Answered step by step

Verified Expert Solution

Question

1 Approved Answer

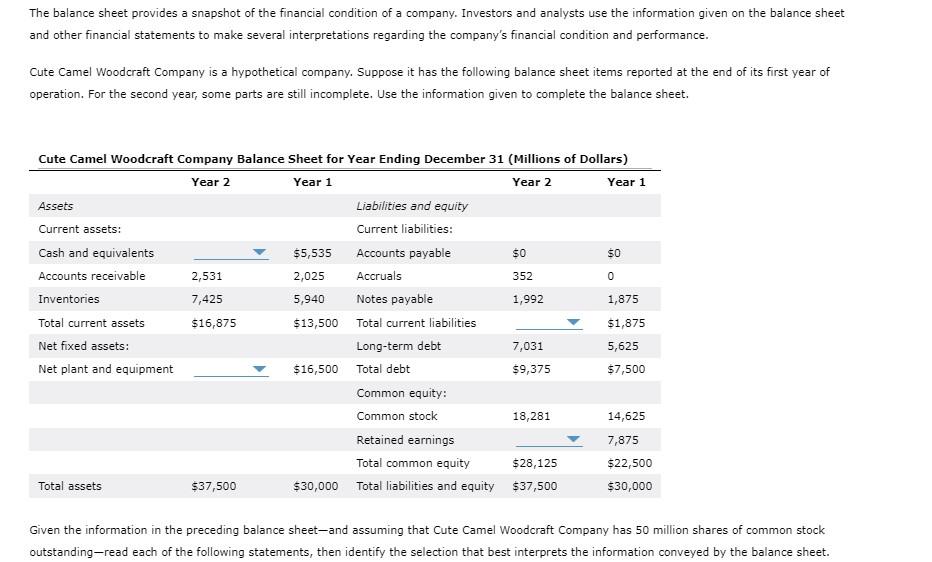

Year 2 options cash n equivalents : 21,769, 18,394, 6,919 Year 2 total current liabilitie s: 3,516, 2,344,2930 Year 2: net plant n equipment :

Year 2 options cash n equivalents : 21,769, 18,394, 6,919

Year 2 total current liabilities: 3,516, 2,344,2930

Year 2: net plant n equipment: 20,625, 34,969,31560

year 2 retained earnings: 37,125,7875,9844

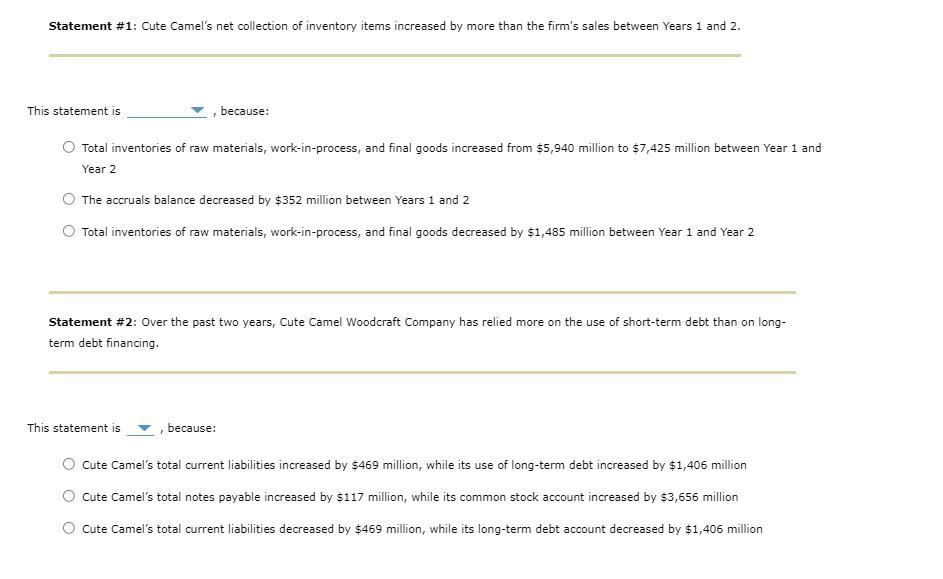

statement 1: Correct, incorrect

Statement 2: true,false

statement 3: correct, incorrect

The balance sheet provides a snapshot of the financial condition of a company. Investors and analysts use the information given on the balance sheet and other financial statements to make several interpretations regarding the company's financial condition and performance. Cute Camel Woodcraft Company is a hypothetical company. Suppose it has the following balance sheet items reported at the end of its first year of operation. For the second year, some parts are still incomplete. Use the information given to complete the balance sheet. Given the information in the preceding balance sheet-and assuming that Cute Camel Woodcraft Company has 50 million shares of common stock outstanding-read each of the following statements, then identify the selection that best interprets the information conveyed by the balance sheet. Statement #1: Cute Camel's net collection of inventory items increased by more than the firm's sales between Years 1 and 2. This statement is , because: Total inventories of raw materials, work-in-process, and final goods increased from $5,940 million to $7,425 million between Year 1 and Year 2 The accruals balance decreased by $352 million between Years 1 and 2 Total inventories of raw materials, work-in-process, and final goods decreased by $1,485 million between Year 1 and Year 2 Statement #2: Over the past two years, Cute Camel Woodcraft Company has relied more on the use of short-term debt than on longterm debt financing. This statement is, because: Cute Camel's total current liabilities increased by $469 million, while its use of long-term debt increased by $1,406 million Cute Camel's total notes payable increased by $117 million, while its common stock account increased by $3,656 million Cute Camel's total current liabilities decreased by $469 million, while its long-term debt account decreased by $1,406 millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started