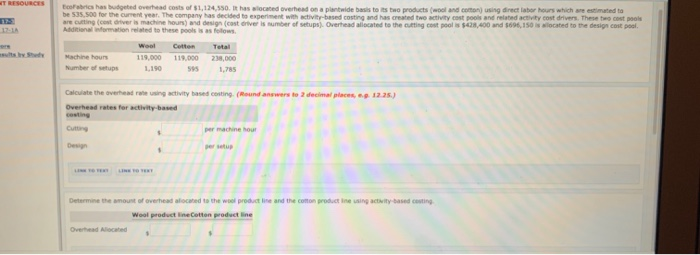

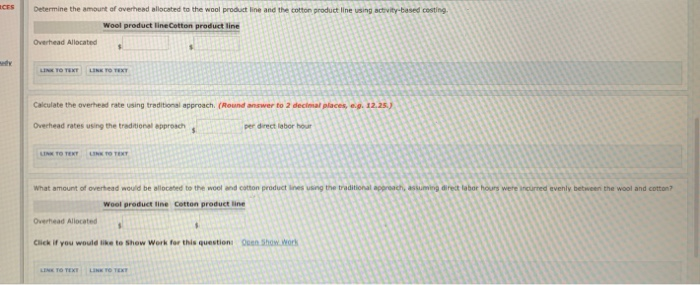

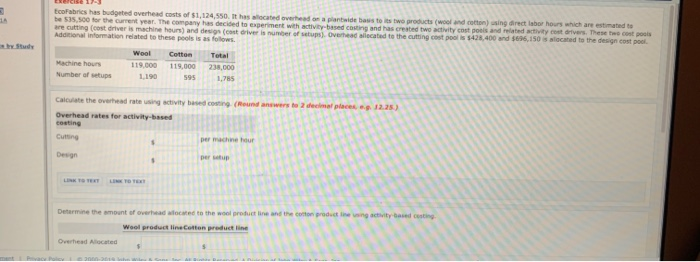

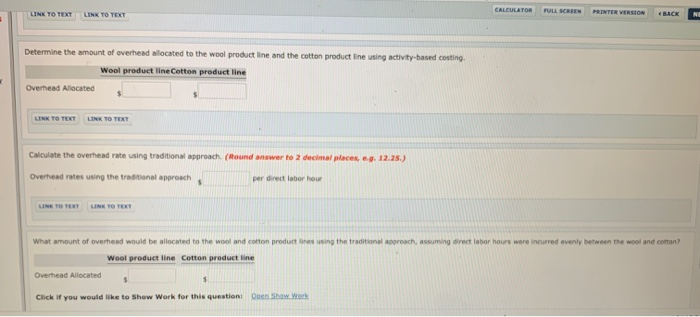

WT RESOURCES Boobs has buted overhead costs of $1,124,550. It has located overed on a plantwide as to two products (wool and co u sing director hours which are estimated to be 53.500 for the current year. The company has decided to experiment with activity based costing and has created two activity cost pool and related activity cost drivers. These two cost pool are cutting cost atveris machine hours) and design (cost over is umber of setups Overhead allocated to the cutting cost pool 2.400 and $696,150 N ocated to the design cost pool Additional wormation related to these pool is as follows Cotton Total Machine hours 119.000 119.000 230,000 Number of ups 1.190 1,785 Calculate the averadreingivity based costing (Round answers Overhead rates for activity based Determine the amount of overhead alocated to the wool product line and the cotton product line using activity-based costing Wool product line Cotton product line Overhead Alocated Determine the amount of overhead allocated to the wool product line and the cotton product line using activity-based costing Wool product lineCotton product line Overhead Allocated LINK TO TEXT LINK TO TEXT Calculate the overhead rate using traditional approach. (Round answer to 2 decimal places, e.g. 12.25 Overhead rates using the traditional approach p er direct labor hour LINK TO TENT LINK TO TEXT What amount of overhead would be allocated to the wool and cotton product lines using the traditional approach, assuming direct labor hours were incurred evenly between the wool and cotton Wool product line cotton product line Overhead Allocated Click if you would like to show Work for this question On Show work LINE TO TEXT LINK TO TEXT toofabrics has budgeted overhead costs of $1,124,550. It has allocated overhead abide bastow e products (wool and cotton) sing direct sbor hours which are estimated to be 55.500 for the current year. The company has decided to experiment with activity-based costing and has created two activity costs and related activity co ver. These controls are cutting (cost driver is machine hours) and design cost driver is number of sep Overhead located to the cutting cost pool 1428.400 and $636,150 cated to the design cost pool Additional information related to these pools is as follows. Machine hours Number of setups Wool 119.000 1190 Cotton 119.000 238.000 Calculate the overhead rating activity based cost Overhead rates for activity-based Determine the amount of overhead cate Wool product line cotton product line Overhead Acated CALCULATOR LINK TO TEXT LINK TO TEXT FULL SCREEN PRINTER VERSION BAC Determine the amount of overhead allocated to the wool product line and the cotton product line using activity-based costing Wool product line Cotton product line Overhead Allocated LINK TO TEXT LINK TO TEXT Calculate the overhead rate using traditional approach (Round answer to 2 decimal places, e.g. 12.25.) Overhead rates using the traditional approach per direct labor how LINK TO TEXT LINK TO TEXT using the traditional proach, assuming direct labor hours were incurred evenly between the wool and cotton? What amount of overhead would be allocated to the wool and cotton products Wool product line Cotton product line Overhead Allocated Click if you would like to Show Work for this questioni Oren Saw York