Answered step by step

Verified Expert Solution

Question

1 Approved Answer

X owns 75% of the ordinary share capital of its subsidiary Y. At the group's year end, 28 February 20x7, X's payables include $3,600 in

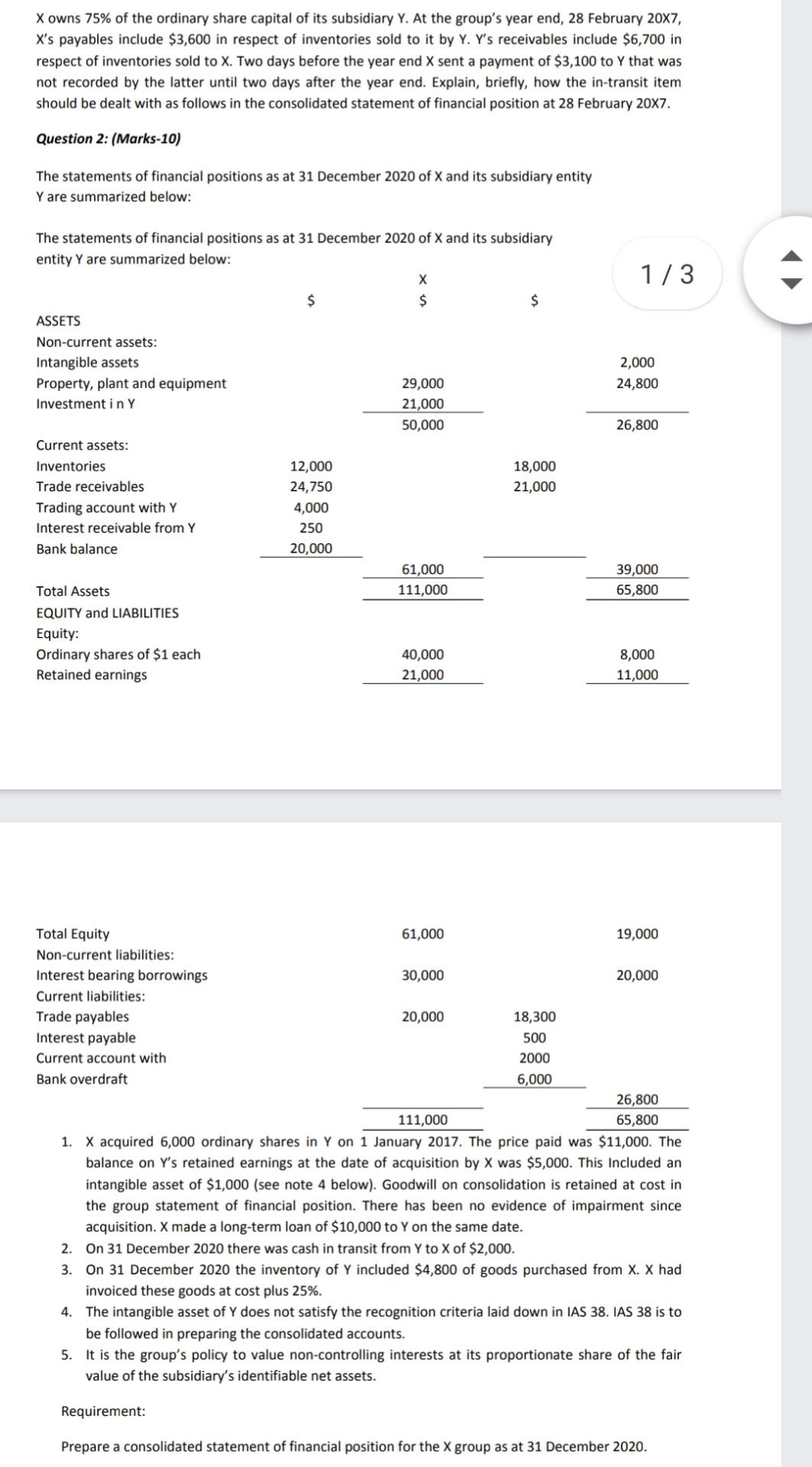

X owns 75% of the ordinary share capital of its subsidiary Y. At the group's year end, 28 February 20x7, X's payables include $3,600 in respect of inventories sold to it by Y. Y's receivables include $6,700 in respect of inventories sold to X. Two days before the year end X sent a payment of $3,100 to Y that was not recorded by the latter until two days after the year end. Explain, briefly, how the in-transit item should be dealt with as follows in the consolidated statement of financial position at 28 February 20x7. Question 2: (Marks-10) The statements of financial positions as at 31 December 2020 of X and its subsidiary entity Y are summarized below: 1/3 2,000 24,800 26,800 The statements of financial positions as at 31 December 2020 of X and its subsidiary entity Y are summarized below: $ $ ASSETS Non-current assets: Intangible assets Property, plant and equipment 29,000 Investment in Y 21,000 50,000 Current assets: Inventories 12,000 18,000 Trade receivables 24,750 21,000 Trading account with Y 4,000 Interest receivable from Y 250 Bank balance 20,000 61,000 Total Assets 111,000 EQUITY and LIABILITIES Equity: Ordinary shares of $1 each 40,000 Retained earnings 21,000 39,000 65,800 8,000 11,000 Total Equity 61,000 19,000 Non-current liabilities: Interest bearing borrowings 30,000 20,000 Current liabilities: Trade payables 20,000 18,300 Interest payable 500 Current account with 2000 Bank overdraft 6,000 26,800 111,000 65,800 1. X acquired 6,000 ordinary shares in Y on 1 January 2017. The price paid was $11,000. The balance on Y's retained earnings at the date of acquisition by X was $5,000. This Included an intangible asset of $1,000 (see note 4 below). Goodwill on consolidation is retained at cost in the group statement of financial position. There has been no evidence of impairment since acquisition. X made a long-term loan of $10,000 to Y on the same date. 2. On 31 December 2020 there was cash in transit from Y to X of $2,000. 3. On 31 December 2020 the inventory of Y included $4,800 of goods purchased from X. X had invoiced these goods at cost plus 25%. 4. The intangible asset of Y does not satisfy the recognition criteria laid down in IAS 38. IAS 38 is to be followed in preparing the consolidated accounts. 5. It is the group's policy to value non-controlling interests at its proportionate share of the fair value of the subsidiary's identifiable net assets. Requirement: Prepare a consolidated statement of financial position for the X group as at 31 December 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started