Answered step by step

Verified Expert Solution

Question

1 Approved Answer

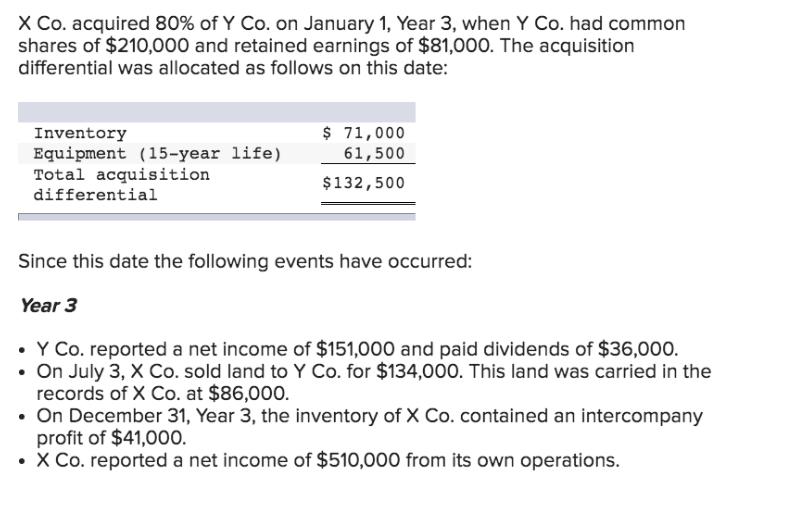

X Co. acquired 80% of Y Co. on January 1, Year 3, when Y Co. had common shares of $210,000 and retained earnings of

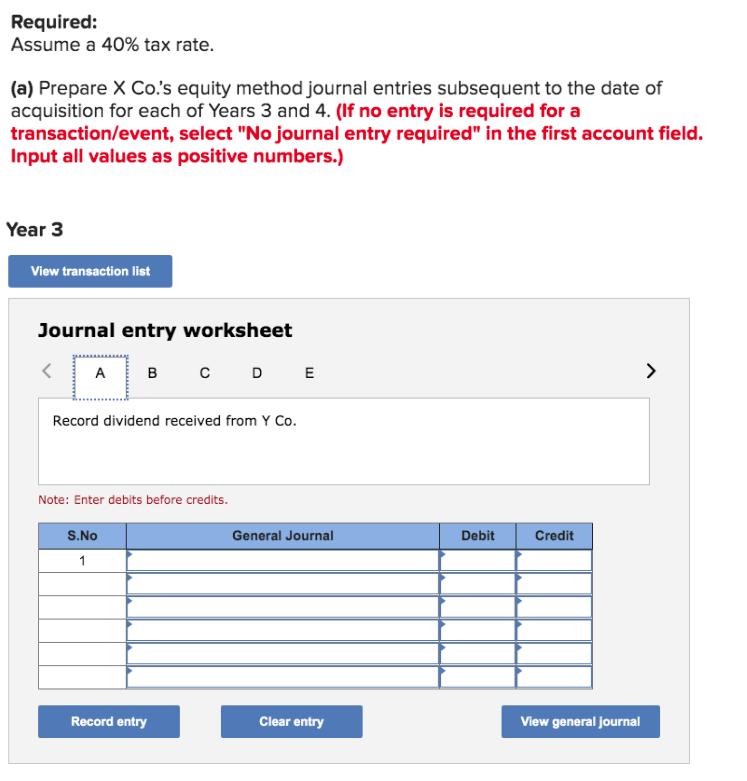

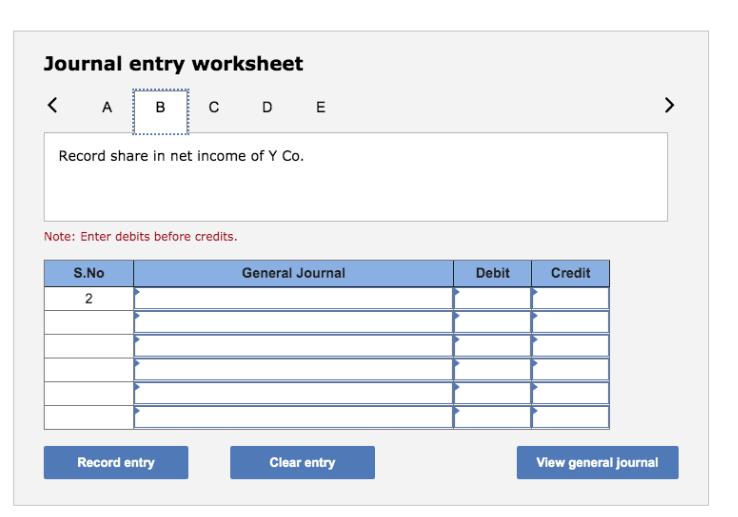

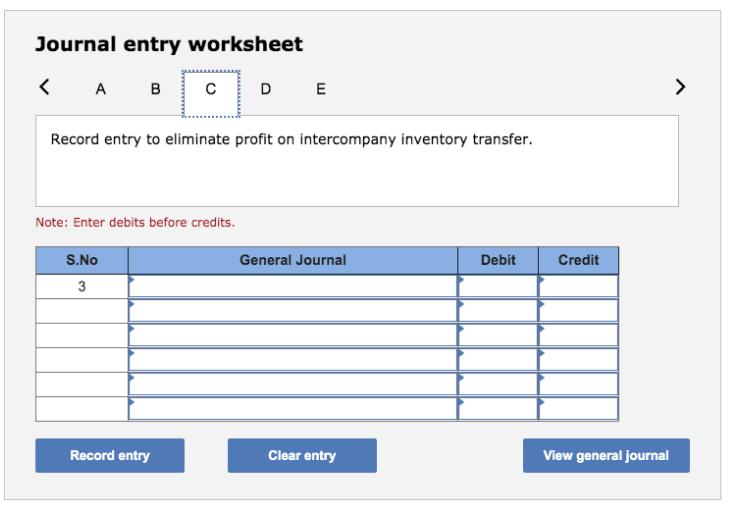

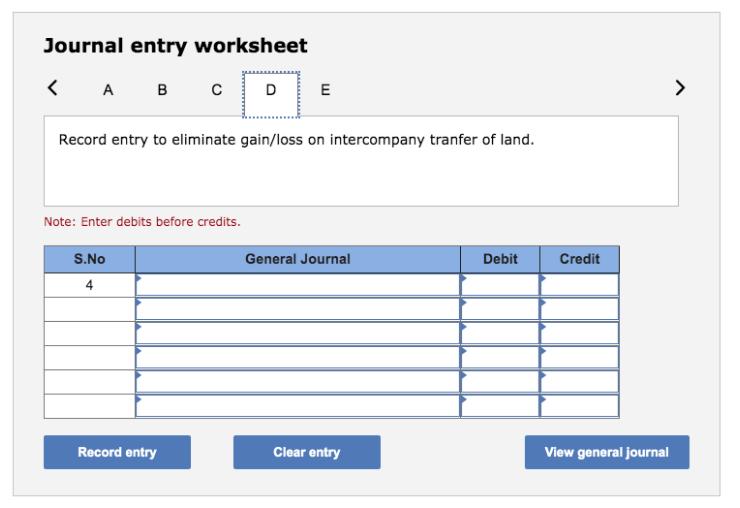

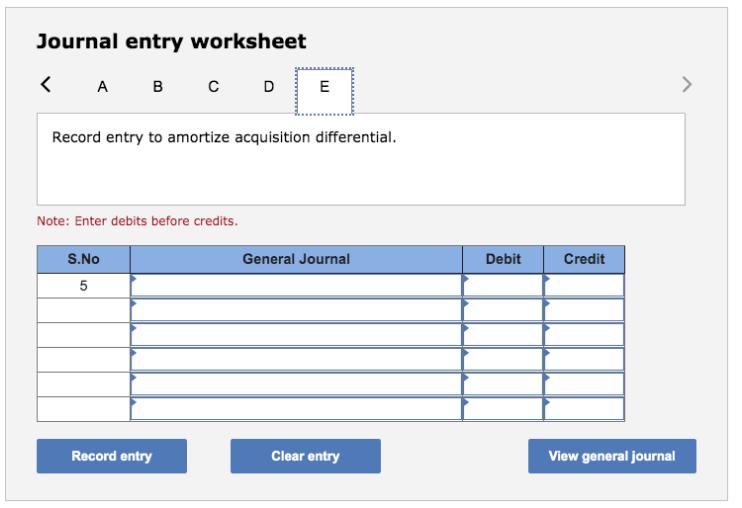

X Co. acquired 80% of Y Co. on January 1, Year 3, when Y Co. had common shares of $210,000 and retained earnings of $81,000. The acquisition differential was allocated as follows on this date: Inventory Equipment (15-year life) Total acquisition differential $ 71,000 61,500 $132,500 Since this date the following events have occurred: Year 3 Y Co. reported a net income of $151,000 and paid dividends of $36,000. On July 3, X Co. sold land to Y Co. for $134,000. This land was carried in the records of X Co. at $86,000. On December 31, Year 3, the inventory of X Co. contained an intercompany profit of $41,000. X Co. reported a net income of $510,000 from its own operations. Required: Assume a 40% tax rate. (a) Prepare X Co.'s equity method journal entries subsequent to the date of acquisition for each of Years 3 and 4. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Input all values as positive numbers.) Year 3 View transaction list Journal entry worksheet A B S.No 1 Record dividend received from Y Co. Note: Enter debits before credits. Record entry DE General Journal Clear entry Debit Credit View general journal > Journal entry worksheet < A B S.No 2 C Record share in net income of Y Co. Note: Enter debits before credits. Record entry DE General Journal Clear entry Debit Credit View general journal > Journal entry worksheet A B < Note: Enter debits before credits. S.No 3 Record entry to eliminate profit on intercompany inventory transfer. Record entry D E General Journal Clear entry Debit Credit View general journal > Journal entry worksheet Journal entry worksheet

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Computation of Net Income Xs Net Income Dividends Received 36000 x 80 Separate Income of Parent Ys N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started