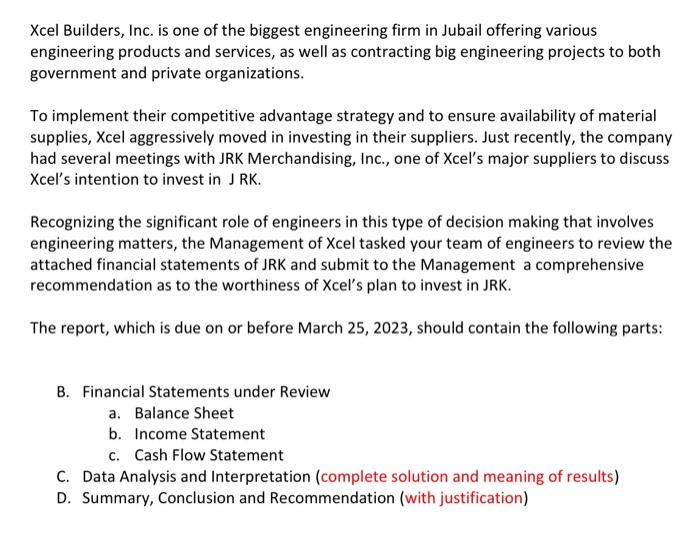

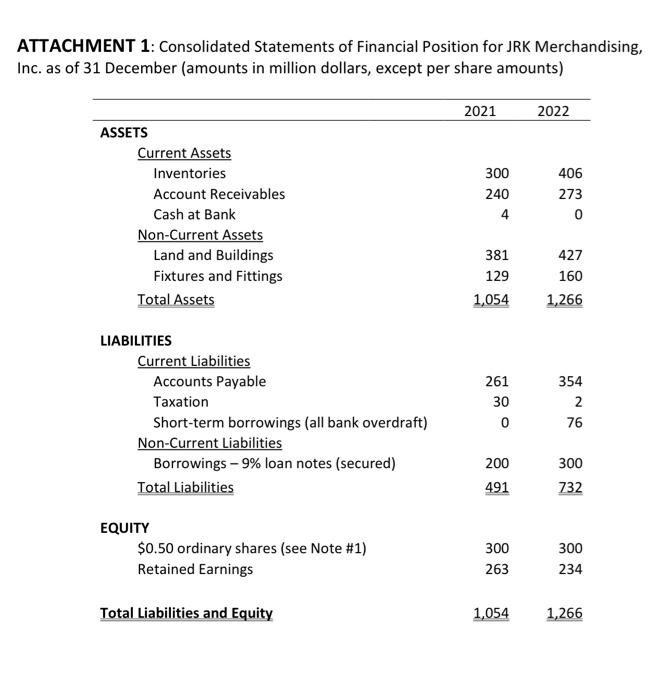

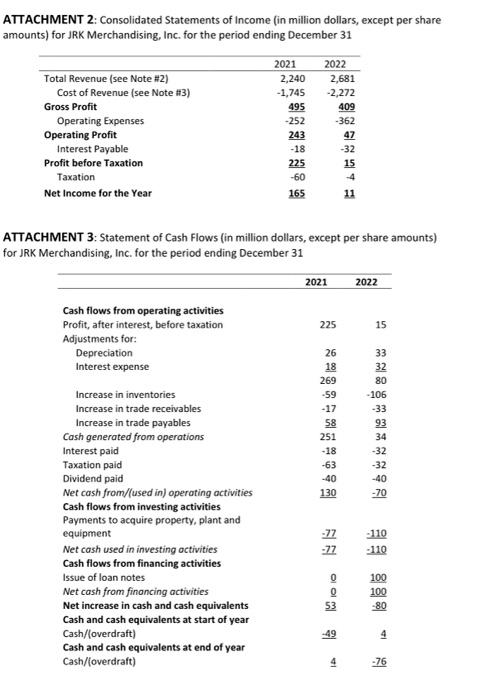

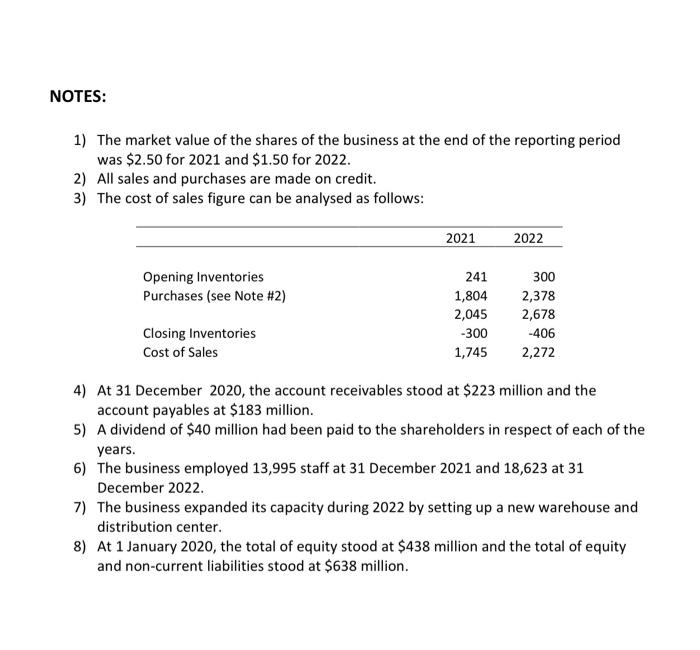

Xcel Builders, Inc. is one of the biggest engineering firm in Jubail offering various engineering products and services, as well as contracting big engineering projects to both government and private organizations. To implement their competitive advantage strategy and to ensure availability of material supplies, Xcel aggressively moved in investing in their suppliers. Just recently, the company had several meetings with JRK Merchandising, Inc., one of Xcel's major suppliers to discuss Xcel's intention to invest in J RK. Recognizing the significant role of engineers in this type of decision making that involves engineering matters, the Management of X Ccel tasked your team of engineers to review the attached financial statements of JRK and submit to the Management a comprehensive recommendation as to the worthiness of Xcel's plan to invest in JRK. The report, which is due on or before March 25, 2023, should contain the following parts: B. Financial Statements under Review a. Balance Sheet b. Income Statement c. Cash Flow Statement C. Data Analysis and Interpretation (complete solution and meaning of results) D. Summary, Conclusion and Recommendation (with justification) Inc. a: ATTACHMENT 2: Consolidated Statements of Income (in million dollars, except per share amounts) for JRK Merchandising, Inc. for the period ending December 31 ATTACHMENT 3: Statement of Cash Flows (in million dollars, except per share amounts) for JRK Merchandising, Inc. for the period ending December 31 NOTES: 1) The market value of the shares of the business at the end of the reporting period was $2.50 for 2021 and $1.50 for 2022 . 2) All sales and purchases are made on credit. 3) The cost of sales figure can be analysed as follows: 4) At 31 December 2020 , the account receivables stood at $223 million and the account payables at $183 million. 5) A dividend of $40 million had been paid to the shareholders in respect of each of the years. 6) The business employed 13,995 staff at 31 December 2021 and 18,623 at 31 December 2022. 7) The business expanded its capacity during 2022 by setting up a new warehouse and distribution center. 8) At 1 January 2020 , the total of equity stood at $438 million and the total of equity and non-current liabilities stood at $638 million