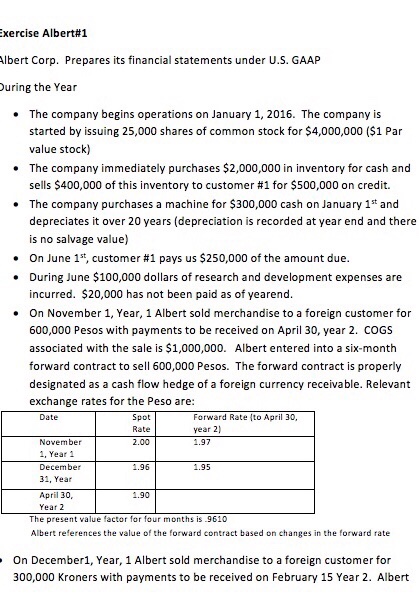

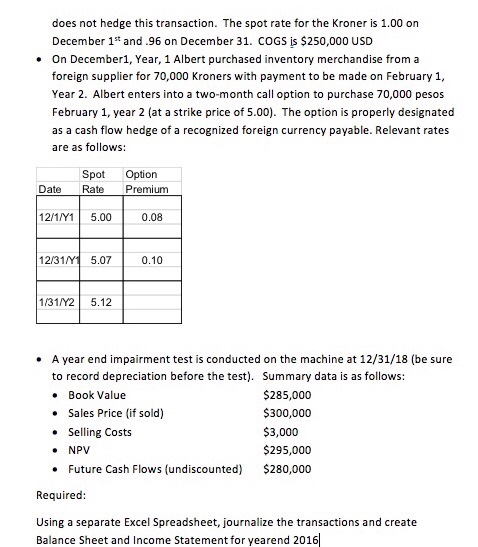

xercise Albert#1 lbert Corp. Prepares its financial statements under U.S. GAAP uring the Year . The company begins operations on January 1, 2016. The company is started by issuing 25,000 shares of common stock for $4,000,000 ($1 Par value stock) . The company immediately purchases $2,000,000 in inventory for cash and sells $400,000 of this inventory to customer #1 for $500,000 on credit. The company purchases a machine for $300,000 cash on January 1st and depreciates it over 20 years(depreciation is recorded at year end and there is no salvage value) On June 1st, customer #1 pays us $250,000 of the amount due . .During June $100,000 dollars of research and development expenses are incurred. $20,000 has not been paid as of yearend On November 1, Year, 1 Albert sold merchandise to a foreign customer for 600,000 Pesos with payments to be rved on April 30, year 2. COGS associated with the sale is $1,000,000. Albert entered into a six-month forward contract to sell 600,000 Pesos. The forward contract is properly designated as a cash flow hedge of a foreign currency receivable. Relevant exchange rates for the Peso are . Spot Rate 2.00 Forward Rate (to April 30, year 2 1.97 November , Year 1 December 31, Year April 30, Year 2 1.96 1.95 1.90 The present value factor for four months is .9610 Albert references the value of the forward contract based on changes in the forward rate On December1, Year, 1 Albert sold merchandise to a foreign customer for 300,000 Kroners with payments to be received on February 15 Year 2. Albert xercise Albert#1 lbert Corp. Prepares its financial statements under U.S. GAAP uring the Year . The company begins operations on January 1, 2016. The company is started by issuing 25,000 shares of common stock for $4,000,000 ($1 Par value stock) . The company immediately purchases $2,000,000 in inventory for cash and sells $400,000 of this inventory to customer #1 for $500,000 on credit. The company purchases a machine for $300,000 cash on January 1st and depreciates it over 20 years(depreciation is recorded at year end and there is no salvage value) On June 1st, customer #1 pays us $250,000 of the amount due . .During June $100,000 dollars of research and development expenses are incurred. $20,000 has not been paid as of yearend On November 1, Year, 1 Albert sold merchandise to a foreign customer for 600,000 Pesos with payments to be rved on April 30, year 2. COGS associated with the sale is $1,000,000. Albert entered into a six-month forward contract to sell 600,000 Pesos. The forward contract is properly designated as a cash flow hedge of a foreign currency receivable. Relevant exchange rates for the Peso are . Spot Rate 2.00 Forward Rate (to April 30, year 2 1.97 November , Year 1 December 31, Year April 30, Year 2 1.96 1.95 1.90 The present value factor for four months is .9610 Albert references the value of the forward contract based on changes in the forward rate On December1, Year, 1 Albert sold merchandise to a foreign customer for 300,000 Kroners with payments to be received on February 15 Year 2. Albert