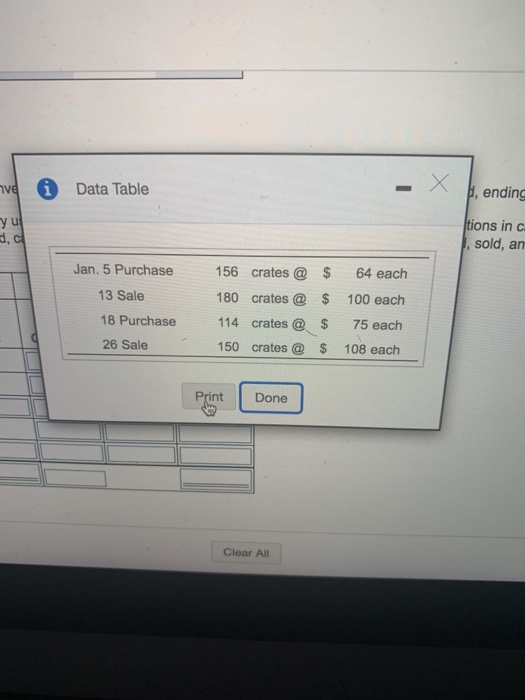

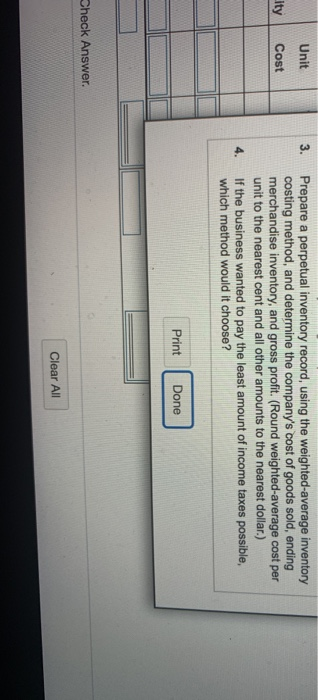

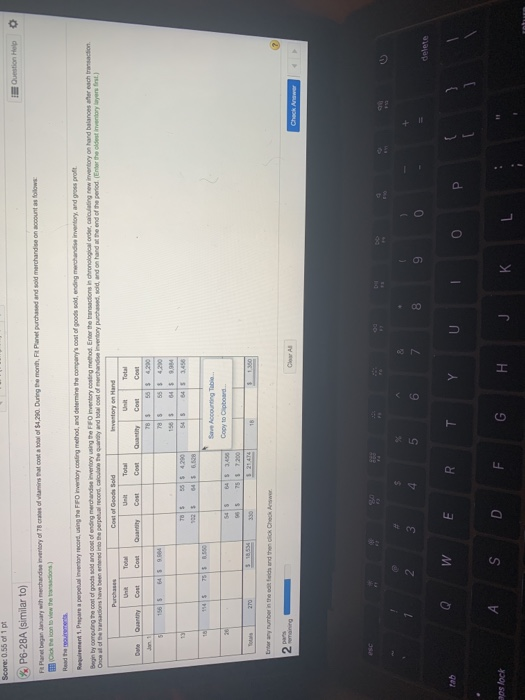

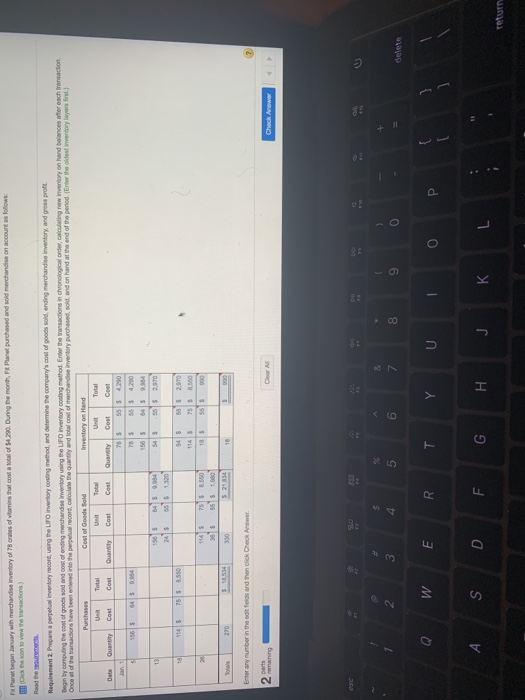

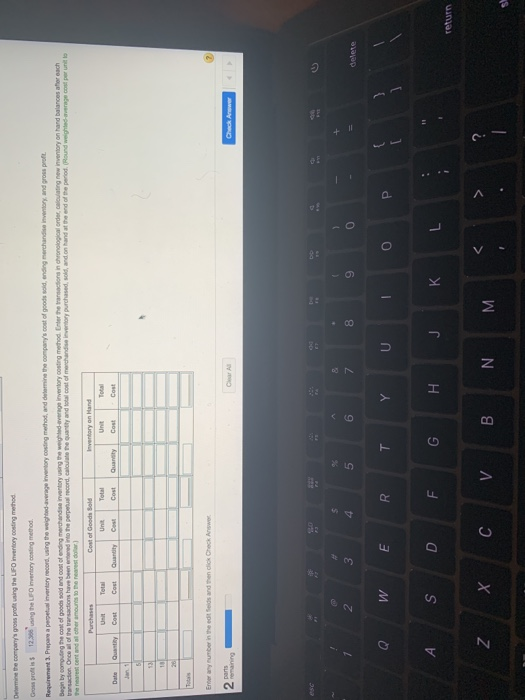

ya Requirement 3. Prepare a perpetual Inventory record, using the weighted average inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross proft Begin by computing the cost of goods sold and cost of ending merchandise inventory using the weighted average inventory costing method: Enter the transactions in chronological order, calculating new inventory on ha transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Round weight the nearestent and all other amounts to the nearest dollar) Purchases Coshof Goods Sold Inventory on Hand Total Unit Total Total Cost Quantity Cost Quantity Enter any number in the ends and then click Check Answer 2 Check And LowERT Yuo G H J K A Data Table H, ending yu tions in c ), sold, an Jan. 5 Purchase 13 Sale 156 crates @ 180 crates @ 114 crates @ 150 crates @ $ $ $ $ 64 each 100 each 75 each 108 each 18 Purchase 26 Sale Pagine Done Clear All Unit Cost Prepare a perpetual inventory record, using the weighted-average inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. (Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar.) If the business wanted to pay the least amount of income taxes possible, which method would it choose? Print Done Check Answer. Clear All cor 0.5 P6-28A (similar to) theory ) rchery purchase of the erpetual reche p O 3,456 A s o F G H J K L of $200During the month, Fanpurchased andmed the cost y b a nd on hand at the end of the period. Er the nearly h cor e f the actions have been the o 2 ananing E RT Y U O a w P s o F G H J K L Determine the company's gross profit using the LIFO inventory costing method Gross profis $ 12.30 using the UFO invertory costing method Requirement 3. Prepare a perpetual inventory record, using the weighted average inventory costing method, and determine the company's cost of goods sold ending merchandisiner, and gross proft Begin by computing the cost of goods sold and cost of ending merchandise v or using the weed-verge inventory costing method Cher the transactions in chronogical ordercolating new inventory on hand balances whereach traction. Once of the reactions have been into the perpetual record, cac h e Guantity and total cost of merchandise very purchased sold, and on hand at the end of the period. Round weight cor netto the restent and all other amounts to the nearest dar) Check Awe delete a WERTY U op i A s o G H K L " return zxc v BN MI