Answered step by step

Verified Expert Solution

Question

1 Approved Answer

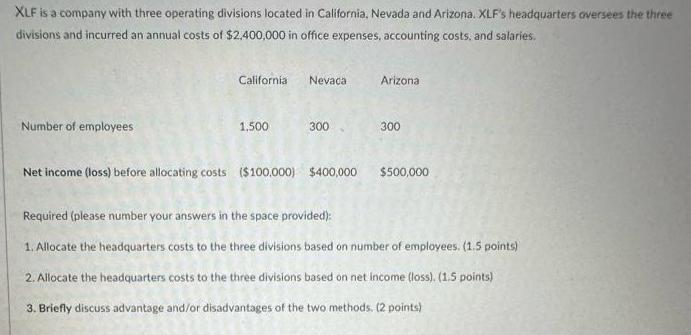

XLF is a company with three operating divisions located in California, Nevada and Arizona. XLF's headquarters oversees the three divisions and incurred an annual

XLF is a company with three operating divisions located in California, Nevada and Arizona. XLF's headquarters oversees the three divisions and incurred an annual costs of $2,400,000 in office expenses, accounting costs, and salaries. Number of employees California Nevada 1,500 300 Net income (loss) before allocating costs ($100,000) $400,000 Arizona 300 $500,000 Required (please number your answers in the space provided): 1. Allocate the headquarters costs to the three divisions based on number of employees. (1.5 points) 2. Allocate the headquarters costs to the three divisions based on net income (loss). (1.5 points) 3. Briefly discuss advantage and/or disadvantages of the two methods. (2 points)

Step by Step Solution

★★★★★

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

1 Allocation of Headquarters Costs Based on Number of Employees To allocate the headquarters costs based on the number of employees we will use a prop...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started