Answered step by step

Verified Expert Solution

Question

1 Approved Answer

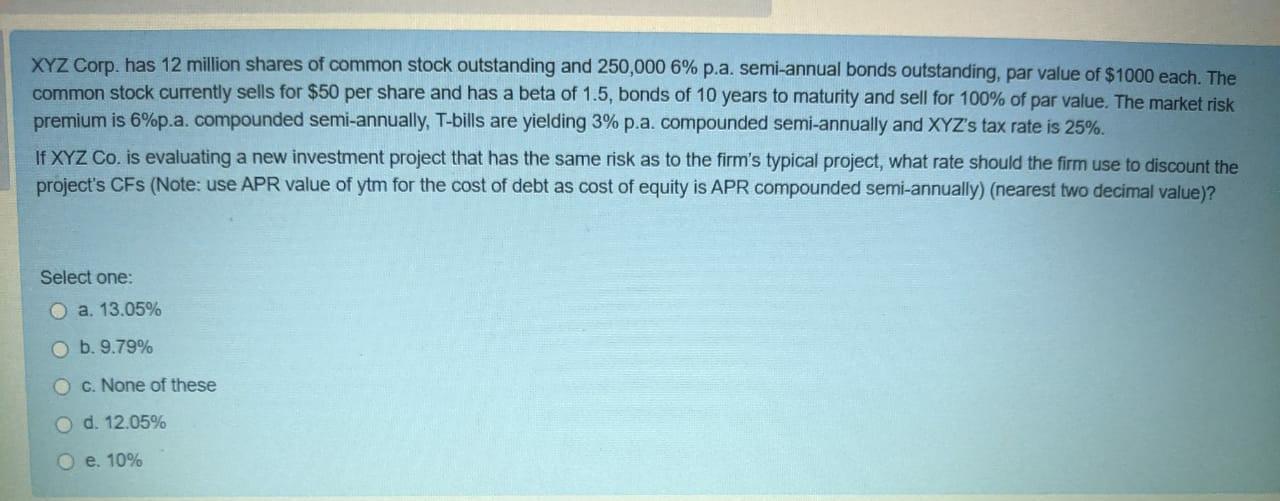

XYZ Corp. has 12 million shares of common stock outstanding and 250,000 6% p.a. semi-annual bonds outstanding, par value of $1000 each. The common stock

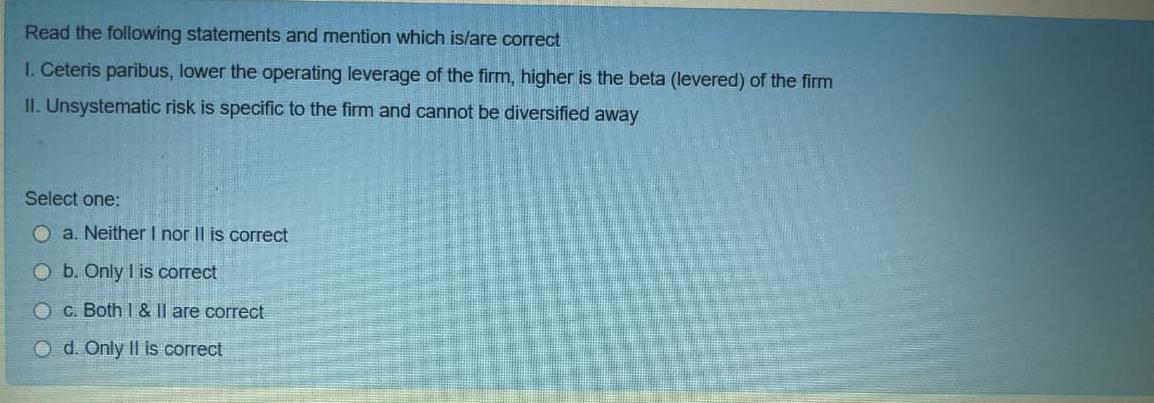

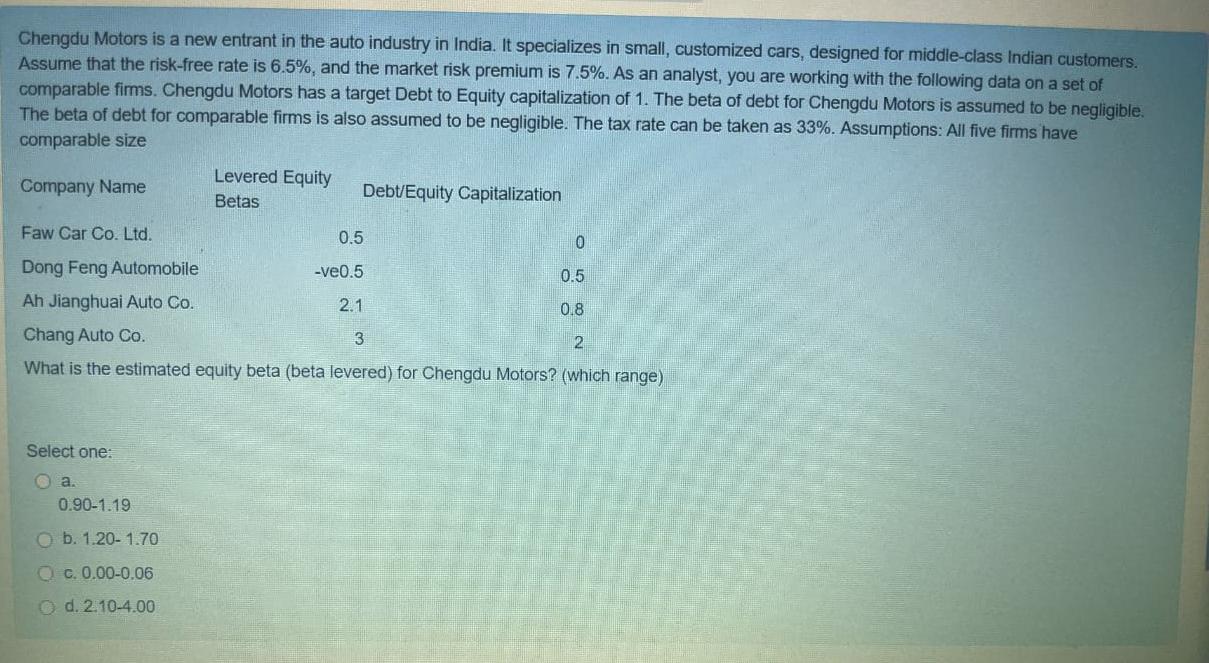

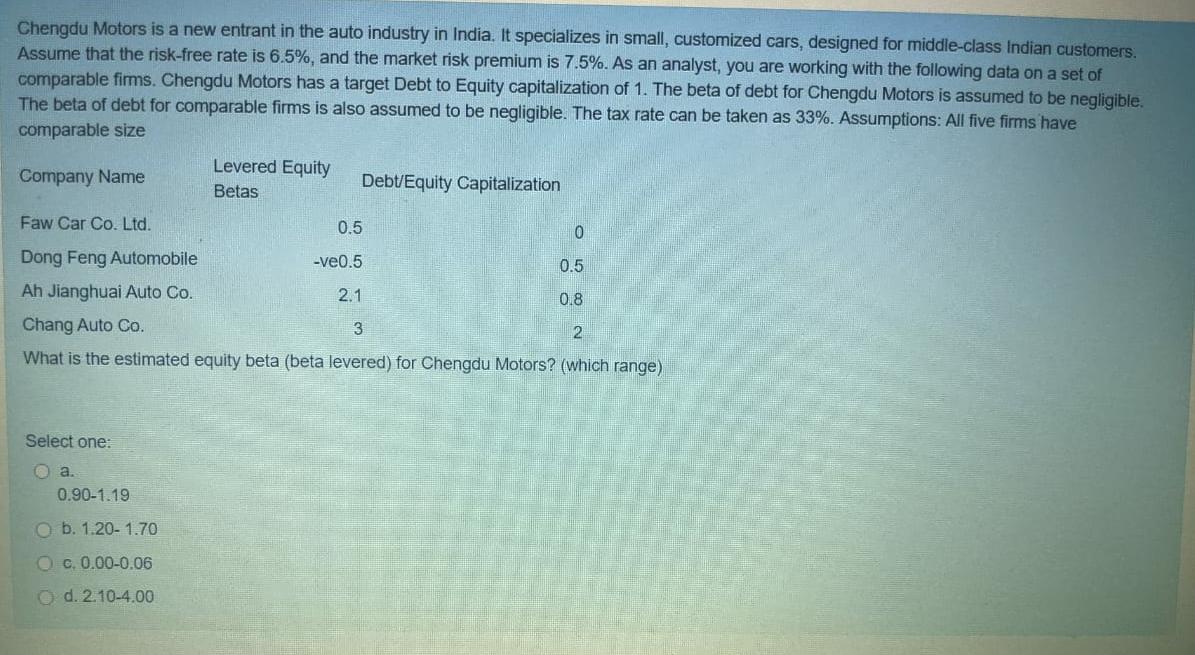

XYZ Corp. has 12 million shares of common stock outstanding and 250,000 6% p.a. semi-annual bonds outstanding, par value of $1000 each. The common stock currently sells for $50 per share and has a beta of 1.5, bonds of 10 years to maturity and sell for 100% of par value. The market risk premium is 6%p.a. compounded semi-annually, T-bills are yielding 3% p.a. compounded semi-annually and XYZ's tax rate is 25%. If XYZ Co. is evaluating a new investment project that has the same risk as to the firm's typical project, what rate should the firm use to discount the project's CFs (Note: use APR value of ytm for the cost of debt as cost of equity is APR compounded semi-annually) (nearest two decimal value)? Select one: O a. 13.05% O b. 9.79% c. None of these O d. 12.05% O e. 10% Read the following statements and mention which is/are correct 1. Ceteris paribus, lower the operating leverage of the firm, higher is the beta (levered) of the firm II. Unsystematic risk is specific to the firm and cannot be diversified away Select one: O a. Neither I nor Il is correct O b. Only 1 is correct c. Both I & Il are correct O d. Only II is correct Chengdu Motors is a new entrant in the auto industry in India. It specializes in small, customized cars, designed for middle-class Indian customers. Assume that the risk-free rate is 6.5%, and the market risk premium is 7.5%. As an analyst, you are working with the following data on a set of comparable firms. Chengdu Motors has a target Debt to Equity capitalization of 1. The beta of debt for Chengdu Motors is assumed to be negligible. The beta of debt for comparable firms is also assumed to be negligible. The tax rate can be taken as 33%. Assumptions: All five firms have comparable size Levered Equity Company Name Debt/Equity Capitalization Betas Faw Car Co. Ltd. 0.5 0 Dong Feng Automobile -ve0.5 0.5 Ah Jianghuai Auto Co. 2.1 0.8 Chang Auto Co. 3 2 What is the estimated equity beta (beta levered) for Chengdu Motors? (which range) Select one: a. 0.90-1.19 O b. 1.20- 1.70 c. 0.00-0.06 d. 210-4.00 Chengdu Motors is a new entrant in the auto industry in India. It specializes in small, customized cars, designed for middle-class Indian customers. Assume that the risk-free rate is 6.5%, and the market risk premium is 7.5%. As an analyst, you are working with the following data on a set of comparable firms. Chengdu Motors has a target Debt to Equity capitalization of 1. The beta of debt for Chengdu Motors is assumed to be negligible. The beta of debt for comparable firms is also assumed to be negligible. The tax rate can be taken as 33%. Assumptions: All five firms have comparable size Levered Equity Company Name Debt/Equity Capitalization Betas Faw Car Co. Ltd. 0.5 0 Dong Feng Automobile -ve0.5 0.5 Ah Jianghuai Auto Co. 2.1 0.8 Chang Auto Co. 3 2 What is the estimated equity beta (beta levered) for Chengdu Motors? (which range) Select one: a. 0.90-1.19 b. 1.20- 1.70 c. 0.00-0.06 d. 2.10-4.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started