Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XYZ Corp. is considering introducing a new 90 flat screen television/monitor for the consumer market. The company's CFO has collected the following information about

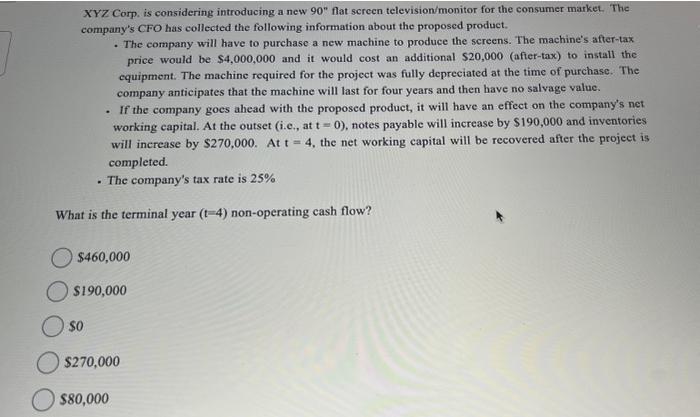

XYZ Corp. is considering introducing a new 90" flat screen television/monitor for the consumer market. The company's CFO has collected the following information about the proposed product. . The company will have to purchase a new machine to produce the screens. The machine's after-tax price would be $4,000,000 and it would cost an additional $20,000 (after-tax) to install the equipment. The machine required for the project was fully depreciated at the time of purchase. The company anticipates that the machine will last for four years and then have no salvage value. If the company goes ahead with the proposed product, it will have an effect on the company's net working capital. At the outset (i.e., at t= 0), notes payable will increase by $190,000 and inventories will increase by $270,000. At t = 4, the net working capital will be recovered after the project is completed. . The company's tax rate is 25% What is the terminal year (t-4) non-operating cash flow? . $460,000 $190,000 $0 $270,000 $80,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The nonoperating cash flow at t0 80000 Determi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started