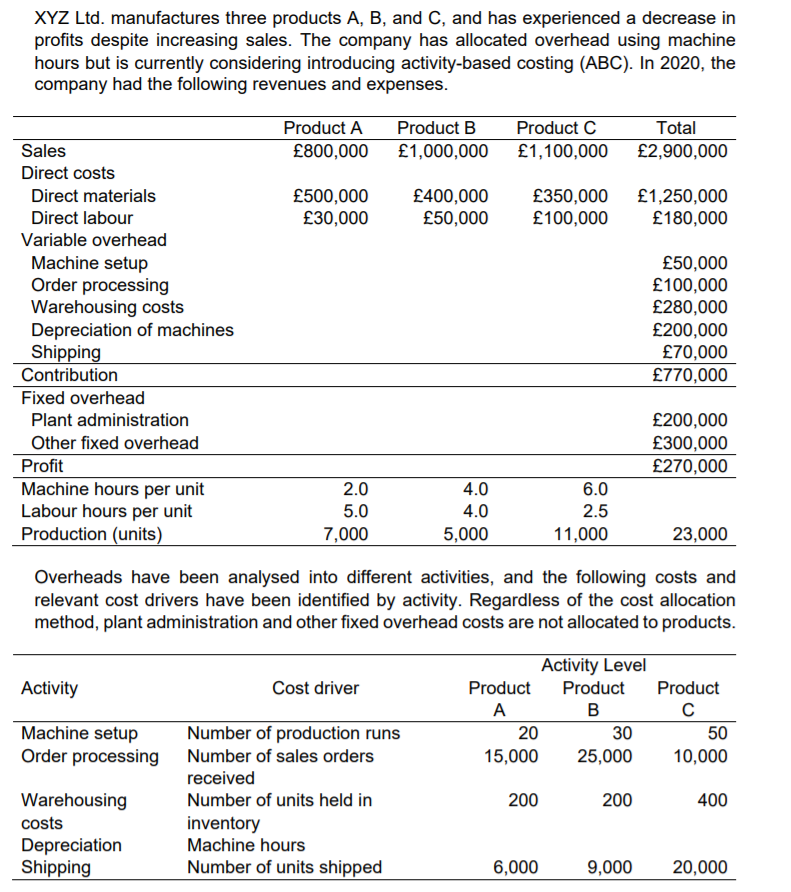

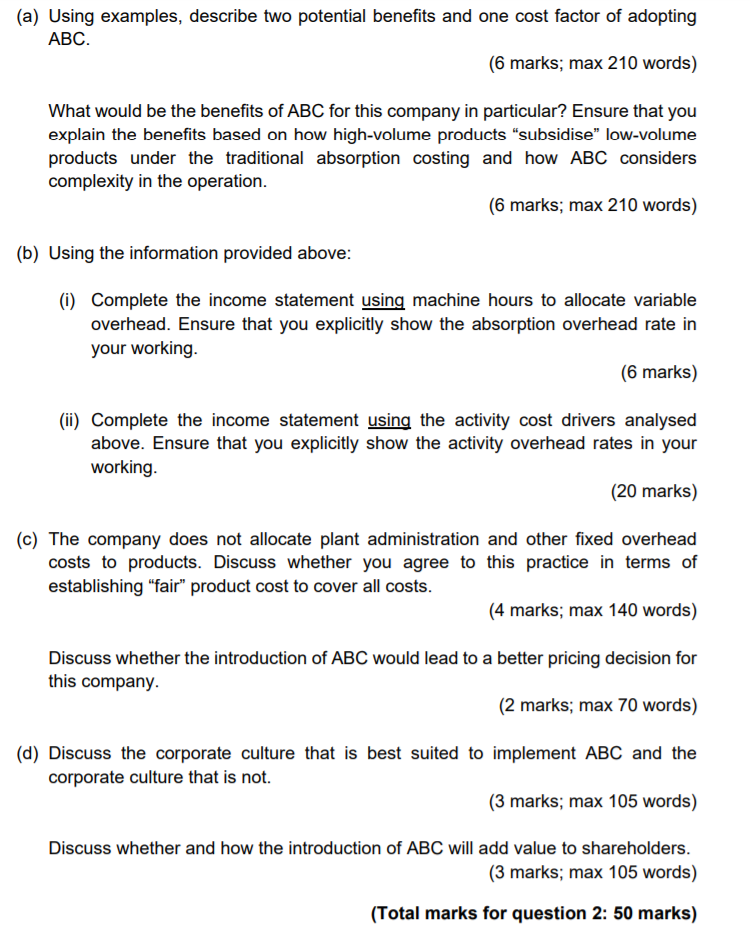

XYZ Ltd. manufactures three products A, B, and C, and has experienced a decrease in profits despite increasing sales. The company has allocated overhead using machine hours but is currently considering introducing activity-based costing (ABC). In 2020, the company had the following revenues and expenses. Product A Product B Product C Total 800,000 1,000,000 1,100,000 2,900,000 Sales Direct costs Direct materials Direct labour Variable overhead 500,000 30,000 400,000 50,000 350,000 100,000 1,250,000 180,000 50,000 100,000 280,000 200,000 70,000 770,000 Machine setup Order processing Warehousing costs Depreciation of machines Shipping Contribution Fixed overhead Plant administration Other fixed overhead Profit Machine hours per unit Labour hours per unit Production (units) 200,000 300,000 270,000 2.0 5.0 7,000 4.0 4.0 5,000 6.0 2.5 11,000 23,000 Overheads have been analysed into different activities, and the following costs and relevant cost drivers have been identified by activity. Regardless of the cost allocation method, plant administration and other fixed overhead costs are not allocated to products. Activity Cost driver Activity Level Product Product Product A B 20 30 50 15,000 25,000 10,000 Machine setup Order processing Number of production runs Number of sales orders received Number of units held in 200 200 400 Warehousing costs Depreciation Shipping inventory Machine hours Number of units shipped 6,000 9,000 20,000 (a) Using examples, describe two potential benefits and one cost factor of adopting ABC. (6 marks; max 210 words) What would be the benefits of ABC for this company in particular? Ensure that you explain the benefits based on how high-volume products subsidise low-volume products under the traditional absorption costing and how ABC considers complexity in the operation. (6 marks; max 210 words) (b) Using the information provided above: (i) Complete the income statement using machine hours to allocate variable overhead. Ensure that you explicitly show the absorption overhead rate in your working (6 marks) (ii) Complete the income statement using the activity cost drivers analysed above. Ensure that you explicitly show the activity overhead rates in your working (20 marks) (c) The company does not allocate plant administration and other fixed overhead costs to products. Discuss whether you agree to this practice in terms of establishing "fair" product cost to cover all costs. (4 marks; max 140 words) Discuss whether the introduction of ABC would lead to a better pricing decision for this company. (2 marks; max 70 words) (d) Discuss the corporate culture that is best suited to implement ABC and the corporate culture that is not (3 marks; max 105 words) Discuss whether and how the introduction of ABC will add value to shareholders. (3 marks; max 105 words) (Total marks for question 2: 50 marks)