Answered step by step

Verified Expert Solution

Question

1 Approved Answer

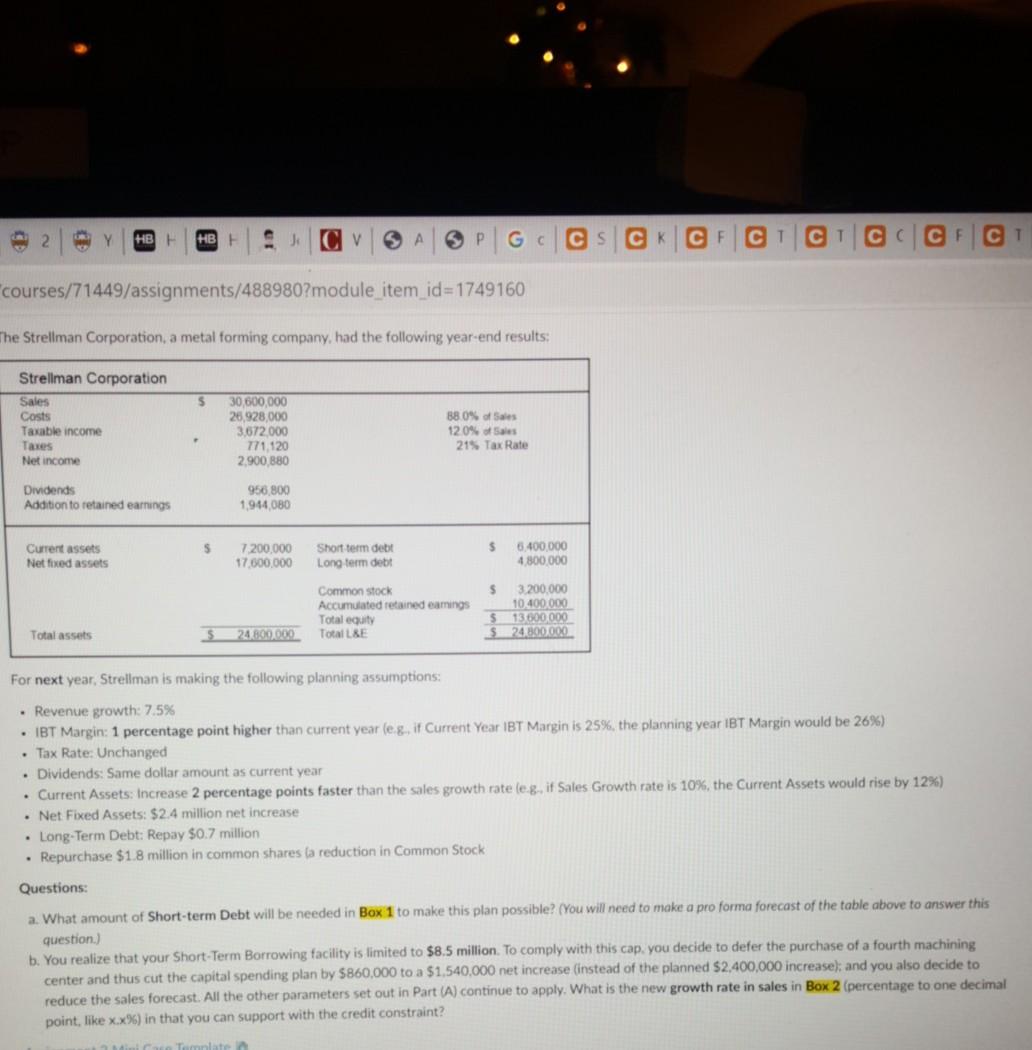

Y HB - HB cs CV SP G C Cs CF CCCCC courses/71449/assignments/488980?module_item_id=1749160 The Strellman Corporation, a metal forming company, had the following year-end results:

Y HB - HB cs CV SP G C Cs CF CCCCC "courses/71449/assignments/488980?module_item_id=1749160 The Strellman Corporation, a metal forming company, had the following year-end results: 5 Strellman Corporation Sales Costs Taxable income Taxes Net income 30,600,000 26,928,000 3,672.000 771.120 2.900 880 88.0% of Sales 120% Sales 215 Tax Rate Dividends Addition to retained earnings 956.800 1944080 $ $ Current assets Net fixed assets 7.200.000 17.000.000 Short term debt Long term debet 6.400,000 4 800 000 Common stock Accumulated retained earings Total equity Total LE 3.200.000 10.400.000 13 800 000 24 800,000 Total assets $24.800.000 $ For next year, Strellman is making the following planning assumptions: Revenue growth: 7.5% IBT Margin: 1 percentage point higher than current year (eg, if Current Year IBT Margin is 25%, the planning year IBT Margin would be 26%) Tax Rate: Unchanged Dividends: Same dollar amount as current year . Current Assets: Increase 2 percentage points faster than the sales growth rate leg, if Sales Growth rate is 10%, the Current Assets would rise by 12%) Net Fixed Assets: $2.4 million net increase Long-Term Debt: Repay $0.7 million Repurchase $1.8 million in common shares la reduction in Common Stock Questions: a. What amount of Short-term Debt will be needed in Box 1 to make this plan possible? (You will need to make a pro forma forecast of the table above to answer this question.) b. You realize that your Short-Term Borrowing facility is limited to $8.5 million. To comply with this cap. you decide to defer the purchase of a fourth machining center and thus cut the capital spending plan by $860,000 to a $1.540,000 net increase (instead of the planned $2,400,000 increase); and you also decide to reduce the sales forecast. All the other parameters set out in Part (A) continue to apply. What is the new growth rate in sales in Box 2 (percentage to one decimal point, like x.x%) in that you can support with the credit constraint

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started