Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Yankee, a US firm, needs to raise USD1 billion or equivalent to acquire Broncon, an Australian firm. Therefore, Yankee firm is trying to decide between

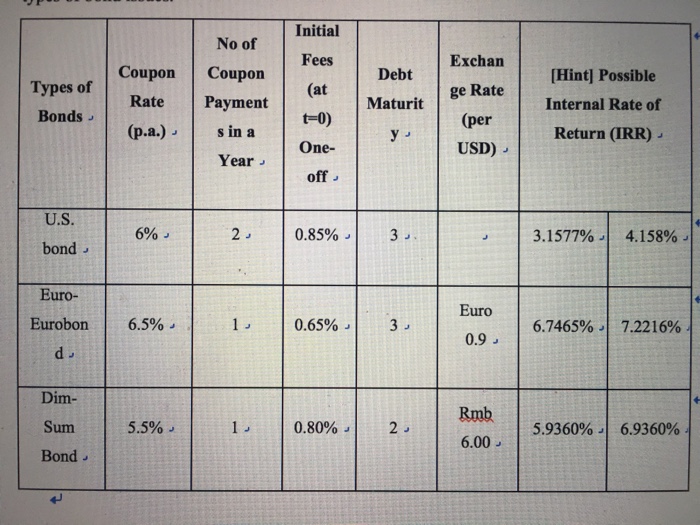

Yankee, a US firm, needs to raise USD1 billion or equivalent to acquire Broncon, an Australian firm. Therefore, Yankee firm is trying to decide between the following three types of bond issues.

Assuming all else is equal, which is the least expensive bond issue solely based on All-in cost for Yankee firm? Please show your full workings. [Hint: Compare the annualized yield to maturity (YTM) for each bond issue. Use the possible internal rate of return given above to speed up your calculation.]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started