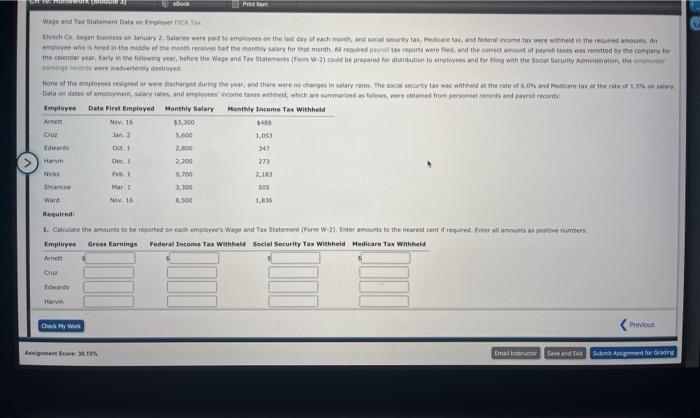

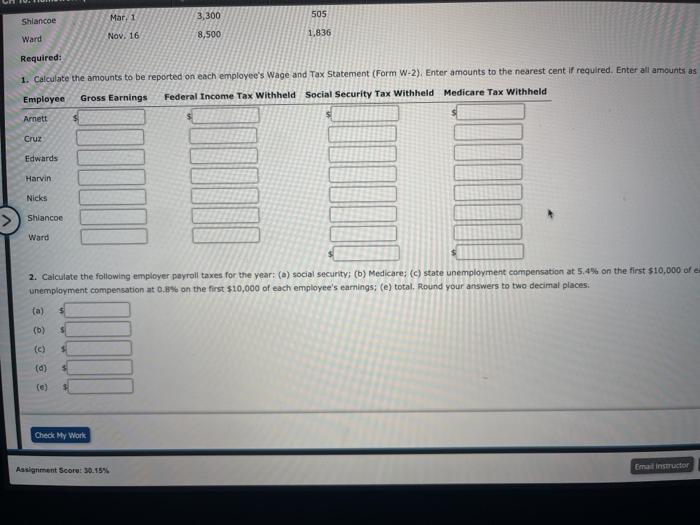

Www Wage and Tax Statement Data per PC Dich began business on a reputo mees on the day of each montowan, Mencetar, and feet income tax were wheld in the red amount An whished in the middle of the month recent the many stary for the month Alor tax reports were fled, and the correct to prove was rented by the company for the calendar year. El the flowing you, before the Wage and Tax Statements rom 3 could be prepared for dation to employees and for ting with the social security Administration, the ts were invertently destroyed Hone of the employees resigned or were discharged during the year, and there are no change in story rates. The social security tax was with red at the rate 6.0 and scare au at the rate of Dotaron dates of moment, yes, and employees income taxes with which we summas were obtained from personnel records and record Employee Date First Employed Monthly salary Monthly Income Tax withheld Nov. 16 53,300 One Jan 2 5.600 1.05 Edwards Det 2.800 347 Harvin Dec 2,200 273 F1 3.700 2,183 Shane Mart 3,300 505 Ward Nov. 16 1.500 1.806 Required 1. Calculate the amounts to be reported on each employee's Wage and Tax Statement For W-2). Enter amounts to the nearest cent if required. Erreram as positive me Employee Gross Earnings Federal Income Tax Withheld Social Security Tax Withheld Medicare Tax Withheld Arne Cruz ws Farve Ciad My Work Previous Asseco 11% Email Save and submit me for Grade 3,300 505 Shiancoe Mar. 1 Ward 1,836 8,500 Nov. 16 Required: 1. Calculate the amounts to be reported on each employee's Wage and Tax Statement (Form W-2) Enter amounts to the nearest cent if required. Enter all amounts as Employee Gross Earnings Federal Income Tax Withheld Social Security Tax Withheld Medicare Tax Withheld Arnett Cruz Edwards Harvin Nicks Shiancoe Ward 2. Calculate the following employer payroll taxes for the year: (a) social security; (b) Medicare; (c) state unemployment compensation at 5.4% on the first $10,000 ofe unemployment compensation at 0.8% on the first $10,000 of each employee's earnings: (e) total. Round your answers to two decimal places. (a) (b) $ (c) (0) (e) Check My Work Assignment Score: 30.15% Email Instructor