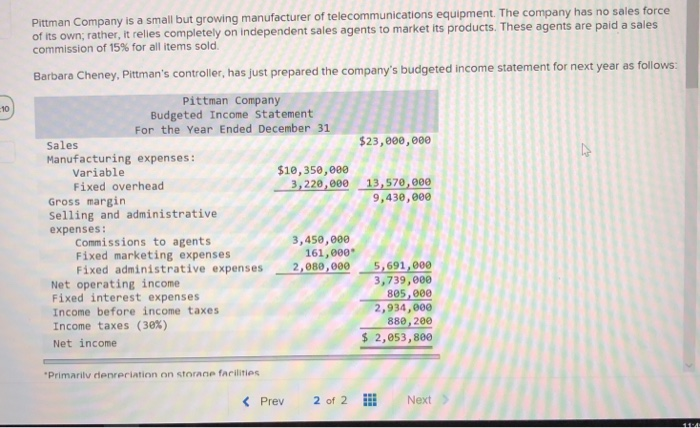

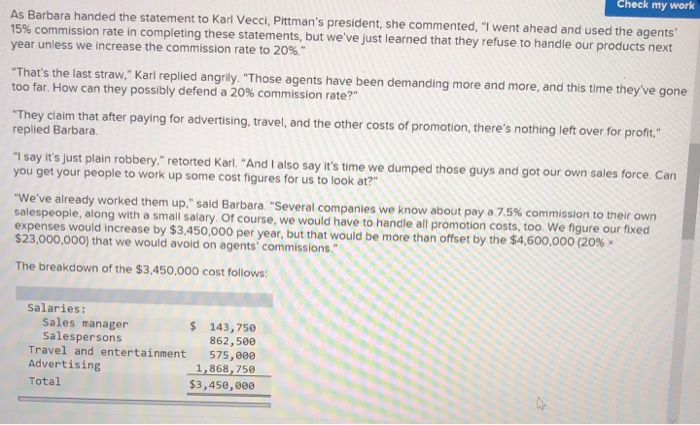

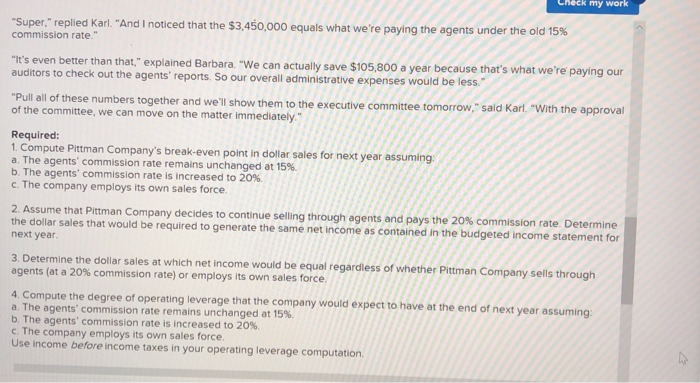

y is a small but growing manufacturer of telecommunications equipment. The company has no sales force Pittman Compan of its own; rather, it relies completely on independent sales agents to market its products. These agen commission of 15% for all items sold. Berbara Cheney, Pittman's controiler, has just prepared the company's budgeted income statement for next year as follows Pittman Company Budgeted Income Statement For the Year Ended December 31 10 $23,000,00e Sales Manufacturing expenses: $10,350,000 Variable Fixed overhead 3,220,000 13,57e,000 9,430,8e0 Gross margin Selling and administrative expenses: 3,450,080 Commissions to agents Fixed marketing expenses Fixed administrative expenses 161,000 2,080,0005,691, Net operating income Fixed interest expenses Income before income taxes Income taxes (30%) Net income 3,739,000 895,000 2,934,80 880 200 2,053,800 Primarilyu denreriation on storane facilities Check my work Super," replied Karl. "And I noticed that the $3,450,000 equals what we're paying the agents un commission rate." "It's even better than that," explained Barbara. "We can actually save $105,800 a year auditors to check out the agents' reports. So our overall administrative expenses would be less because that's "Pull all of these numbers together and w'll show them to the executive committee tomorrow.," sald K of the committee, we can move on the matter immediately." Required 1. Compute Pittman Company's break-even point in dollar sales for next year assuming a. The agents' commission rate remains unchanged at 15%. b. The agents' commission rate is increased to 20% c. The company employs its own sales force. 2. Assume that Pittman Company decides to continue selling through agents and pays the 20% commission rate Determine the dollar sales that would be required to generate the same net income as contained in the budgeted income statement for next year 3. Determine the dollar sales at which net income would be equal regardless of whether Pittman Company sells through agents (at a 20% commission rate) or employs its own sales force. 4 Compute the degree of operating leverage that the company would expect to have at the end of next year assuming: a. The agents' commission rate remains unchanged at 15% b The agents' commission rate is increased to 20%. c. The company employs its own sales force Use income before income taxes in your operating leverage computation