Answered step by step

Verified Expert Solution

Question

1 Approved Answer

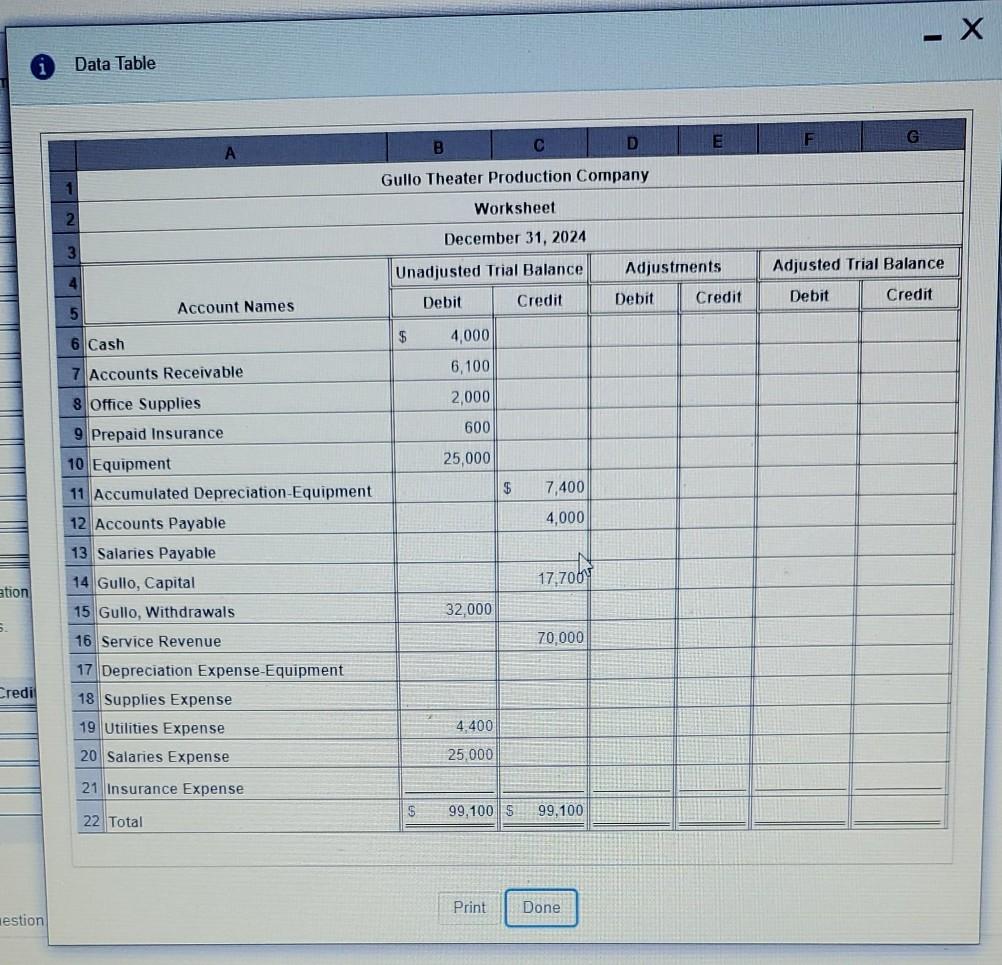

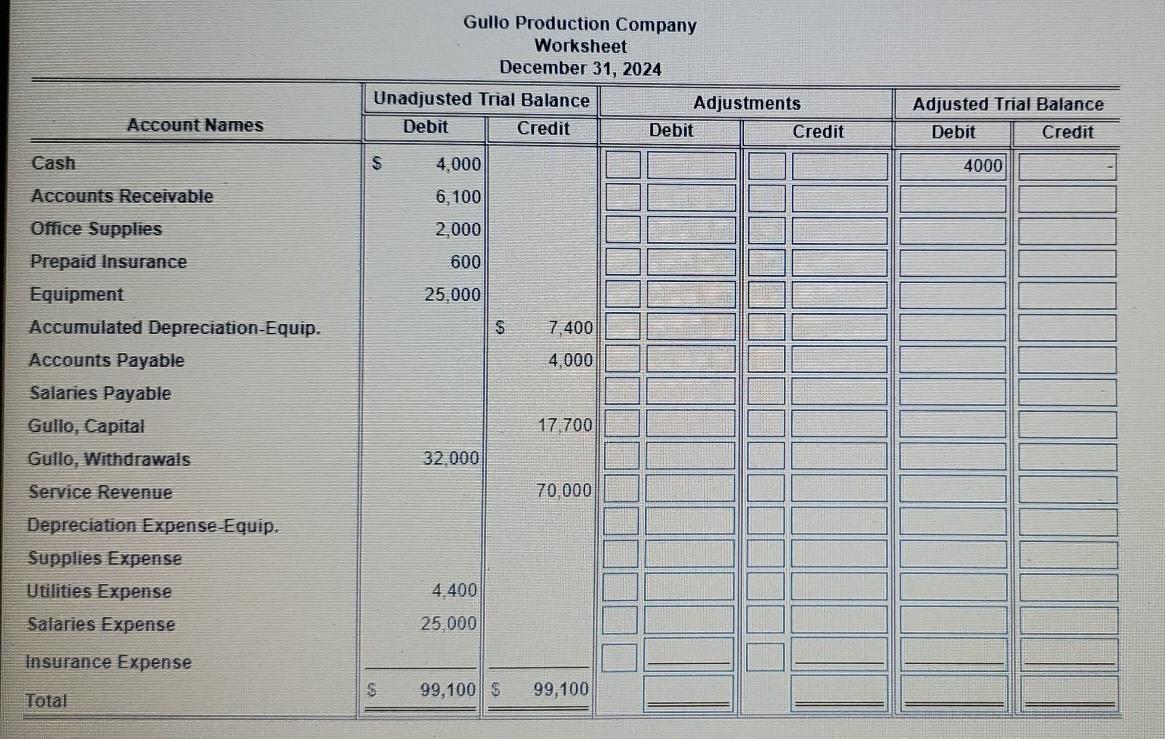

-X Data Table D E F A Gullo Theater Production Company Worksheet 2. December 31, 2024 3 Unadjusted Trial Balance 4 Adjustments Debit Credit Adjusted

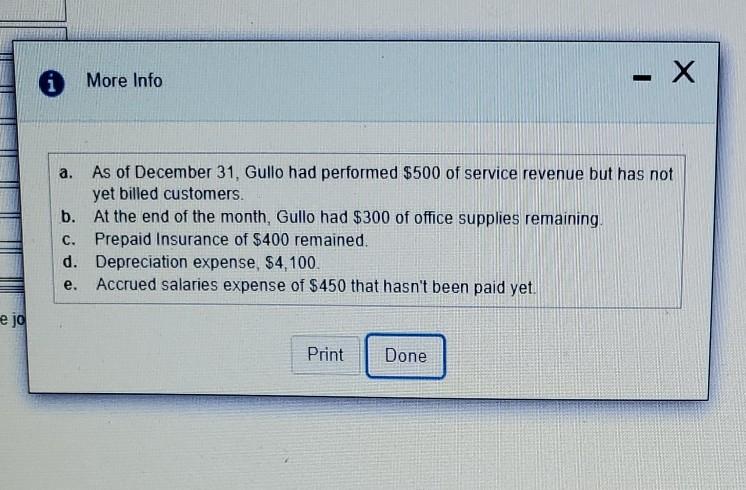

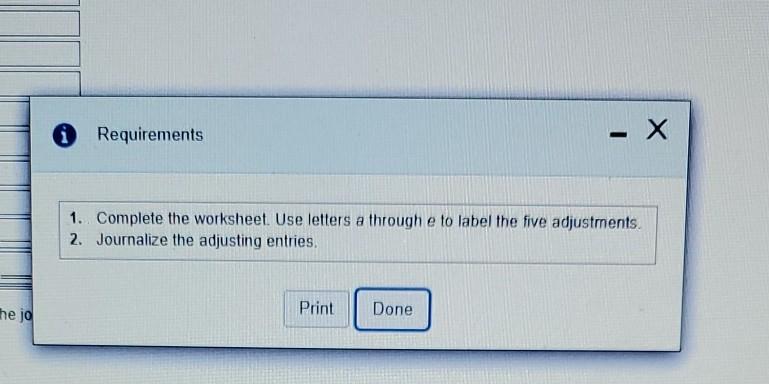

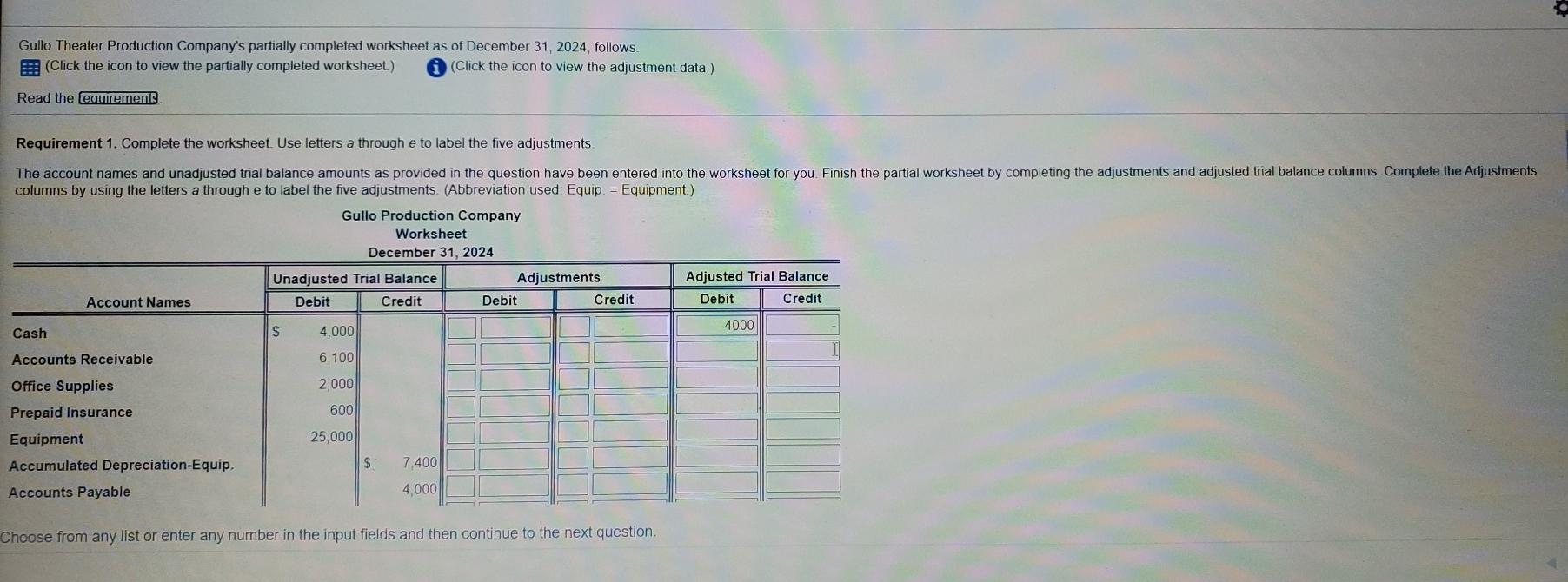

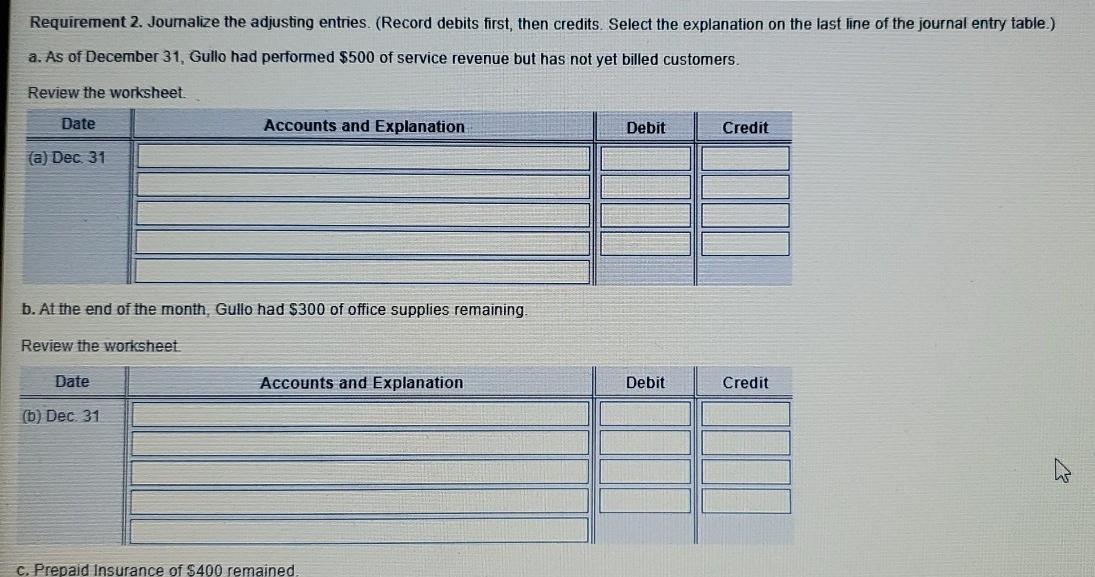

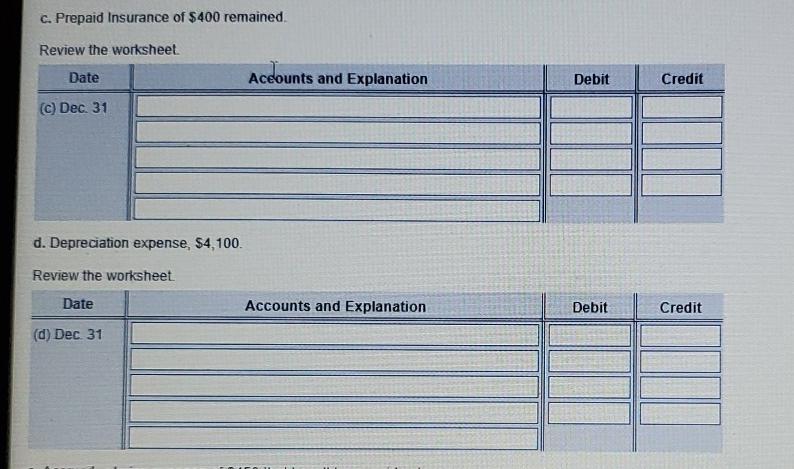

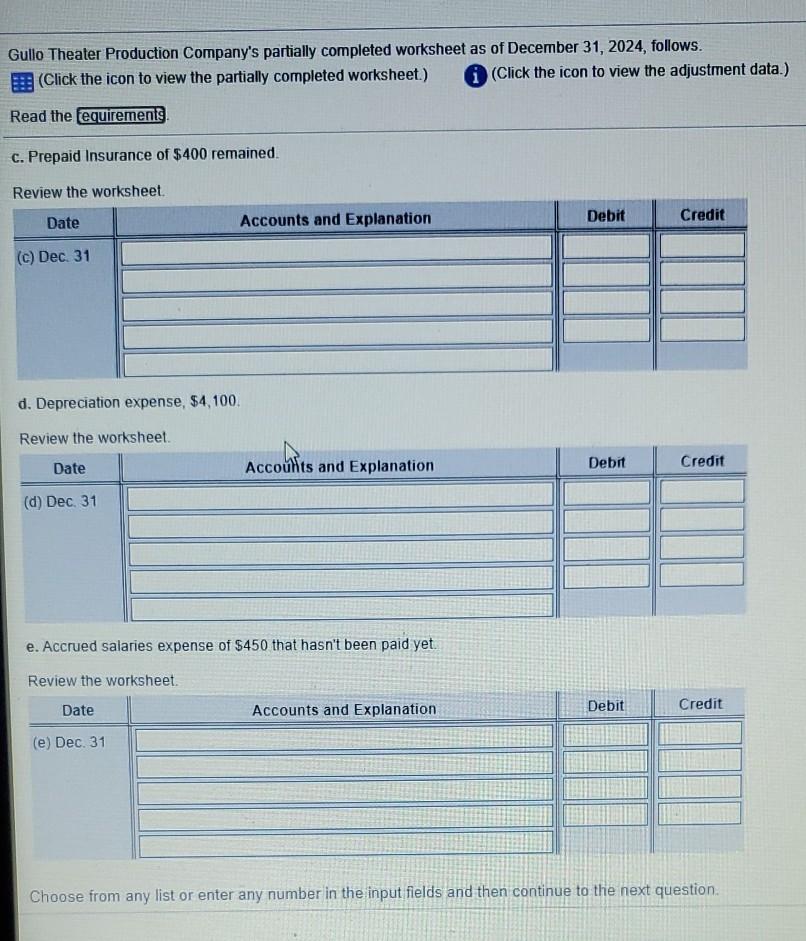

-X Data Table D E F A Gullo Theater Production Company Worksheet 2. December 31, 2024 3 Unadjusted Trial Balance 4 Adjustments Debit Credit Adjusted Trial Balance Debit Credit Debit Account Names Credit 5 $ 6 Cash 7 Accounts Receivable 4,000 6,100 2,000 8 Office Supplies 600 9 Prepaid Insurance 25,000 $ 7,400 10 Equipment 11 Accumulated Depreciation Equipment 12 Accounts Payable 13 Salaries Payable 4,000 17,7060 ation 32,000 5. 70,000 14 Gullo, Capital 15 Gullo, Withdrawals 16 Service Revenue 17 Depreciation Expense-Equipment 18 Supplies Expense 19 Utilities Expense 20 Salaries Expense Credi 4.400 25,000 21 Insurance Expense 5 99,1005 99 100 22 Total Print Done estion i More Info - X a. As of December 31, Gullo had performed $500 of service revenue but has not yet billed customers. b. At the end of the month, Gullo had $300 of office supplies remaining c. Prepaid Insurance of $400 remained. d. Depreciation expense, $4,100 Accrued salaries expense of $450 that hasn't been paid yet. e. e jo Print Done 0 Requirements 1. Complete the worksheet. Use letters a through e to label the five adjustments 2. Journalize the adjusting entries. the jo Print Done Gullo Theater Production Company's partially completed worksheet as of December 31, 2024, follows B (Click the icon to view the partially completed worksheet.) (Click the icon to view the adjustment data) Read the fequirements Requirement 1. Complete the worksheet. Use letters a through e to label the five adjustments The account names and unadjusted trial balance amounts as provided in the question have been entered into the worksheet for you Finish the partial worksheet by completing the adjustments and adjusted trial balance columns Complete the Adjustments columns by using the letters a through e to label the five adjustments. (Abbreviation used: Equip. = Equipment.) Gullo Production Company Worksheet December 31, 2024 Unadjusted Trial Balance Adjustments Adjusted Trial Balance Account Names Debit Credit Debit Credit Debit Credit 4000 Cash $ 4,000 Accounts Receivable 6.100 2,000 600 Office Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equip. Accounts Payable 25,000 $ 7 400 4.000 Choose from any list or enter any number in the input fields and then continue to the next question. Gullo Production Company Worksheet December 31, 2024 Unadjusted Trial Balance Adjustments Debit Credit Debit Credit Account Names Adjusted Trial Balance Debit Credit Cash S 4,000 4000 Accounts Receivable 6,100 2,000 600 25,000 09 7,400 4,000 Office Supplies Prepaid Insurance Equipment Accumulated Depreciation Equip. Accounts Payable Salaries Payable Gullo, Capital Gulio, Withdrawals Service Revenue Depreciation Expense-Equip. Supplies Expense Utilities Expense Salaries Expense 17,700 32.000 70.000 4,400 25.000 Insurance Expense S 99,100 $ 99,100 Total Requirement 2. Joumalize the adjusting entries. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) a. As of December 31, Gullo had performed $500 of service revenue but has not yet billed customers. Review the worksheet. Date Accounts and Explanation Debit Credit (a) Dec 31 b. At the end of the month, Gullo had $300 of office supplies remaining Review the worksheet. Date Accounts and Explanation Debit Credit (b) Dec. 31 C. Prepaid Insurance of $400 remained C. Prepaid Insurance of $400 remained Review the worksheet. Date Aceounts and Explanation Debit Credit (C) Dec. 31 d. Depreciation expense, $4,100 Review the worksheet Date Accounts and Explanation Debit Credit (d) Dec 31 Gullo Theater Production Company's partially completed worksheet as of December 31, 2024, follows. Click the icon to view the partially completed worksheet) i (Click the icon to view the adjustment data.) Read the fequirements c. Prepaid Insurance of $400 remained. Review the worksheet. Date Accounts and Explanation Debit Credit (c) Dec 31 d. Depreciation expense, $4,100 Review the worksheet. Date Accounts and Explanation Debit Credit (d) Dec. 31 e. Accrued salaries expense of $450 that hasn't been paid yet. Review the worksheet. Date Credit Debit Accounts and Explanation (e) Dec. 31 Choose from any list or enter any number in the input fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started