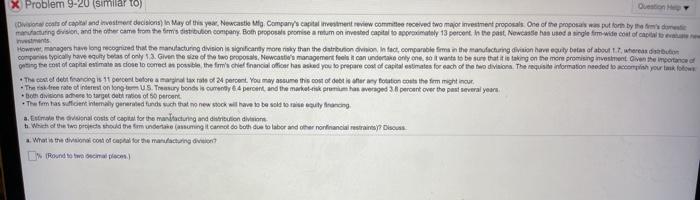

X Problem 9-20 (similar to) to coats of capital and investiere decisions la May of the year. Newcastle Mt. Company's capital Festment recew committee received two major investment proposals One of the proposals we put torn by the tomados maarung Glor, and the other came from the stribution coma. Both proposals promise a um on invested capital to promotely 13 percent in the past, Newcastle has used a sorglem wide cost of cap However, managers have long recognized that the manufacturing division is significantly morensky than the distribution in Infect, comparablems in the manufacturing division have equity batus of about whereas companies typically have equily belas only. Given the size of the two proposals, Newcastle management folo con undertake only one to wants to be sure that it taking on the more promising Investment Give the importance of sing the most of capital estimate ose to correspout the firschel financial officer has asked you to prepare cool of capital estimates for each of the two division. The requisite information needed to comprish your own The cotet det financing is 15 percent before a marginal tax rate of 24 percent. You may assume this cost of this for any touton costs the firm might incur This free rate of interest on tonom US. Truy bonde is curreny 4 percent and the marketeikums waged 3 percent over the past several years The femasse emaily arench ch that new book will have to be sold to my tranny a. Entheosonal costs of capital for the molecture and distribution division Which of the words should them underming It care do both due to laborando ar norteancat erairmy Blooms What is the divisional cost of capital for the manufacturing den I Round wom) X Problem 9-20 (similar to) to coats of capital and investiere decisions la May of the year. Newcastle Mt. Company's capital Festment recew committee received two major investment proposals One of the proposals we put torn by the tomados maarung Glor, and the other came from the stribution coma. Both proposals promise a um on invested capital to promotely 13 percent in the past, Newcastle has used a sorglem wide cost of cap However, managers have long recognized that the manufacturing division is significantly morensky than the distribution in Infect, comparablems in the manufacturing division have equity batus of about whereas companies typically have equily belas only. Given the size of the two proposals, Newcastle management folo con undertake only one to wants to be sure that it taking on the more promising Investment Give the importance of sing the most of capital estimate ose to correspout the firschel financial officer has asked you to prepare cool of capital estimates for each of the two division. The requisite information needed to comprish your own The cotet det financing is 15 percent before a marginal tax rate of 24 percent. You may assume this cost of this for any touton costs the firm might incur This free rate of interest on tonom US. Truy bonde is curreny 4 percent and the marketeikums waged 3 percent over the past several years The femasse emaily arench ch that new book will have to be sold to my tranny a. Entheosonal costs of capital for the molecture and distribution division Which of the words should them underming It care do both due to laborando ar norteancat erairmy Blooms What is the divisional cost of capital for the manufacturing den I Round wom)