Question

XY Merchandising Company was established on January 1, 2018. As of December 31, 2018, the following additional information is available: $5.000 of Office Supplies has

XY Merchandising Company was established on January 1, 2018. As of December 31, 2018, the following additional information is available:

$5.000 of Office Supplies has been used. Accrued interest revenue is $10.000. $15.000 of prepaid rent has expired as of December 31, 2018. As of December 31, 2016, $20.000 of the Unearned Service Revenue is earned.

Question:

4) Journalize the closing entries. 5) Prepare Income Statement and Statement of Financial Position (Balance Sheet) of Thanos Service Company in proper form.

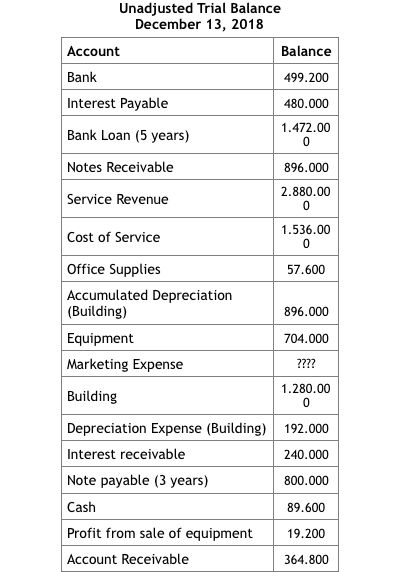

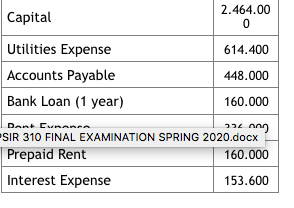

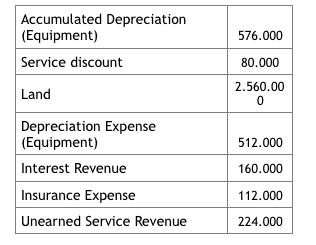

Please note that The marketing expense is missing in the chart.

Unadjusted Trial Balance December 13, 2018 Account Balance Bank 499.200 Interest Payable 480.000 1.472.00 Bank Loan (5 years) 0 Notes Receivable 896.000 2.880.00 Service Revenue 0 1.536.00 Cost of Service 0 Office Supplies 57.600 Accumulated Depreciation (Building) 896.000 Equipment 704.000 Marketing Expense ???? 1.280.00 Building 0 Depreciation Expense (Building) 192.000 Interest receivable 240.000 Note payable (3 years) 800.000 Cash 89.600 Profit from sale of equipment 19.200 Account Receivable 364.800 Capital 2.464.00 0 614.400 Utilities Expense Accounts Payable Bank Loan (1 year) 448.000 160.000 34 an DAR. CURARRA SIR 310 FINAL EXAMINATION SPRING 2020.docx Prepaid Rent 160.000 Interest Expense 153.600 Accumulated Depreciation (Equipment) Service discount 576.000 80.000 Land 2.560.00 0 512.000 Depreciation Expense (Equipment) Interest Revenue Insurance Expense Unearned Service Revenue 160.000 112.000 224.000 Unadjusted Trial Balance December 13, 2018 Account Balance Bank 499.200 Interest Payable 480.000 1.472.00 Bank Loan (5 years) 0 Notes Receivable 896.000 2.880.00 Service Revenue 0 1.536.00 Cost of Service 0 Office Supplies 57.600 Accumulated Depreciation (Building) 896.000 Equipment 704.000 Marketing Expense ???? 1.280.00 Building 0 Depreciation Expense (Building) 192.000 Interest receivable 240.000 Note payable (3 years) 800.000 Cash 89.600 Profit from sale of equipment 19.200 Account Receivable 364.800 Capital 2.464.00 0 614.400 Utilities Expense Accounts Payable Bank Loan (1 year) 448.000 160.000 34 an DAR. CURARRA SIR 310 FINAL EXAMINATION SPRING 2020.docx Prepaid Rent 160.000 Interest Expense 153.600 Accumulated Depreciation (Equipment) Service discount 576.000 80.000 Land 2.560.00 0 512.000 Depreciation Expense (Equipment) Interest Revenue Insurance Expense Unearned Service Revenue 160.000 112.000 224.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started