Answered step by step

Verified Expert Solution

Question

1 Approved Answer

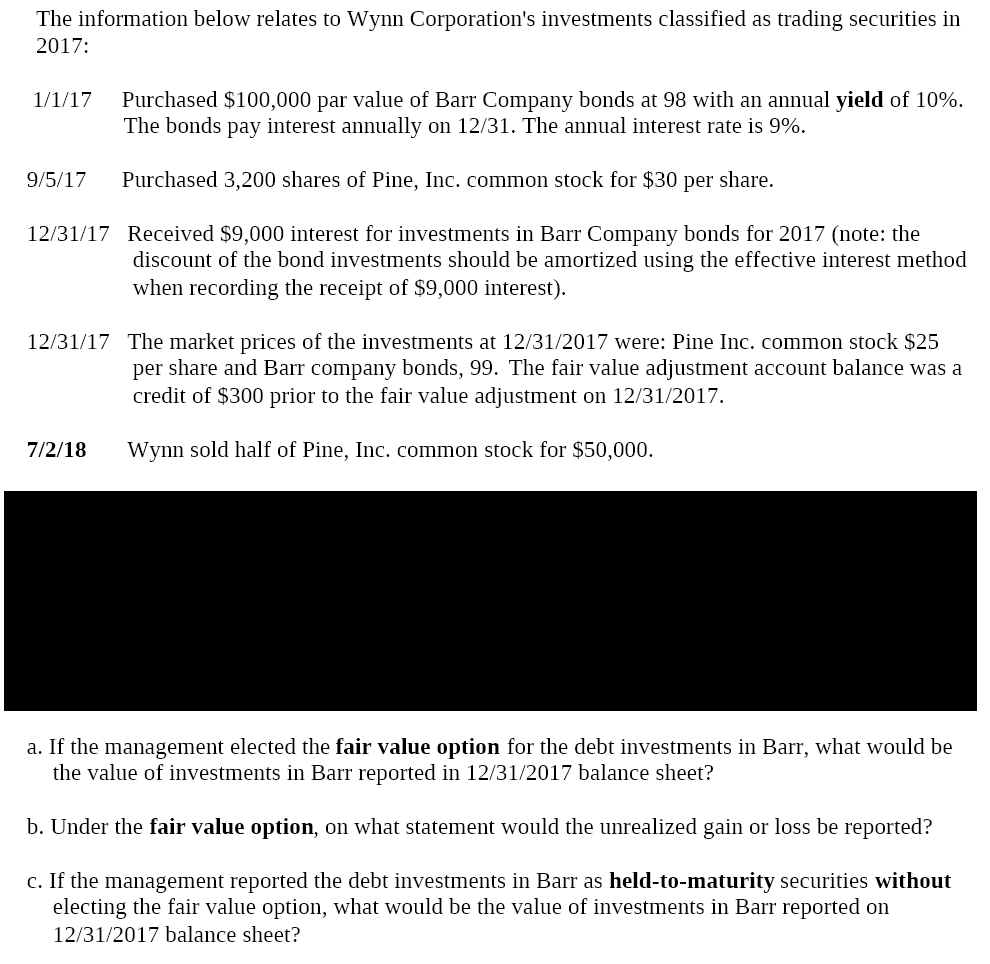

Wynn Corporation purchased a $ 1 0 0 , 0 0 0 par value of Barr Company bonds at 9 8 with an annual yield

Wynn Corporation purchased a $ par value of Barr Company bonds at with an annual yield of on The bonds pay interest annually on and the stated annual interest rate is Wynn classified the investments in bonds as trading securities Wynn received $ interest for investments in Barr Company bonds for on note: the discount of the bond investments should be amortized using the effective interest method when recording the receipt of $ interest on The market price of Barr company bonds was

on The fair value adjustment account balance was a debit of $ before the fair value adjustment on

Required:

a Fill in the following discount amortization table and prepare journal entries for the transactions that occurred in ie The acquisition of bonds on and the receipt of interest on

Date

Cash dr Int. Rev. cr Dis. Amor. dr Debt Investments Make the appropriate entry to apply the fair market valuation rule for the debt investments in Barr Company's

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started