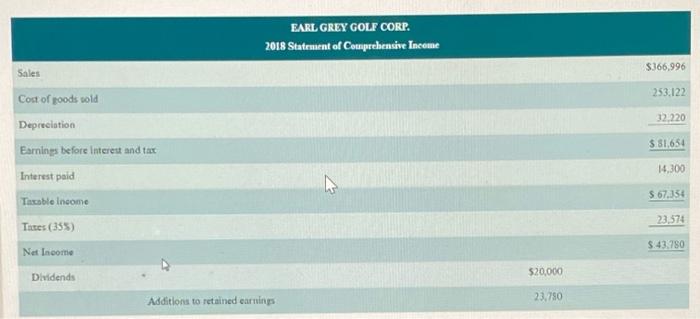

ws 27. Calculating Financial Ratios (L03) Find the following financial ratios for Earl Grey Golf Corp. (use year-end figures rather than average values where appropriate): Short-term solvency ratios a. Current ratio & Quick ratio c. Cash ratio Asset utilization ratios 2. Total asset turnover e Inventory tumover S. Receivables turnover Longterm solveney ratios Page 107 3. Total debt ratio A. Debt-equity ratio i. Equity multiplier J. Times interest earned ratio k. Cash coverage ratio Profitability ratios L. Profit margin IN. Return on assets 1. Return on equity EARL GREY GOLF CORP. 2017 and 2018 Statement of Financial Position Assens Liabilities and Owner' Equity 2017 2018 2017 2015 Current assets Current liabilities $ 23.184 Cash $ 24.046 $ 24.253 Accounts payable $ 27,420 12.000 Accounts receivable D 15,235 10.800 12.448 Notes payable 25392 11.571 Inventory 15,553 27.153 Other $ 53.773 Total $ 61,886 $ 66,645 $ 46.755 Total $ 80,000 $ 95,000 Fised on $10.000 $ 40,000 Net plant and equipment $324,695 $365,734 Longterm debt Owners' equity Common stock and paid in surplus Retained earning Total 219.526 243.606 $259,826 $283.606 $186.511 3432.379 Total acts Total liabilities and owners equity $386.581 $132.379 BARI, GREY GOLF CORP. 2018 Statement of Comprehensive Income EARL GREY GOLF CORP. 2018 Statement of Comprehensive Income $366,996 Sales 253.122 32.220 Cost of goods sold Depreciation Earnings before interest and tax Interest paid $ 81,654 14.300 $ 67,354 Tascable Income 23.574 Tises (355) $.43.750 Net Income Didends $20,000 Additions to retained earnings 23.750 ws 27. Calculating Financial Ratios (L03) Find the following financial ratios for Earl Grey Golf Corp. (use year-end figures rather than average values where appropriate): Short-term solvency ratios a. Current ratio & Quick ratio c. Cash ratio Asset utilization ratios 2. Total asset turnover e Inventory tumover S. Receivables turnover Longterm solveney ratios Page 107 3. Total debt ratio A. Debt-equity ratio i. Equity multiplier J. Times interest earned ratio k. Cash coverage ratio Profitability ratios L. Profit margin IN. Return on assets 1. Return on equity EARL GREY GOLF CORP. 2017 and 2018 Statement of Financial Position Assens Liabilities and Owner' Equity 2017 2018 2017 2015 Current assets Current liabilities $ 23.184 Cash $ 24.046 $ 24.253 Accounts payable $ 27,420 12.000 Accounts receivable D 15,235 10.800 12.448 Notes payable 25392 11.571 Inventory 15,553 27.153 Other $ 53.773 Total $ 61,886 $ 66,645 $ 46.755 Total $ 80,000 $ 95,000 Fised on $10.000 $ 40,000 Net plant and equipment $324,695 $365,734 Longterm debt Owners' equity Common stock and paid in surplus Retained earning Total 219.526 243.606 $259,826 $283.606 $186.511 3432.379 Total acts Total liabilities and owners equity $386.581 $132.379 BARI, GREY GOLF CORP. 2018 Statement of Comprehensive Income EARL GREY GOLF CORP. 2018 Statement of Comprehensive Income $366,996 Sales 253.122 32.220 Cost of goods sold Depreciation Earnings before interest and tax Interest paid $ 81,654 14.300 $ 67,354 Tascable Income 23.574 Tises (355) $.43.750 Net Income Didends $20,000 Additions to retained earnings 23.750