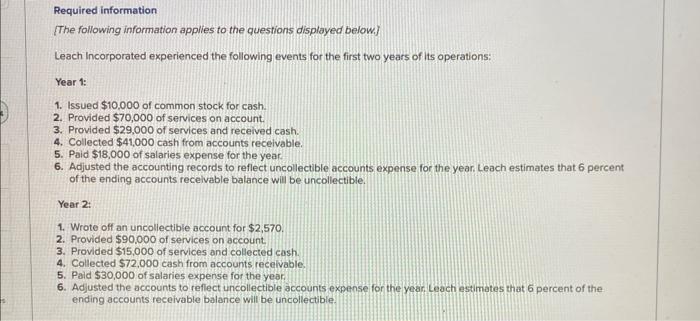

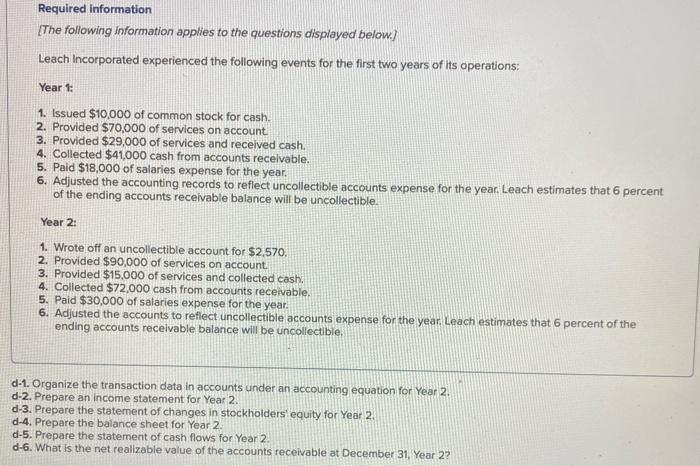

Year 1: 1. Issued $10,000 of common stock for cash. 2. Provided $70,000 of services on account. 3. Provided $29,000 of services and received cash. 4. Collected $41,000 cash from accounts recelvable. 5. Paid $18,000 of salaries expense for the year. 6. Adjusted the accounting records to reflect uncollectible accounts expense for the year Leach estimates that 6 percent of the ending accounts recelvable balance will be uncollectible. Year 2: 1. Wrote off an uncollectible account for $2,570. 2. Provided $90,000 of services on account. 3. Provided $15,000 of services and collected cash. 4. Collected \$72,000 cash from accounts recelvable. 5. Paid $30,000 of salaries expense for the year 6. Adjusted the accounts to reflect uncollectible accounts expense for the year Leach estimates that 6 percent of the ending accounts receivable balance will be uncollectible. Year 1: 1. Issued $10,000 of common stock for cash. 2. Provided $70,000 of services on account 3. Provided $29,000 of services and received cash. 4. Collected $41,000 cash from accounts recelvable. 5. Paid $18,000 of salaries expense for the year. 6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 6 percent of the ending accounts recelvable balance will be uncollectible. Year 2: 1. Wrote off an uncollectible account for $2,570, 2. Provided $90,000 of services on account 3. Provided $15,000 of services and collected cash. 4. Collected $72,000 cash from accounts receivable. 5. Paid $30,000 of salaries expense for the year: 6. Adjusted the accounts to reflect uncollectible accounts expense for the year Leach estimates that 6 percent of the ending accounts receivable balance will be uncollectible. d-1. Organize the transaction data in accounts under an accounting equation for Year 2 . d-2. Prepare an income statement for Year 2. d-3. Prepare the statement of changes in stockholders equity for Year 2. d-4. Prepare the balance sheet for Year 2. d-5. Prepare the statement of cash flows for Year 2. d-6. What is the net realizable value of the accounts receivable at December 31, Year 2