Question

XYZ University is seeking from Mr. Copperfield of Dallas, TX. The textbook example was from a few years ago. Now, that the first endowment has

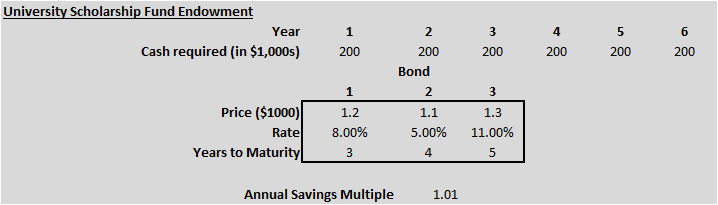

XYZ University is seeking from Mr. Copperfield of Dallas, TX. The textbook example was from a few years ago. Now, that the first endowment has been used up, the university is seeking another donation from him. It would be a one-time donation at the beginning of the next year that should cover the scholarship needs of the next 6 years. The finance department at the university has been asked to give him a number so that he can write the check to the University after running it by his accountant. The Treasurer of the University recalculates the scholarship amounts for the next 6 years (in thousands of dollars), because the new system restricts the amounts for consistency year after year, and the new numbers are as follows and the cash required is due at the beginning of each year:

The financing plan for the University endowment program includes investments in three types government bonds and in savings. Due to the Federal Interest rates plummeting to a low level in 2020 and other financial stresses in the economy, the first type of bond pays 8% interest and matures in 3 years, the second one pays 5% and matures in 4 years, and the third one pays 11% rate and matures in 5 years. The government bonds always pay $1,000 per bond at maturity regardless of their price. Moreover, any of the funds that are not invested in bonds will be placed in a savings account for which the annual rate of interest is 1%. Also, the bond investments have to be made as soon as the funds are received, and more bonds cannot be purchased from that endowment in the next 6 years. Create a Linear Programming Model to help the Treasurer identify what is the minimum amount Mr. Copperfield needs to donate to the University to cover the relevant scholarship costs for the next 6 years.

- You can use the spreadsheet directly from Chapter 8 example file.

- Write the LP equations again, and pay specific attention to the maturity dates for the three bonds

- Make the required changes to the LHS and RHS portions for the relevant constraints in the Excel sheet to obtain a correct solution.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started