Question

Yandie Izzo manages a dividend growth strategy for a large asset management firm. Izzo meets with her investment team to discuss potential investments in three

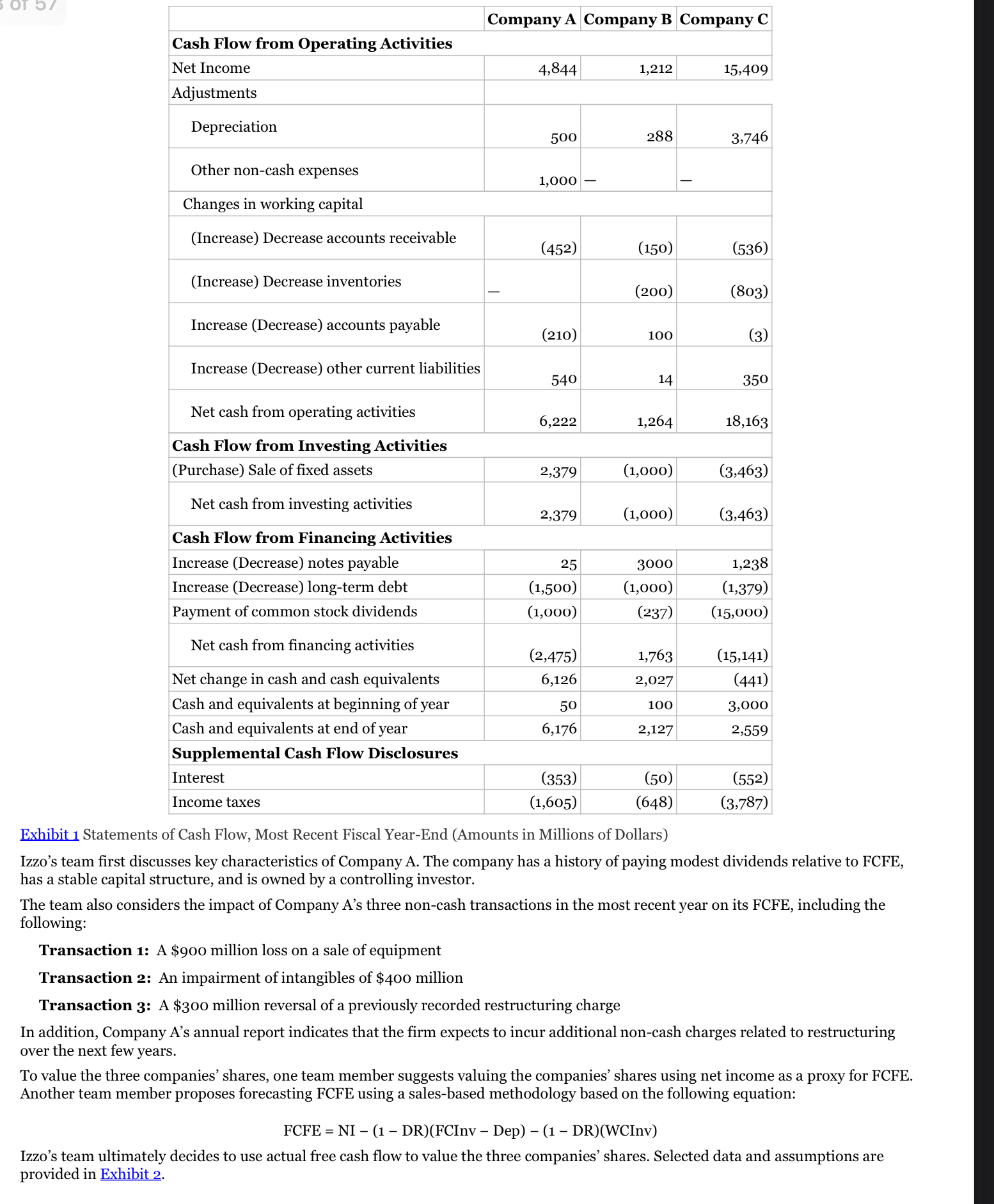

Yandie Izzo manages a dividend growth strategy for a large asset management firm. Izzo meets with her investment team to discuss potential investments in three companies: Company A, Company B, and Company C. Statements of cash flow for the three companies are presented in Exhibit 1.

Please help and provide explanation/calculation to show how you answered the question? WIll thumbs up, thank you !!

28. Based on Exhibit 1, using the proposed sales-based methodology to forecast FCFE would produce an inaccurate FCFE projection for which company? A. Company A B. Company B C. Company C

29A. Based on Exhibits 1 and 2 and the proposed two-stage FCFE model, the intrinsic value of Company Bs equity is closest to:

A. $70,602 million. B. $73,588 million. C. $79,596 million.

29B. Based on Exhibits 1 and 2 and the proposed single-stage FCFF model, the intrinsic value of Company Cs equity is closest to:

A. $277,907 million. B. $295,876 million. C. $306,595 million.

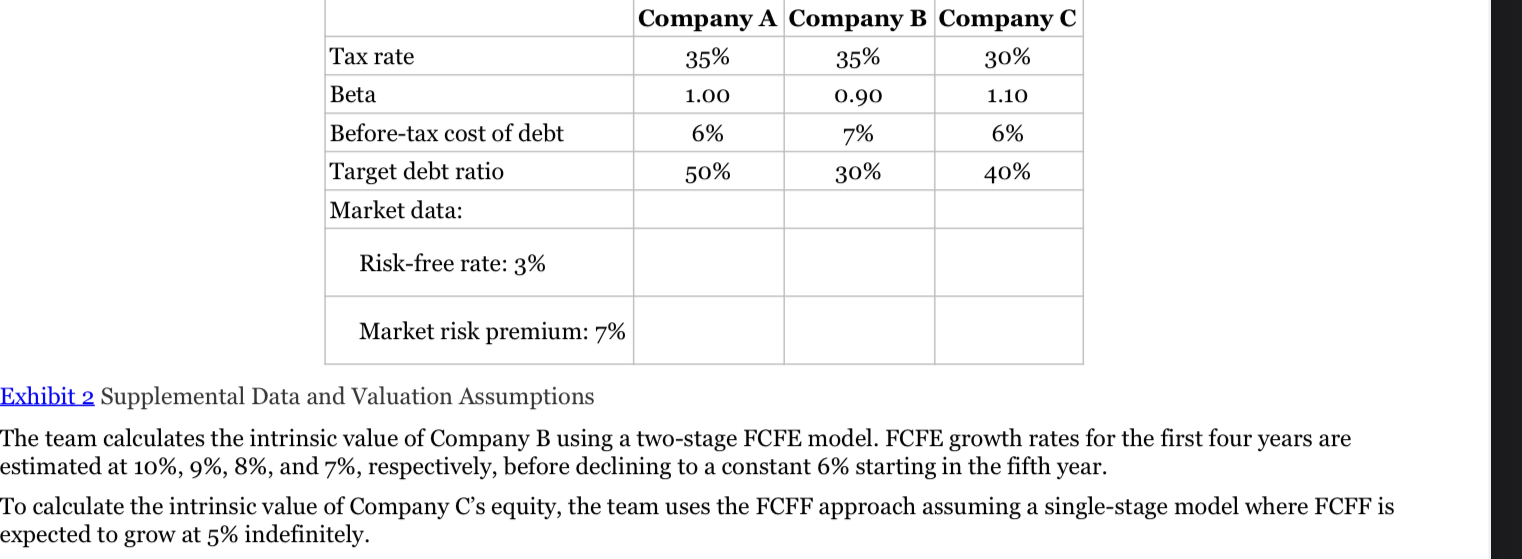

Exhibit 1 Statements Izzo's team first discusses key cnaracterstcs or Lompany A. I ne company nas a nistory or paying modest dividenas relative to FCFE, has a stable capital structure, and is owned by a controlling investor. The team also considers the impact of Company A's three non-cash transactions in the most recent year on its FCFE, including the following: Transaction 1: A $900 million loss on a sale of equipment Transaction 2: An impairment of intangibles of $400 million Transaction 3: A $300 million reversal of a previously recorded restructuring charge In addition, Company A's annual report indicates that the firm expects to incur additional non-cash charges related to restructuring over the next few years. To value the three companies' shares, one team member suggests valuing the companies' shares using net income as a proxy for FCFE. Another team member proposes forecasting FCFE using a sales-based methodology based on the following equation: FCFE=NI(1DR)(FCInvDep)(1DR)(WCInv) Izzo's team ultimately decides to use actual free cash flow to value the three companies' shares. Selected data and assumptions are provided in Exhibit 2. Exhibit 2 Supplemental Data and Valuation Assumptions The team calculates the intrinsic value of Company B using a two-stage FCFE model. FCFE growth rates for the first four years are estimated at 10%,9%,8%, and 7%, respectively, before declining to a constant 6% starting in the fifth year. To calculate the intrinsic value of Company C's equity, the team uses the FCFF approach assuming a single-stage model where FCFF is expected to grow at 5% indefinitelyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started