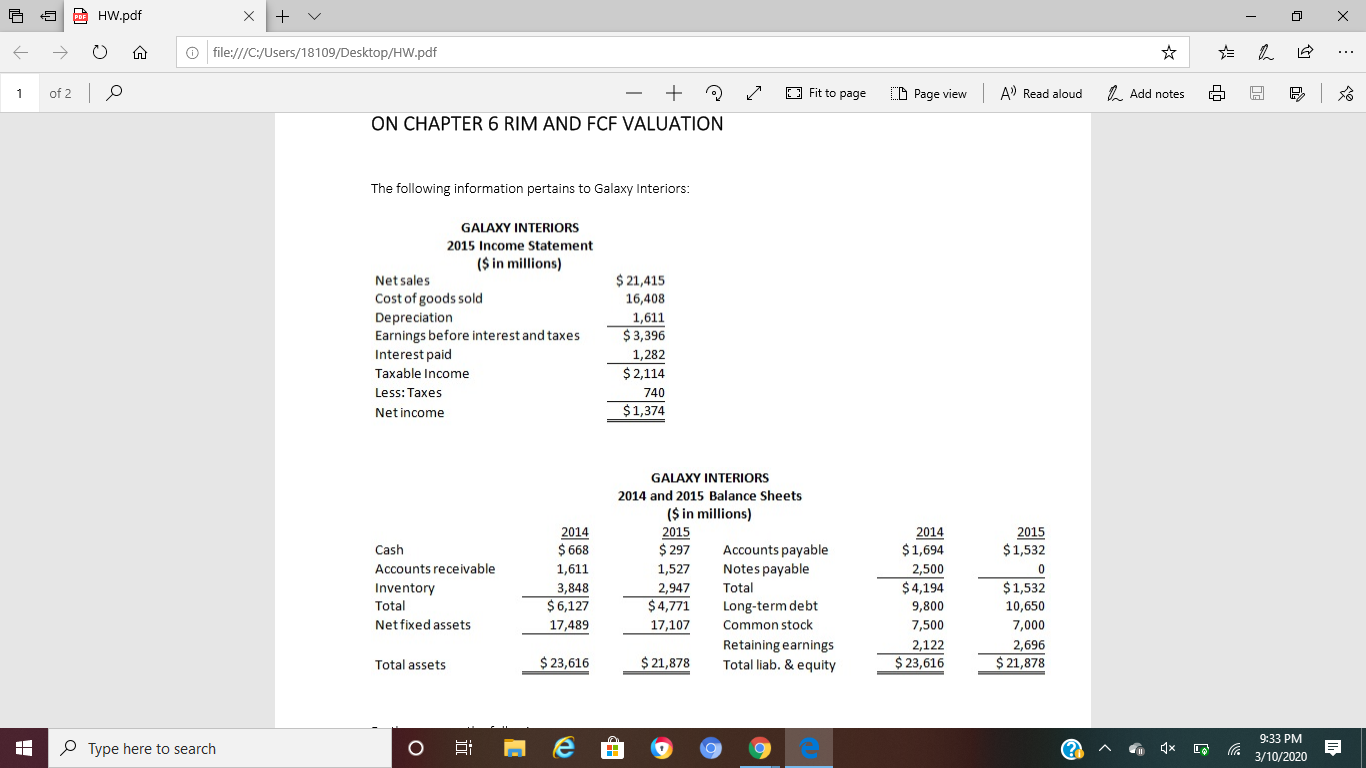

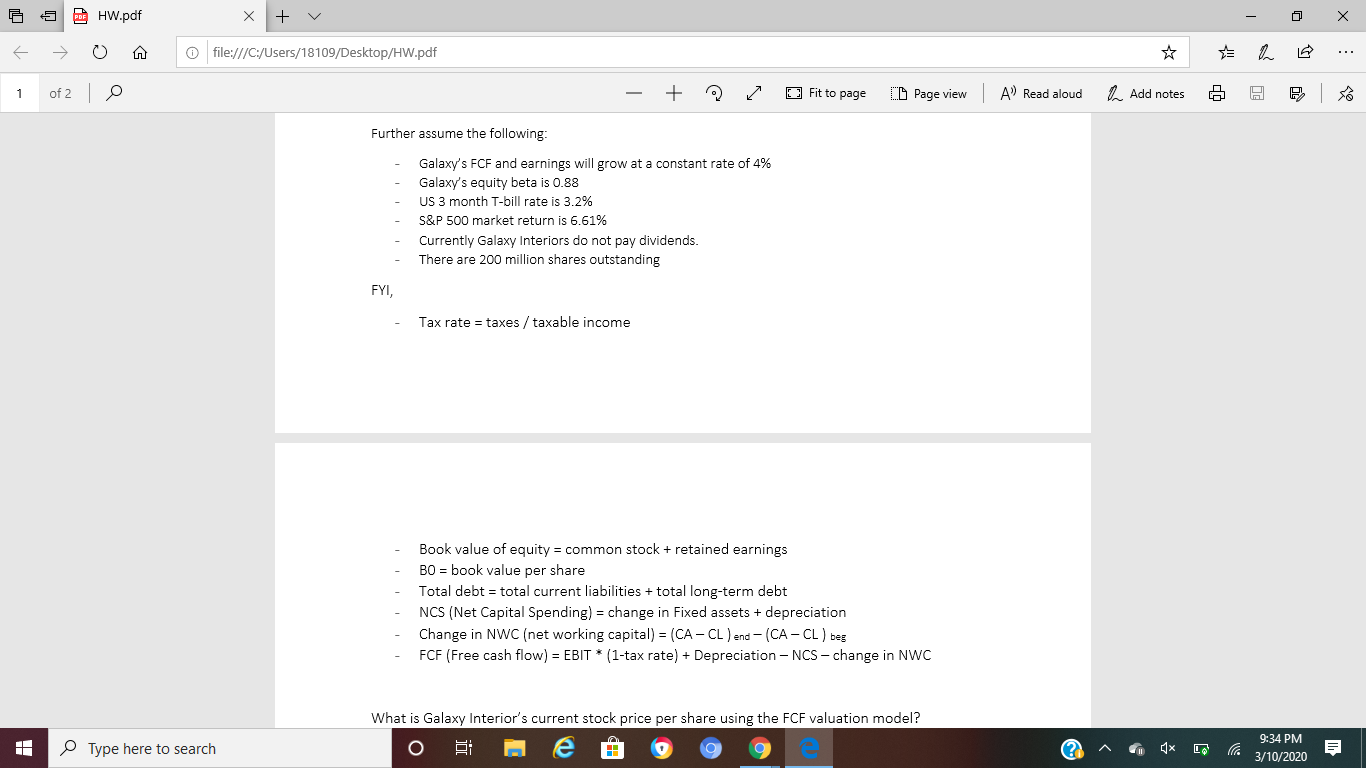

Xtv - O X 6 E 1 5 = of 2 HW.pdf 0 o file:///C:/Users/18109/Desktop/HW.pdf D Fit to page 9 Page view A Read aloud Add notes H + ON CHAPTER 6 RIM AND FCF VALUATION The following information pertains to Galaxy Interiors: GALAXY INTERIORS 2015 Income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Less: Taxes Net income $ 21,415 16,408 1,611 $ 3,396 1,282 $ 2,114 740 $ 1,374 2015 $1,532 Cash Accounts receivable Inventory Total Net fixed assets 2014 $ 668 1,611 3,848 $ 6,127 17,489 GALAXY INTERIORS 2014 and 2015 Balance Sheets ($ in millions) 2015 $ 297 Accounts payable 1,527 Notes payable 2,947 Total $4,771 Long-term debt 17,107 Common stock Retaining earnings $ 21,878 Total liab. & equity 2014 $1,694 2,500 $ 4,194 9,800 7,500 2,122 $ 23,616 $1,532 10,650 7,000 2,696 $ 21,878 Total assets $ 23,616 9:33 PM Type here to search o @ @ @ @ 9 e, @ ^ 0x D l 3/10/2020 - O X 6 E 1 5 of 2 HW.pdf 0 o Xtv file:///C:/Users/18109/Desktop/HW.pdf 0 - + Fit to page D Page view | A Read aloud m Add notes H F Further assume the following: Galaxy's FCF and earnings will grow at a constant rate of 4% Galaxy's equity beta is 0.88 US 3 month T-bill rate is 3.2% S&P 500 market return is 6.61% Currently Galaxy Interiors do not pay dividends. There are 200 million shares outstanding - - Tax rate = taxes / taxable income - Book value of equity = common stock + retained earnings BO = book value per share Total debt = total current liabilities + total long-term debt NCS (Net Capital Spending) = change in Fixed assets + depreciation Change in NWC (net working capital) = (CA - CL ) end (CA - CL ) beg FCF (Free cash flow) = EBIT * (1-tax rate) + Depreciation - NCS-change in NWC What is Galaxy Interior's current stock price per share using the FCF valuation model? - 9:34 PM Type here to search @ ^ D l 3/10/2020 Xtv - O X 6 E 1 5 = of 2 HW.pdf 0 o file:///C:/Users/18109/Desktop/HW.pdf D Fit to page 9 Page view A Read aloud Add notes H + ON CHAPTER 6 RIM AND FCF VALUATION The following information pertains to Galaxy Interiors: GALAXY INTERIORS 2015 Income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Less: Taxes Net income $ 21,415 16,408 1,611 $ 3,396 1,282 $ 2,114 740 $ 1,374 2015 $1,532 Cash Accounts receivable Inventory Total Net fixed assets 2014 $ 668 1,611 3,848 $ 6,127 17,489 GALAXY INTERIORS 2014 and 2015 Balance Sheets ($ in millions) 2015 $ 297 Accounts payable 1,527 Notes payable 2,947 Total $4,771 Long-term debt 17,107 Common stock Retaining earnings $ 21,878 Total liab. & equity 2014 $1,694 2,500 $ 4,194 9,800 7,500 2,122 $ 23,616 $1,532 10,650 7,000 2,696 $ 21,878 Total assets $ 23,616 9:33 PM Type here to search o @ @ @ @ 9 e, @ ^ 0x D l 3/10/2020 - O X 6 E 1 5 of 2 HW.pdf 0 o Xtv file:///C:/Users/18109/Desktop/HW.pdf 0 - + Fit to page D Page view | A Read aloud m Add notes H F Further assume the following: Galaxy's FCF and earnings will grow at a constant rate of 4% Galaxy's equity beta is 0.88 US 3 month T-bill rate is 3.2% S&P 500 market return is 6.61% Currently Galaxy Interiors do not pay dividends. There are 200 million shares outstanding - - Tax rate = taxes / taxable income - Book value of equity = common stock + retained earnings BO = book value per share Total debt = total current liabilities + total long-term debt NCS (Net Capital Spending) = change in Fixed assets + depreciation Change in NWC (net working capital) = (CA - CL ) end (CA - CL ) beg FCF (Free cash flow) = EBIT * (1-tax rate) + Depreciation - NCS-change in NWC What is Galaxy Interior's current stock price per share using the FCF valuation model? - 9:34 PM Type here to search @ ^ D l 3/10/2020