Answered step by step

Verified Expert Solution

Question

1 Approved Answer

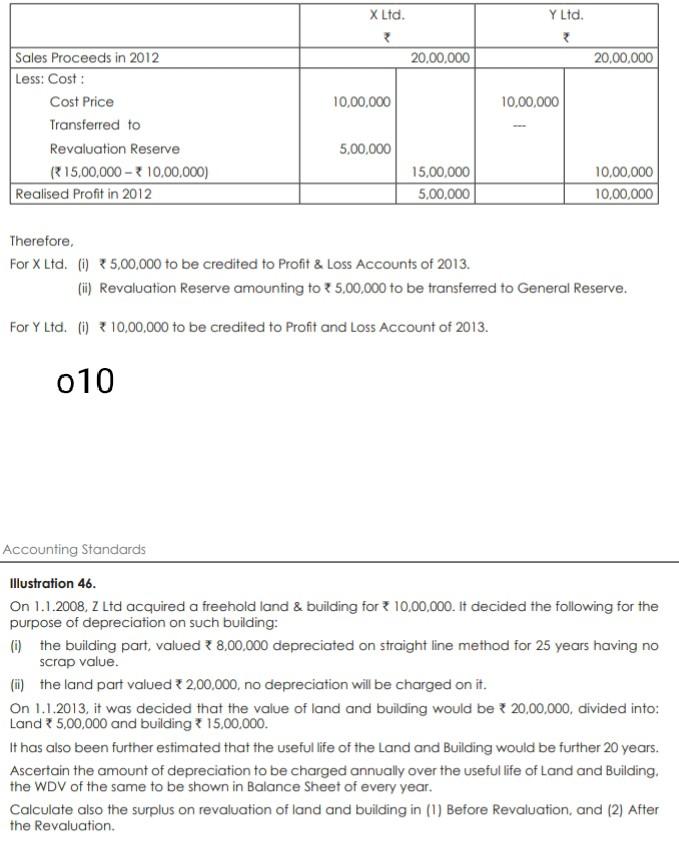

X Ltd. 20,00,000 Y Ltd. 20,00.000 10,00.000 10,00,000 Sales Proceeds in 2012 Less: Cost: Cost Price Transferred to Revaluation Reserve R15,00,000 - 10,00,000) Realised Profit

X Ltd. 20,00,000 Y Ltd. 20,00.000 10,00.000 10,00,000 Sales Proceeds in 2012 Less: Cost: Cost Price Transferred to Revaluation Reserve R15,00,000 - 10,00,000) Realised Profit in 2012 5,00,000 15,00,000 5,00,000 10,00,000 10,00,000 Therefore, For X Ltd. (1) 5,00,000 to be credited to Profit & Loss Accounts of 2013. (i) Revaluation Reserve amounting to 5,00,000 to be transferred to General Reserve. For Y Ltd. (0) 210,00,000 to be credited to profit and Loss Account of 2013. 010 Accounting Standards Illustration 46. On 1.1.2008, Z Ltd acquired a freehold land & building for 10,00,000. It decided the following for the purpose of depreciation on such building: () the building part, valued ? 8,00.000 depreciated on straight line method for 25 years having no scrap value. the land part valued ? 2,00,000, no depreciation will be charged on it. On 1.1.2013, it was decided that the value of land and building would be ? 20,00,000, divided into: Land 5,00,000 and building ? 15,00,000. It has also been further estimated that the useful life of the Land and Building would be further 20 years. Ascertain the amount of depreciation to be charged annually over the useful life of Land and Building. the WDV of the same to be shown in Balance sheet of every year. Calculate also the surplus on revaluation of land and building in (1) Before Revaluation, and (2) After the Revaluation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started