Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XYZ Co.'s employees have a mandatory retirement age of 65. On 1 April 20X3, XYZ Co. offers (and the employee accepts) 10,000 to an

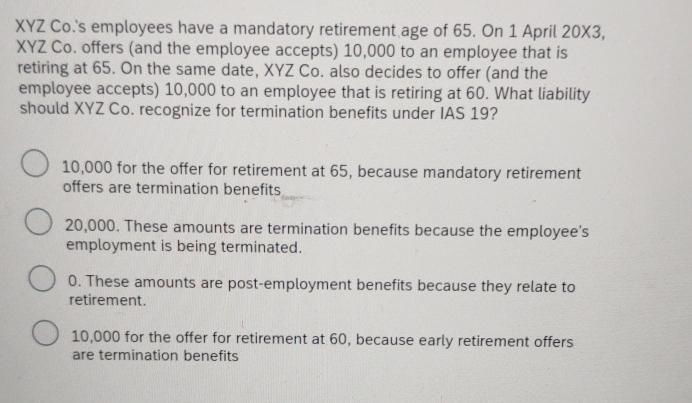

XYZ Co.'s employees have a mandatory retirement age of 65. On 1 April 20X3, XYZ Co. offers (and the employee accepts) 10,000 to an employee that is retiring at 65. On the same date, XYZ Co. also decides to offer (and the employee accepts) 10,000 to an employee that is retiring at 60. What liability should XYZ Co. recognize for termination benefits under IAS 19? 10,000 for the offer for retirement at 65, because mandatory retirement offers are termination benefits 20,000. These amounts are termination benefits because the employee's employment is being terminated. 0. These amounts are post-employment benefits because they relate to retirement. 10,000 for the offer for retirement at 60, because early retirement offers are termination benefits

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The image shows a multiplechoice question referencing International Accounting Standard 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started