Question

X=3.25 The maintenance costs per year would be $3250. Y=29.25 The yearly benefits would be $29250. As a consultant to the City Council, you have

X=3.25

The maintenance costs per year would be $3250.

Y=29.25

The yearly benefits would be $29250.

As a consultant to the City Council, you have been asked to prepare cash-flow diagrams of the three proposals, compare the proposals using economic evaluation methods, and recommend the most financially viable option for the 25 years of their design lives. You have been asked to use two methods of economic evaluation (the Net Present Value method, and an appropriate form of the Benefit-Cost Ratio methods) to compare the three proposals. Present your detailed calculations for all methods and comment on your results, including the suitability of the methods.

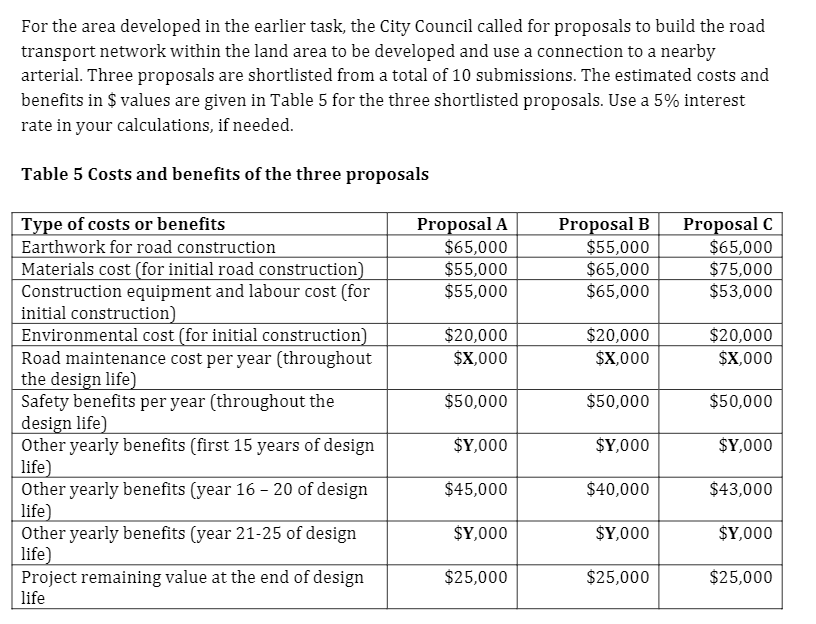

For the area developed in the earlier task, the City Council called for proposals to build the road transport network within the land area to be developed and use a connection to a nearby arterial. Three proposals are shortlisted from a total of 10 submissions. The estimated costs and benefits in $ values are given in Table 5 for the three shortlisted proposals. Use a 5% interest rate in your calculations, if needed. Table 5 Costs and benefits of the three proposals Proposal A $65,000 $55,000 $55,000 Proposal B $55,000 $65,000 $65,000 Proposal $65,000 $75,000 $53,000 $20,000 $X,000 $20,000 $8,000 $20,000 $8,000 Type of costs or benefits Earthwork for road construction Materials cost (for initial road construction) Construction equipment and labour cost (for initial construction) Environmental cost (for initial construction) Road maintenance cost per year (throughout the design life) Safety benefits per year (throughout the design life) Other yearly benefits (first 15 years of design life Other yearly benefits (year 16 - 20 of design life Other yearly benefits (year 21-25 of design life) Project remaining value at the end of design life $50,000 $50,000 $50,000 $4,000 $Y,000 $8,000 $45,000 $40,000 $43,000 $Y,000 $Y,000 $Y,000 $25,000 $25,000 $25,000 For the area developed in the earlier task, the City Council called for proposals to build the road transport network within the land area to be developed and use a connection to a nearby arterial. Three proposals are shortlisted from a total of 10 submissions. The estimated costs and benefits in $ values are given in Table 5 for the three shortlisted proposals. Use a 5% interest rate in your calculations, if needed. Table 5 Costs and benefits of the three proposals Proposal A $65,000 $55,000 $55,000 Proposal B $55,000 $65,000 $65,000 Proposal $65,000 $75,000 $53,000 $20,000 $X,000 $20,000 $8,000 $20,000 $8,000 Type of costs or benefits Earthwork for road construction Materials cost (for initial road construction) Construction equipment and labour cost (for initial construction) Environmental cost (for initial construction) Road maintenance cost per year (throughout the design life) Safety benefits per year (throughout the design life) Other yearly benefits (first 15 years of design life Other yearly benefits (year 16 - 20 of design life Other yearly benefits (year 21-25 of design life) Project remaining value at the end of design life $50,000 $50,000 $50,000 $4,000 $Y,000 $8,000 $45,000 $40,000 $43,000 $Y,000 $Y,000 $Y,000 $25,000 $25,000 $25,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started