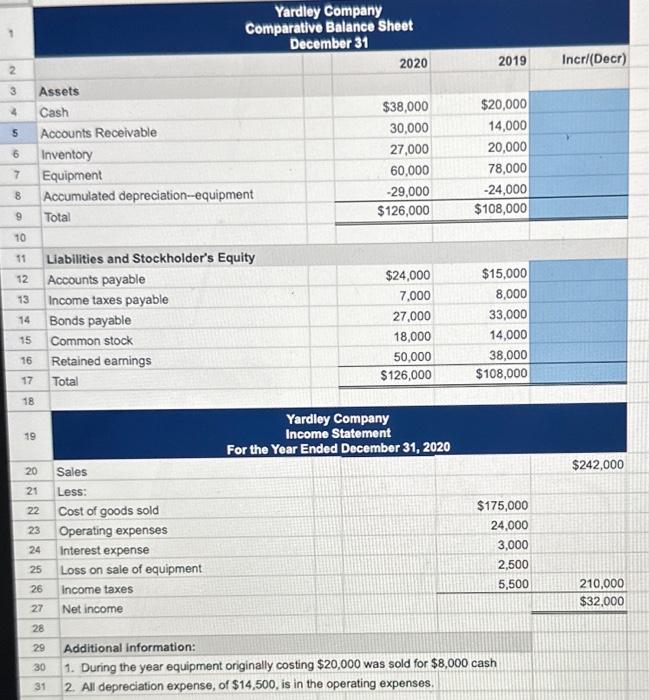

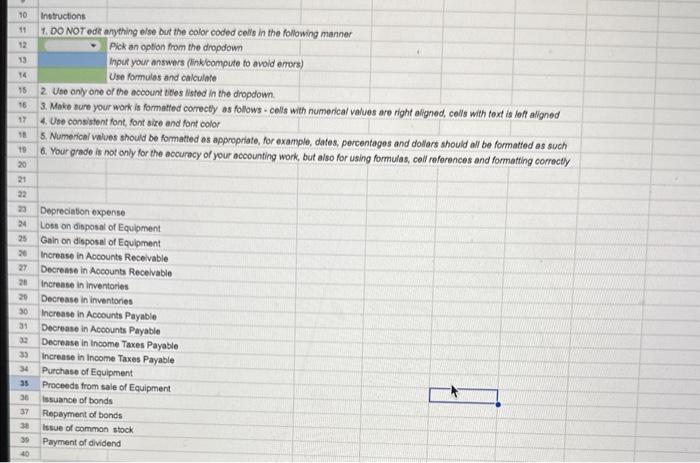

Yardley Company Comparative Balance Sheet December 31 \begin{tabular}{|l|l} \hline 2 & \\ \hline 3 & Assets \\ \hline 4 & Cash \\ \hline 5 & Accounts Receivable \\ \hline 6 & Inventory \\ \hline 7 & Equipment \\ \hline 8 & Accumulated depreciation-equipment \\ \hline & Total \end{tabular} 20202019Incr/(Decr) \begin{tabular}{|l|l|r|r|} \hline 12 & Accounts payable & $24,000 & $15,000 \\ \hline 13 & Income taxes payable & 7,000 & 8,000 \\ \hline 14 & Bonds payable & 27,000 & 33,000 \\ \hline 15 & Common stock & 18,000 & 14,000 \\ \hline 16 & Retained earnings & 50,000 & 38,000 \\ \hline 17 & Total & $126,000 & $108,000 \\ \hline \end{tabular} Yardley Company Income Statement For the Year Ended December 31, 2020 20 Sales $242,000 21 Less: 29 Additional information: 30 1. During the year equipment originally costing $20,000 was sold for $8,000 cash 31 2. All depreciation expense, of $14,500, is in the operating expenses. 1. DO NOT edr anthing else but the color coded cells in the following manner * Pick an opton from the dropdown inpur your answers (inklcompute to avoid enors) Use fomules and calculate 2. Use only ane of the acoount bites listed in the dropdown. 3. Make sure your work is formaHted comectly as follows - colls with numerical values are right alligned, ceils with toxt is loft alligned 4. Use consistent font, font size and font color 5. Numerical values should be fomatted as appropriate, for example, dates, porcentages and dollars should all bo formatiod as such 6. Your grade is not only for the accuracy of your accounting work, but aiso for using formuias, cell references and formatting correctly Depreciabon expense Loss on disposal of Equipment Gain on disposel of Equipment Increase in Accounts Receivable Decrease in Accounts Recelvable increase in inventories Decrease in inventories Increase in Acoounts Payable Decrease in Acoounts Payable Decrease in Income Taxes Payable Increase in income Taxes Payable Purchase of Equipment Proceeds from sale of Equipment issuance of bonds Repayment of bonds Issue of common stock Payment of dividend