Answered step by step

Verified Expert Solution

Question

1 Approved Answer

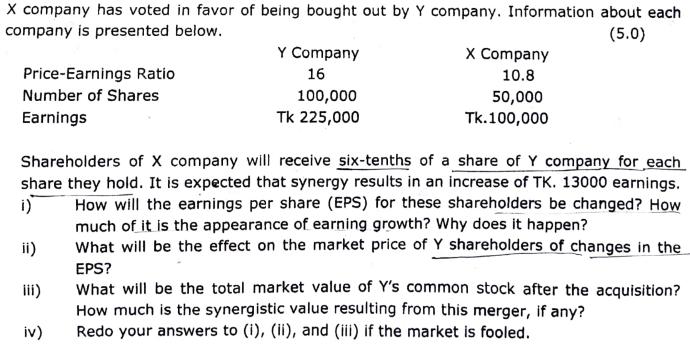

X company has voted in favor of being bought out by Y company. Information about each company is presented below. (5.0) Price-Earnings Ratio Number

X company has voted in favor of being bought out by Y company. Information about each company is presented below. (5.0) Price-Earnings Ratio Number of Shares Earnings Y Company 16 100,000 TK 225,000 X Company 10.8 50,000 Tk. 100,000 Shareholders of X company will receive six-tenths of a share of Y company for each share they hold. It is expected that synergy results in an increase of TK. 13000 earnings. How will the earnings per share (EPS) for these shareholders be changed? How much of it is the appearance of earning growth? Why does it happen? i) ii) What will be the effect on the market price of Y shareholders of changes in the EPS? iii) What will be the total market value of Y's common stock after the acquisition? How much is the synergistic value resulting from this merger, if any? Redo your answers to (i), (ii), and (iii) if the market is fooled. iv)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below i How will the earnings per share EPS for these shareholders be changed To calculate the EPS for the shareholders of X company after the ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started