Question: 3. Terry and June have a property valued at 1,210,000. They have additional cash investments of 75,000. They would like to leave their property

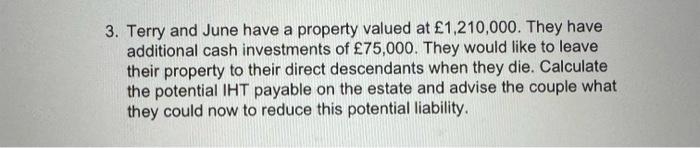

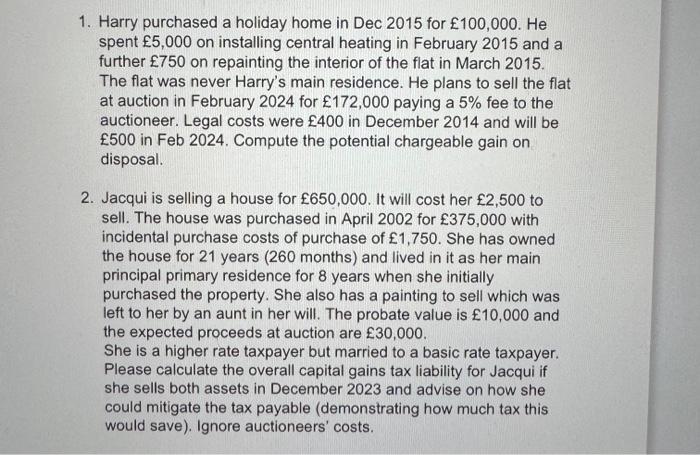

3. Terry and June have a property valued at 1,210,000. They have additional cash investments of 75,000. They would like to leave their property to their direct descendants when they die. Calculate the potential IHT payable on the estate and advise the couple what they could now to reduce this potential liability. 1. Harry purchased a holiday home in Dec 2015 for 100,000. He spent 5,000 on installing central heating in February 2015 and a further 750 on repainting the interior of the flat in March 2015. The flat was never Harry's main residence. He plans to sell the flat at auction in February 2024 for 172,000 paying a 5% fee to the auctioneer. Legal costs were 400 in December 2014 and will be 500 in Feb 2024. Compute the potential chargeable gain on disposal. 2. Jacqui is selling a house for 650,000. It will cost her 2,500 to sell. The house was purchased in April 2002 for 375,000 with incidental purchase costs of purchase of 1,750. She has owned the house for 21 years (260 months) and lived in it as her main principal primary residence for 8 years when she initially purchased the property. She also has a painting to sell which was left to her by an aunt in her will. The probate value is 10,000 and the expected proceeds at auction are 30,000. She is a higher rate taxpayer but married to a basic rate taxpayer. Please calculate the overall capital gains tax liability for Jacqui if she sells both assets in December 2023 and advise on how she could mitigate the tax payable (demonstrating how much tax this would save). Ignore auctioneers' costs.

Step by Step Solution

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Terry and Junes potential IHT liability Estate value Property 1210000 Investments 75000 1285000 Nilrate band allowance in 202324 is 325000 Potential c... View full answer

Get step-by-step solutions from verified subject matter experts