Answered step by step

Verified Expert Solution

Question

1 Approved Answer

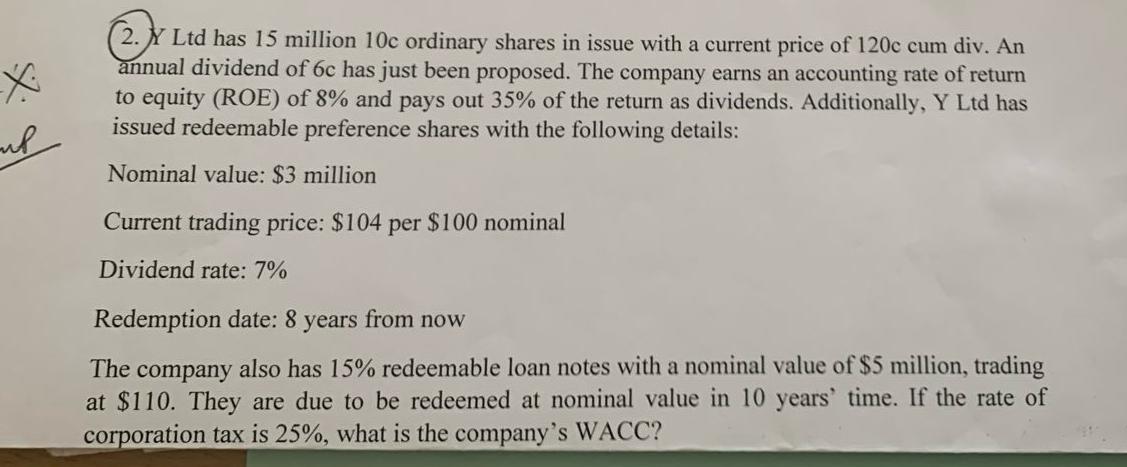

Y Ltd has 1 5 million 1 0 c ordinary shares in issue with a current price of 1 2 0 c cum div. An

Y Ltd has million ordinary shares in issue with a current price of cum div. An annual dividend of has just been proposed. The company earns an accounting rate of return to equity ROE of and pays out of the return as dividends. Additionally, Y Ltd has issued redeemable preference shares with the following details:

Nominal value: $ million

Current trading price: $ per $ nominal

Dividend rate:

Redemption date: years from now

The company also has redeemable loan notes with a nominal value of $ million, trading at $ They are due to be redeemed at nominal value in years' time. If the rate of corporation tax is what is the company's WACC?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started