Answered step by step

Verified Expert Solution

Question

1 Approved Answer

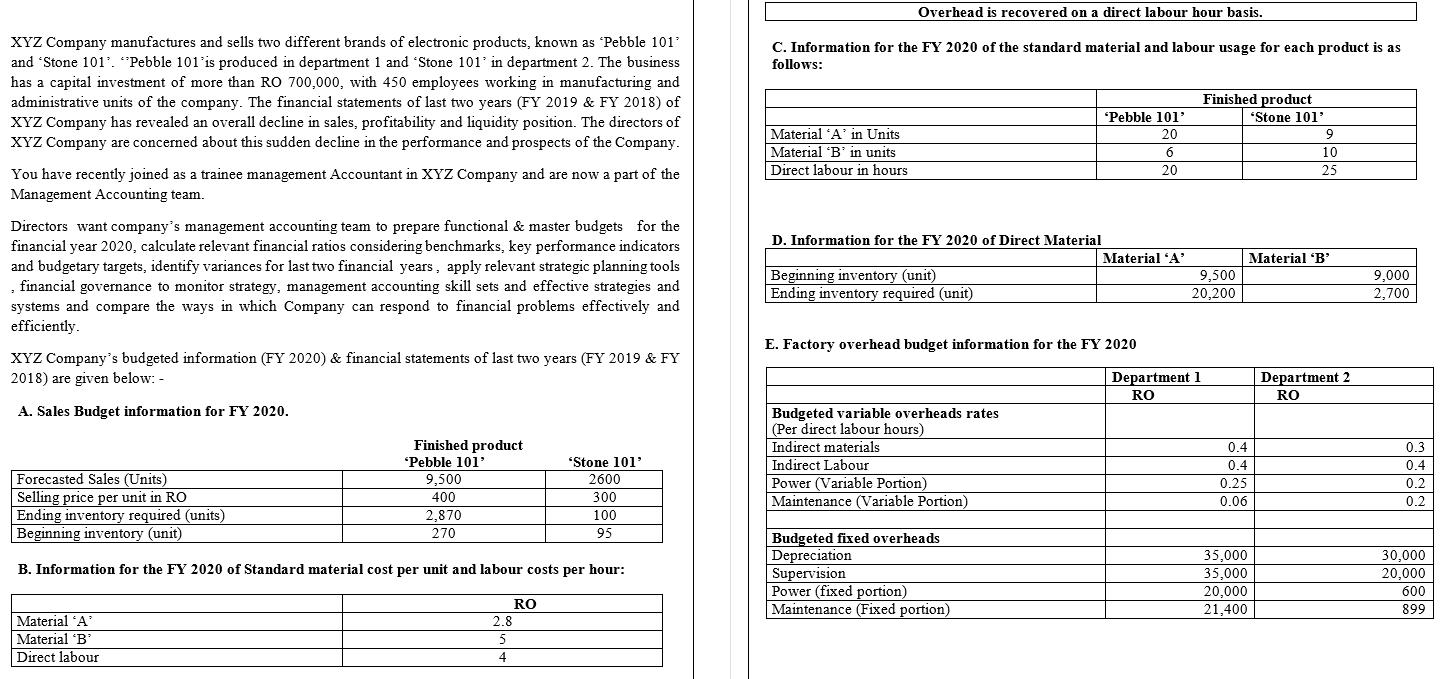

XYZ Company manufactures and sells two different brands of electronic products, known as 'Pebble 101' and Stone 101'. Pebble 101'is produced in department 1

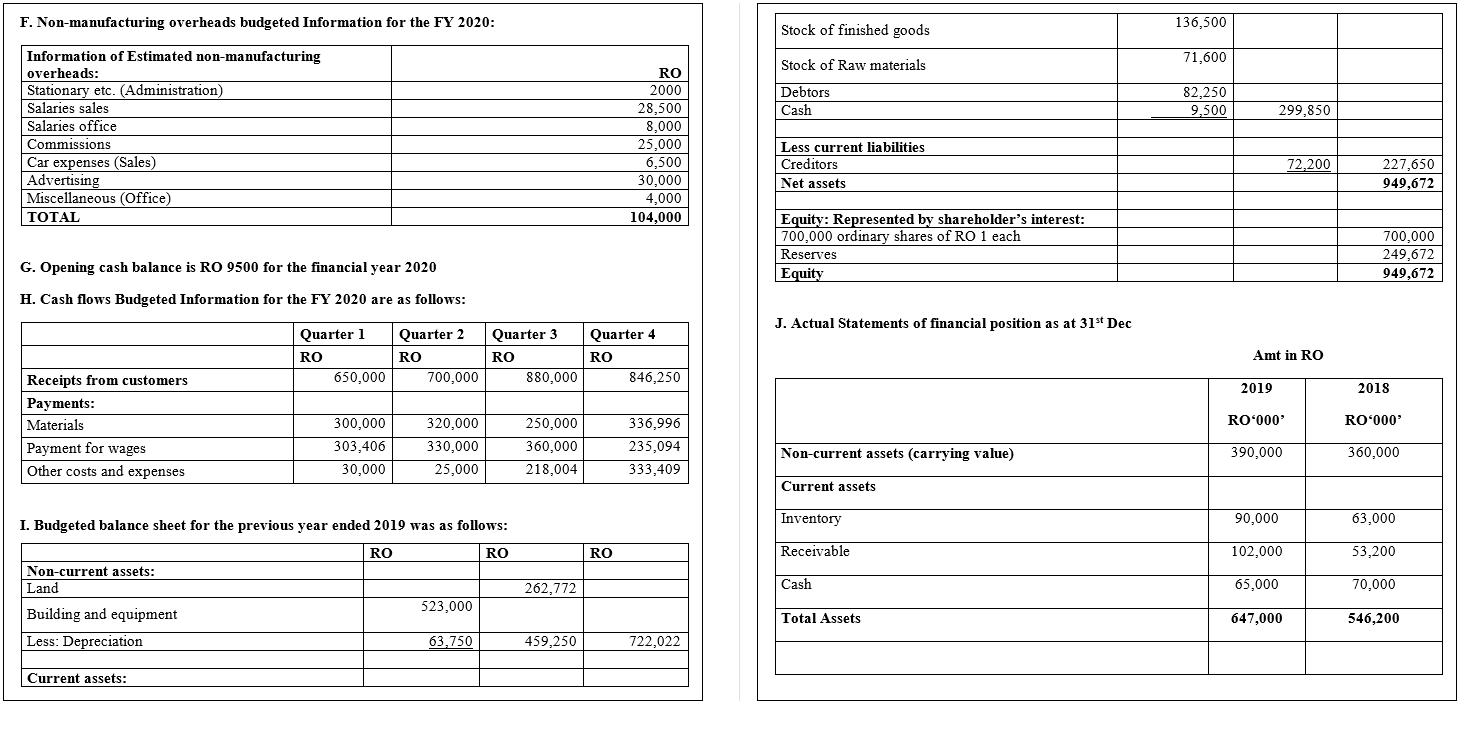

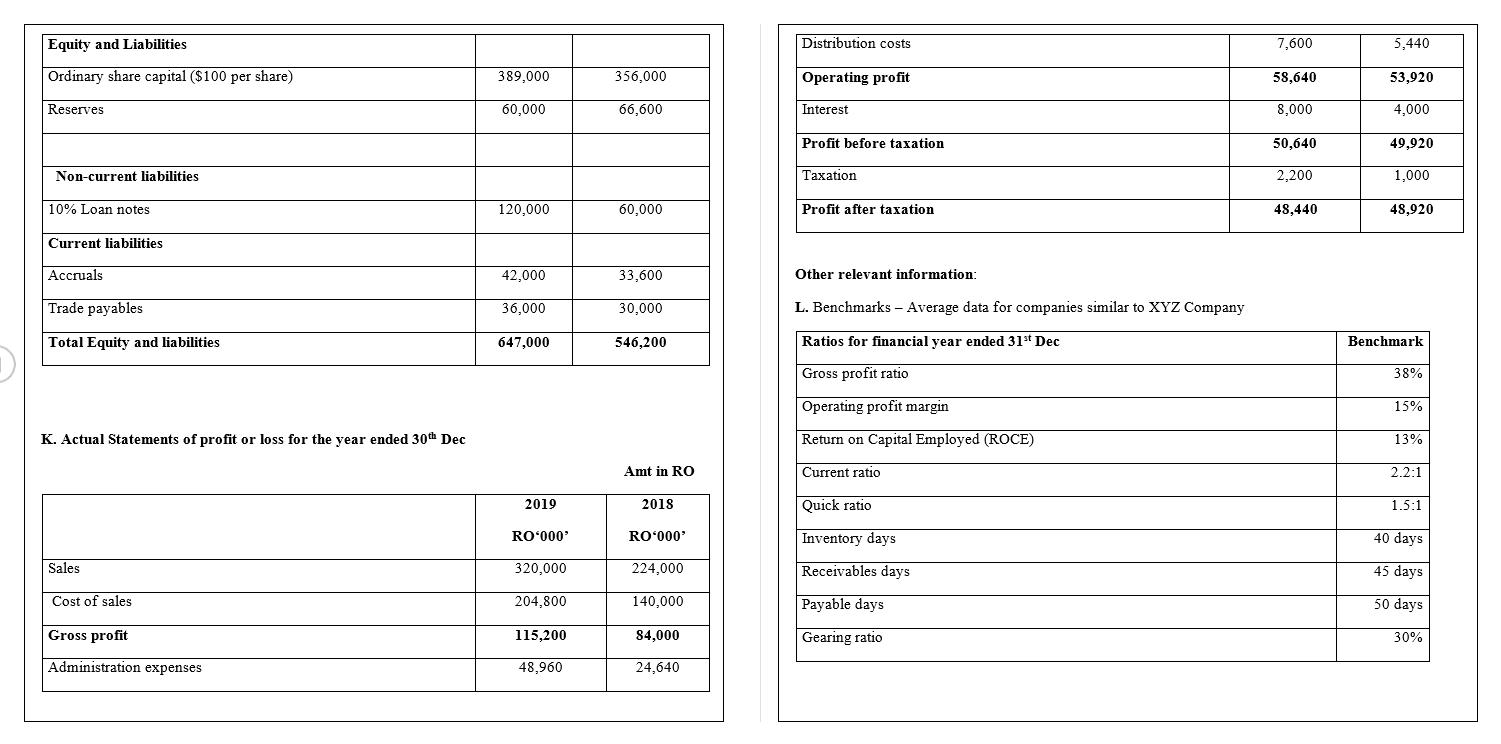

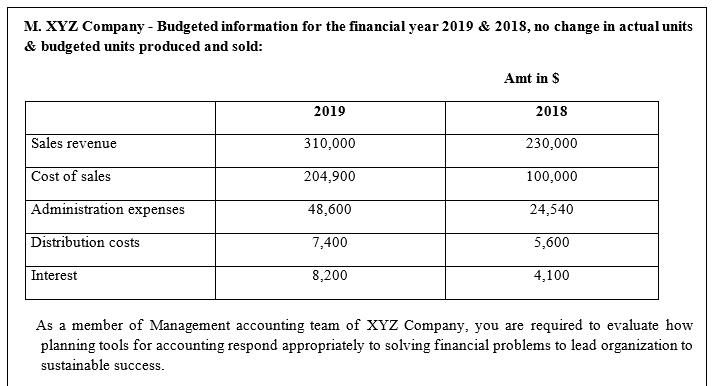

XYZ Company manufactures and sells two different brands of electronic products, known as 'Pebble 101' and "Stone 101'. "Pebble 101'is produced in department 1 and 'Stone 101 in department 2. The business has a capital investment of more than RO 700,000, with 450 employees working in manufacturing and administrative units of the company. The financial statements of last two years (FY 2019 & FY 2018) of XYZ Company has revealed an overall decline in sales, profitability and liquidity position. The directors of XYZ Company are concerned about this sudden decline in the performance and prospects of the Company. You have recently joined as a trainee management Accountant in XYZ Company and are now a part of the Management Accounting team. Directors want company's management accounting team to prepare functional & master budgets for the financial year 2020, calculate relevant financial ratios considering benchmarks, key performance indicators and budgetary targets, identify variances for last two financial years, apply relevant strategic planning tools , financial governance to monitor strategy, management accounting skill sets and effective strategies and systems and compare the ways in which Company can respond to financial problems effectively and efficiently. XYZ Company's budgeted information (FY 2020) & financial statements of last two years (FY 2019 & FY 2018) are given below:- A. Sales Budget information for FY 2020. Finished product 'Pebble 101' Material A Material 'B' Direct labour Forecasted Sales (Units) 9,500 Selling price per unit in RO 400 Ending inventory required (units) 2,870 270 Beginning inventory (unit) B. Information for the FY 2020 of Standard material cost per unit and labour costs per hour: 2.8 5 4 'Stone 101' 2600 300 100 95 RO Overhead is recovered on a direct labour hour basis. C. Information for the FY 2020 of the standard material and labour usage for each product is as follows: Material 'A' in Units. Material 'B' in units Direct labour in hours D. Information for the FY 2020 of Direct Material Beginning inventory (unit) Ending inventory required (unit) Budgeted variable overheads rates (Per direct labour hours) E. Factory overhead budget information for the FY 2020 Indirect materials Indirect Labour Power (Variable Portion) Maintenance (Variable Portion) Budgeted fixed overheads Depreciation Supervision 'Pebble 101' 20 6 20 Power (fixed portion) Maintenance (Fixed portion) Material 'A' Finished product 'Stone 101' 9,500 20,200 Department 1 RO 0.4 0.4 0.25 0.06 35,000 35,000 20,000 21,400 9 10 25 Material 'B' Department 2 RO 9,000 2,700 0.3 0.4 0.2 0.2 30,000 20,000 600 899 F. Non-manufacturing overheads budgeted Information for the FY 2020: Information of Estimated non-manufacturing overheads: Stationary etc. (Administration) Salaries sales Salaries office Commissions Car expenses (Sales) Advertising Miscellaneous (Office) TOTAL G. Opening cash balance is RO 9500 for the financial year 2020 H. Cash flows Budgeted Information for the FY 2020 are as follows: Receipts from customers. Payments: Materials Payment for wages Other costs and expenses Quarter 1 RO Non-current assets: Land Building and equipment Less: Depreciation Current assets: 650,000 300,000 303,406 30,000 Quarter 2 RO 700,000 320,000 330,000 25,000 I. Budgeted balance sheet for the previous year ended 2019 was as follows: RO RO 523,000 Quarter 3 RO 63,750 880,000 250,000 360,000 218,004 262,772 459,250 RO 2000 28,500 8,000 25,000 6,500 30,000 4,000 104,000 Quarter 4 RO RO 846,250 336,996 235,094 333,409 722,022 Stock of finished goods Stock of Raw materials. Debtors Cash Less current liabilities Creditors Net assets Equity: Represented by shareholder's interest: 700,000 ordinary shares of RO 1 each Reserves Equity J. Actual Statements of financial position as at 31st Dec Non-current assets (carrying value) Current assets Inventory Receivable Cash Total Assets 136,500 71,600 82,250 9,500 299,850 2019 Amt in RO RO'000' 390,000 90,000 102,000 65,000 72,200 647,000 227,650 949,672 700,000 249,672 949,672 2018 RO'000' 360,000 63,000 53,200 70,000 546,200 Equity and Liabilities Ordinary share capital ($100 per share) Reserves Non-current liabilities 10% Loan notes Current liabilities Accruals Trade payables Total Equity and liabilities. K. Actual Statements of profit or loss for the year ended 30th Dec Sales Cost of sales Gross profit Administration expenses 389,000 60,000 120,000 42,000 36,000 647,000 2019 RO'000' 320,000 204,800 115,200 48,960 356,000 66,600 60,000 33,600 30,000 546,200 Amt in RO 2018 RO'000' 224,000 140,000 84,000 24,640 Distribution costs Operating profit Interest Profit before taxation Taxation Profit after taxation Other relevant information: L. Benchmarks - Average data for companies similar to XYZ Company Ratios for financial year ended 31st Dec Gross profit ratio Operating profit margin Return on Capital Employed (ROCE) Current ratio Quick ratio Inventory days Receivables days Payable days Gearing ratio 7,600 58,640 8,000 50,640 2,200 48,440 5,440 53,920 4,000 49,920 1,000 48,920 Benchmark 38% 15% 13% 2.2:1 1.5:1 40 days 45 days 50 days 30% M. XYZ Company - Budgeted information for the financial year 2019 & 2018, no change in actual units & budgeted units produced and sold: Sales revenue Cost of sales Administration expenses Distribution costs Interest 2019 310,000 204,900 48,600 7,400 8,200 Amt in $ 2018 230,000 100,000 24,540 5,600 4,100 As a member of Management accounting team of XYZ Company, you are required to evaluate how planning tools for accounting respond appropriately to solving financial problems to lead organization to sustainable success.

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

As a member of the Management Accounting team at XYZ Company you have been tasked with evaluating how planning tools for accounting can respond effectively to solve financial problems and lead the org...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started