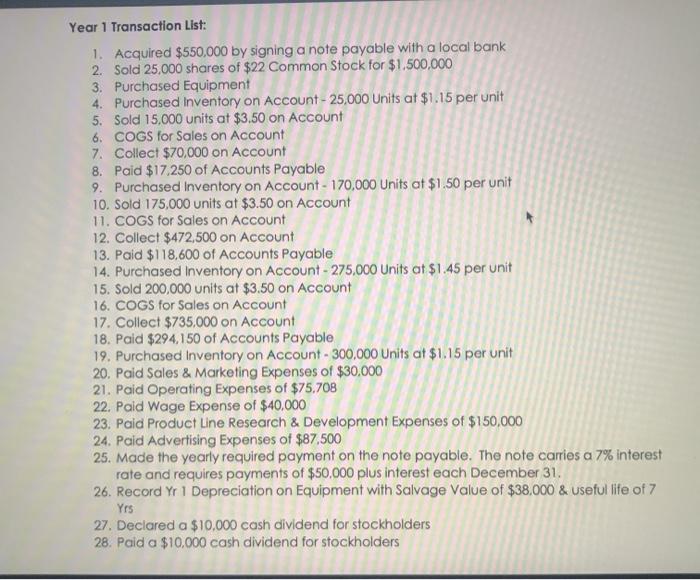

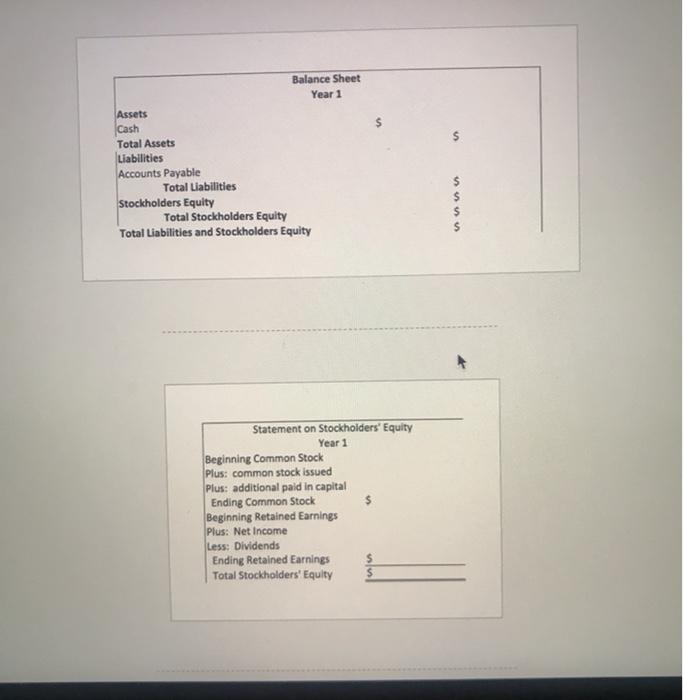

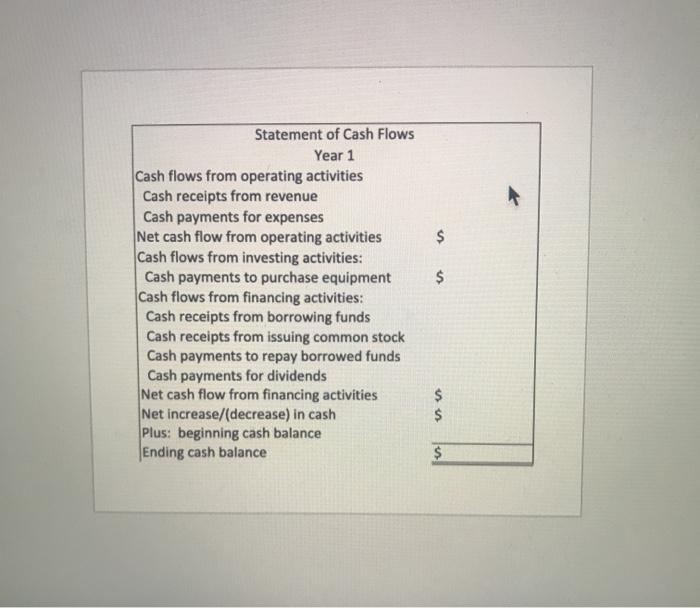

Year 1 Transaction List: 1. Acquired $550,000 by signing a note payable with a local bank 2. Sold 25.000 shares of $22 Common Stock for $1.500,000 3. Purchased Equipment 4. Purchased Inventory on Account - 25,000 Units at $1.15 per unit 5. Sold 15,000 units at $3.50 on Account 6. COGS for Sales on Account 7. Collect $70,000 on Account 8. Paid $17.250 of Accounts Payable 9. Purchased Inventory on Account - 170.000 units at $1.50 per unit 10. Sold 175,000 units at $3.50 on Account 11. COGS for Sales on Account 12. Collect $472,500 on Account 13. Paid $118,600 of Accounts Payable 14. Purchased Inventory on Account - 275,000 Units at $1.45 per unit 15. Sold 200,000 units at $3.50 on Account 16. COGS for Sales on Account 17. Collect $735.000 on Account 18. Paid $294,150 of Accounts Payable 19. Purchased Inventory on Account - 300,000 units at $1.15 per unit 20. Paid Sales & Marketing Expenses of $30,000 21. Paid Operating Expenses of $75.708 22. Paid Wage Expense of $40,000 23. Paid Product Line Research & Development Expenses of $150,000 24. Paid Advertising Expenses of $87,500 25. Made the yearly required payment on the note payable. The note carries a 7% interest rate and requires payments of $50,000 plus interest each December 31. 26. Record Yr 1 Depreciation on Equipment with Salvage Value of $38,000 & useful life of 7 Yrs 27. Declared a $10,000 cash dividend for stockholders 28. Paid a $10,000 cash dividend for stockholders $ Balance Sheet Year 1 Assets Cash Total Assets Liabilities Accounts Payable Total Liabilities Stockholders Equity Total Stockholders Equity Total Liabilities and Stockholders Equity Statement on Stockholders' Equity Year 1 Beginning Common Stock Plus: common stock issued Plus: additional paid in capital Ending Common Stock Beginning Retained Earnings Plus: Net Income Less: Dividends Ending Retained Earnings $ Total Stockholders' Equity $ $ $ $ Statement of Cash Flows Year 1 Cash flows from operating activities Cash receipts from revenue Cash payments for expenses Net cash flow from operating activities Cash flows from investing activities: Cash payments to purchase equipment Cash flows from financing activities: Cash receipts from borrowing funds Cash receipts from issuing common stock Cash payments to repay borrowed funds Cash payments for dividends Net cash flow from financing activities Net increase/(decrease) in cash Plus: beginning cash balance Ending cash balance $ $ $