Question

XYZ Corporation has a target capital structure of 50% common stock, 5% preferred stock, and 45% debt. Its cost of equity is 18%, the

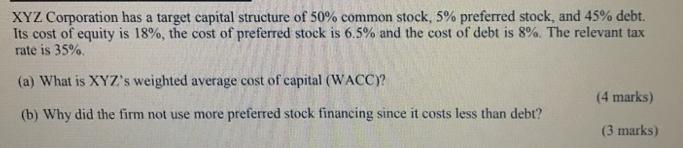

XYZ Corporation has a target capital structure of 50% common stock, 5% preferred stock, and 45% debt. Its cost of equity is 18%, the cost of preferred stock is 6.5% and the cost of debt is 8%. The relevant tax rate is 35%. (a) What is XYZ's weighted average cost of capital (WACC)? (4 marks) (b) Why did the firm not use more preferred stock financing since it costs less than debt? (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate XYZ Corporations weighted average cost of capital WACC we need to determine the weights of each component of capital and multiply them ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Corporate Finance

Authors: Stephen A. Ross, Randolph Westerfield, Bradford D. Jordan

6th Edition

0072553073, 9780072553079

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App