Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Xen, Yen and Zen are in partnership and share profits and losses in the ratio 3:4:5. On 1 March 20.9 they decided to dissolve

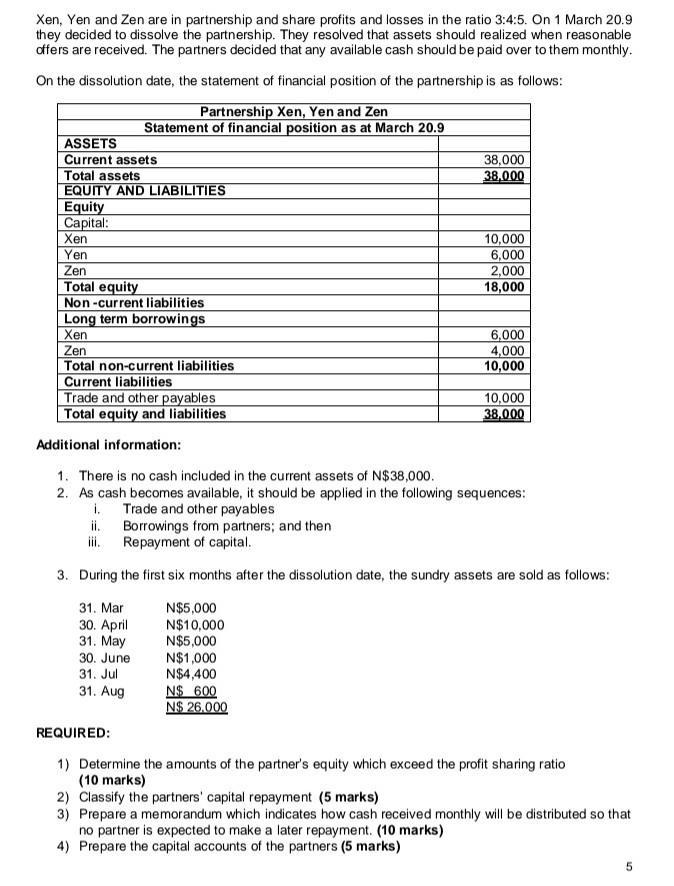

Xen, Yen and Zen are in partnership and share profits and losses in the ratio 3:4:5. On 1 March 20.9 they decided to dissolve the partnership. They resolved that assets should realized when reasonable offers are received. The partners decided that any available cash should be paid over to them monthly. On the dissolution date, the statement of financial position of the partnership is as follows: Partnership Xen, Yen and Zen Statement of financial position as at March 20.9 ASSETS Current assets 38,000 38.000 Total assets EQUITY AND LIABILITIES Equity Capital: Xen Yen Zen Total equity Non-current liabilities Long term borrowings en 10,000 6,000 2,000 18,000 6,000 4,000 10,000 Zen Total non-current liabilities Current liabilities Trade and other payables Total equity and liabilities 10,000 38,000 Additional information: 1. There is no cash included in the current assets of N$38,000. 2. As cash becomes available, it should be applied in the following sequences: i. Trade and other payables ii. Borrowings from partners; and then ii. Repayment of capital. 3. During the first six months after the dissolution date, the sundry assets are sold as follows: 31. Mar N$5,000 N$10,000 N$5,000 N$1,000 N$4,400 N$ 600 N$ 26,000 30. April 31. May 30. June 31. Jul 31. Aug REQUIRED: 1) Determine the amounts of the partner's equity which exceed the profit sharing ratio (10 marks) 2) Classify the partners' capital repayment (5 marks) 3) Prepare a memorandum which indicates how cash received monthly will be distributed so that no partner is expected to make a later repayment. (10 marks) 4) Prepare the capital accounts of the partners (5 marks)

Step by Step Solution

★★★★★

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 The amount of the partner s equity which exceeds ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started