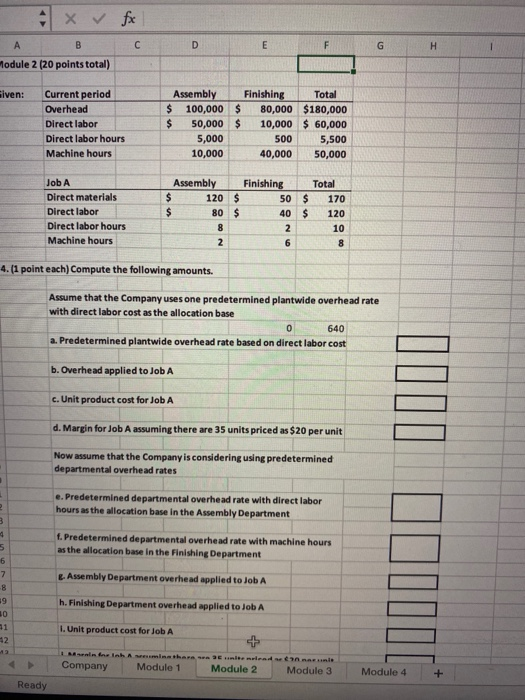

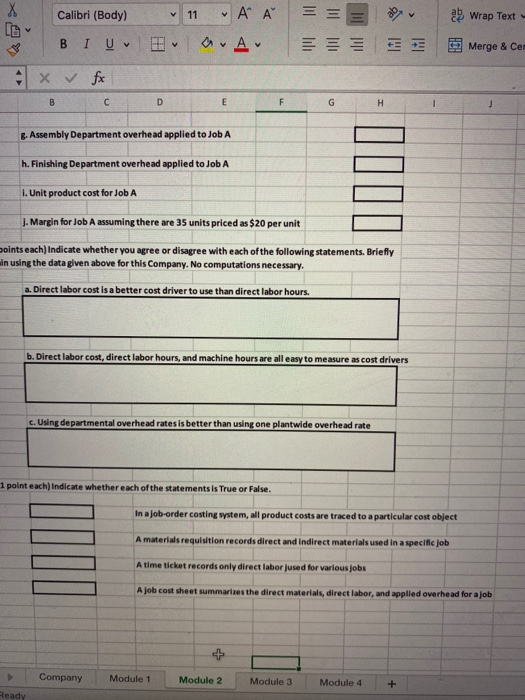

x & fx D E G H A B Module 2 (20 points total) Given: Current period Overhead Direct labor Direct labor hours Machine hours Assembly Finishing Total $ 100,000 $ 80,000 $180,000 50,000 $ 10,000 $ 60,000 5,000 500 5,500 10,000 40,000 50,000 $ JobA Direct materials Direct labor Direct labor hours Machine hours Assembly $ 120 $ $ 80 $ 8 2 Finishing 50 $ 40 $ 2 6 Total 170 120 10 8 4. (1 point each) Compute the following amounts. Assume that the Company uses one predetermined plantwide overhead rate with direct labor cost as the allocation base 0 640 a. Predetermined plantwide overhead rate based on direct labor cost b. Overhead applied to JobA c. Unit product cost for JobA d. Margin for Job A assuming there are 35 units priced as $20 per unit Now assume that the Company is considering using predetermined departmental overhead rates e. Predetermined departmental overhead rate with direct labor hours as the allocation base in the Assembly Department 2 3 4 5 f. Predetermined departmental overhead rate with machine hours as the allocation base in the Finishing Department 6 7 E. Assembly Department overhead applied to JobA 8 39 h. Finishing Department overhead applied to Job A 10 71 42 1. Unit product cost for JobA Company Module 1 Module 2 Module 3 Module 4 + Ready Calibri (Body) v 11 v A u a. Av HHI Wrap Text- % 19:11 BIU v lili Merge & Cer fx B D E F G 8. Assembly Department overhead applied to JobA h. Finishing Department overhead applied to JobA 1100 I. Unit product cost for JobA J. Margin for Job A assuming there are 35 units priced as $20 per unit Doints each) Indicate whether you agree or disagree with each of the following statements. Briefly in using the data given above for this Company. No computations necessary. a. Direct labor cost is a better cost driver to use than direct labor hours. b. Direct labor cost, direct labor hours, and machine hours are all easy to measure as cost drivers c. Using departmental overhead rates is better than using one plantwide overhead rate 1 point each) Indicate whether each of the statements is True or False. In a job-order costing system, all product costs are traced to a particular cost object A materials requisition records direct and indirect materials used in a specific job A time ticket records only direct labor Jused for various jobs A job cost sheet summarizes the direct materials, direct labor, and applied overhead for a job Company Module 1 Module 2 Module 3 Module 4 + Ready