Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XY=71 b) Suppose you invest $1000 today at a rate of X.Y% per annum (compounded annually). What will your investment be worth in 30 years

XY=71

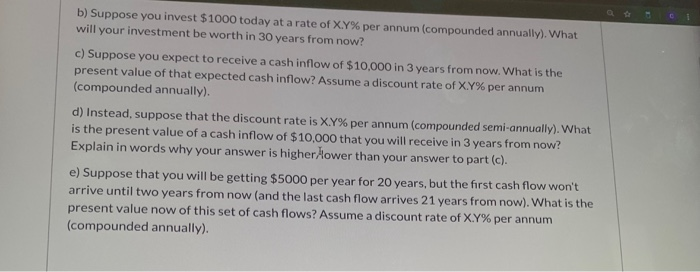

b) Suppose you invest $1000 today at a rate of X.Y% per annum (compounded annually). What will your investment be worth in 30 years from now? C) Suppose you expect to receive a cash inflow of $10.000 in 3 years from now. What is the present value of that expected cash inflow? Assume a discount rate of XY% per annum (compounded annually). d) Instead, suppose that the discount rate is X.Y% per annum (compounded semi-annually). What is the present value of a cash inflow of $10,000 that you will receive in 3 years from now? Explain in words why your answer is higher Hower than your answer to part (c). e) Suppose that you will be getting $5000 per year for 20 years, but the first cash flow won't arrive until two years from now (and the last cash flow arrives 21 years from now). What is the present value now of this set of cash flows? Assume a discount rate of X.Y% per annum (compounded annually) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started