Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Yes, this is all one problem. Hawking, Inc. had the following activities occur in the current year: 6. Purchased $189,000 of inventory on account. 7.

Yes, this is all one problem.

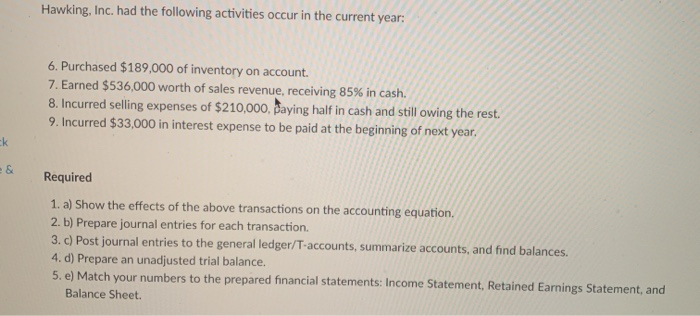

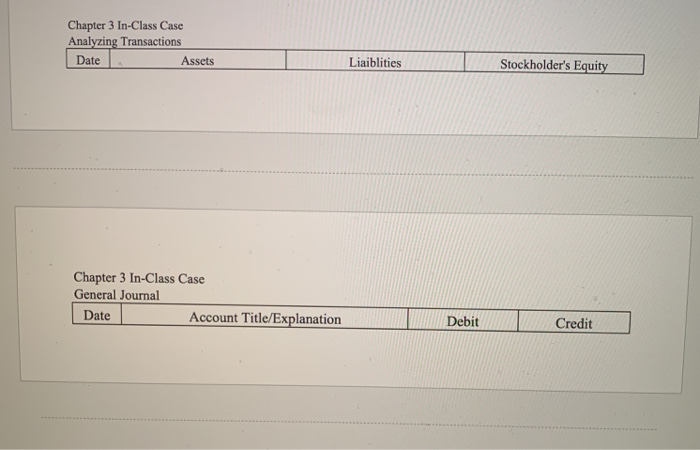

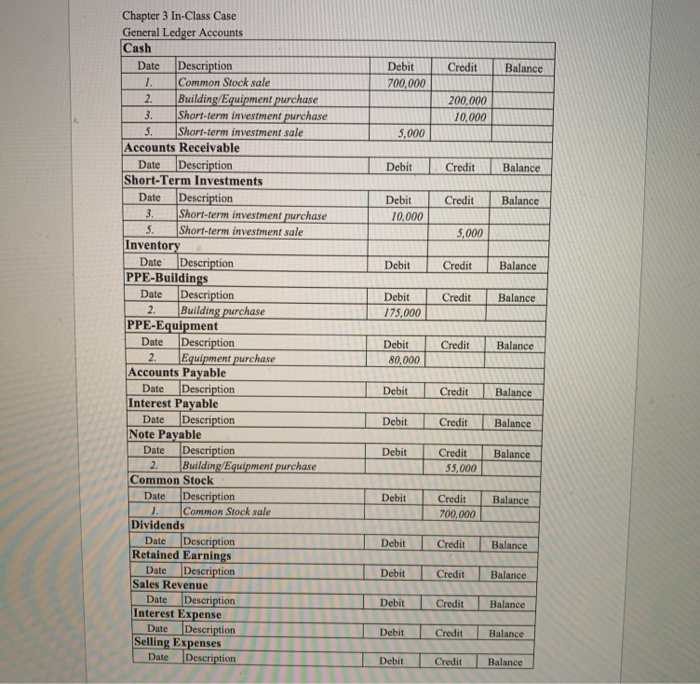

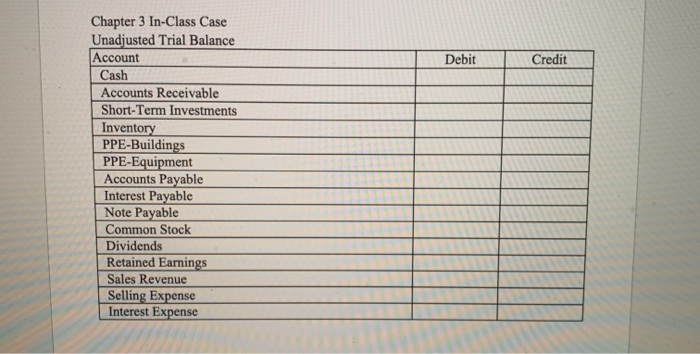

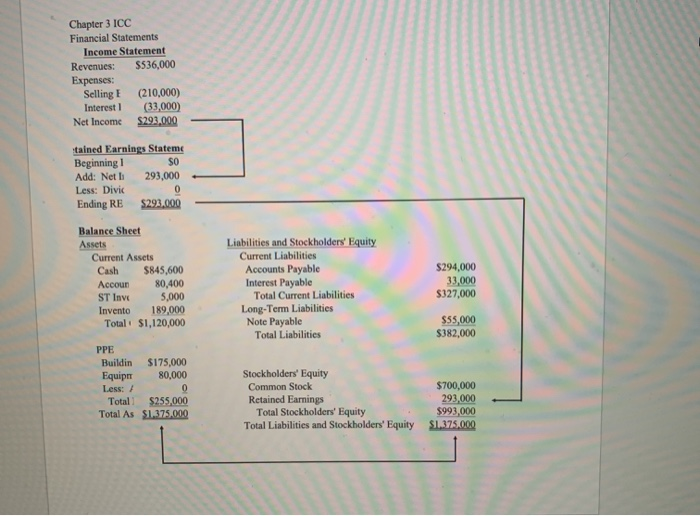

Hawking, Inc. had the following activities occur in the current year: 6. Purchased $189,000 of inventory on account. 7. Earned $536,000 worth of sales revenue, receiving 85% in cash. 8. Incurred selling expenses of $210,000, Baying half in cash and still owing the rest. 9. Incurred $33,000 in interest expense to be paid at the beginning of next year. ok & Required 1. a) Show the effects of the above transactions on the accounting equation. 2. b) Prepare journal entries for each transaction. 3. c) Post journal entries to the general ledger/T-accounts, summarize accounts, and find balances. 4. d) Prepare an unadjusted trial balance. 5. e) Match your numbers to the prepared financial statements: Income Statement, Retained Earnings Statement, and Balance Sheet Chapter 3 In-Class Case Analyzing Transactions Date Assets Liaiblities Stockholder's Equity Chapter 3 In-Class Case General Journal Date Account Title/Explanation Debit Credit Credit Balance Debit 700,000 200,000 10,000 5,000 Debit Credit Balance Credit Balance Debit 10,000 5,000 Debit Credit Balance Credit Balance Debit 175,000 Chapter 3 In-Class Case General Ledger Accounts Cash Date Description 1. Common Stock sale 2. Building/Equipment purchase 3. Short-term investment purchase 5. Short-term investment sale Accounts Receivable Date Description Short-Term Investments Date Description 3. Short-term investment purchase 5. Short-term investment sale Inventory Date Description PPE-Buildings Date Description 2. Building purchase PPE-Equipment Date Description 2. Equipment purchase Accounts Payable Date Description Interest Payable Date Description Note Payable Date Description 2. Building Equipment purchase Common Stock Date Description 1. Common Stock sale Dividends Date Description Retained Earnings Date Description Sales Revenue Date Description Interest Expense Date Description Selling Expenses Date Description Credit Balance Debit 80,000 Debit Credit Balance Debit Credit Balance Debit Balance Credit 55,000 Debit Balance Credit 700,000 Debit Credit Balance Debit Credit Balance Debit Credit Balance Debit Credit Balance Debit Credit Balance Debit Credit Chapter 3 In-Class Case Unadjusted Trial Balance Account Cash Accounts Receivable Short-Term Investments Inventory PPE-Buildings PPE-Equipment Accounts Payable Interest Payable Note Payable Common Stock Dividends Retained Earnings Sales Revenue Selling Expense Interest Expense Chapter 3 ICC Financial Statements Income Statement Revenues: 5536,000 Expenses: Selling E (210,000) Interest (33,000) Net Income S293.000 tained Earnings Stateme Beginning 1 SO Add: Net II 293.000 Less: Divic 0 Ending RE $293.000 Balance Sheet Assets Current Assets Cash $845,600 Accoun 80,400 ST Inve 5,000 Invento 189,000 Total: $1,120,000 Liabilities and Stockholders' Equity Current Liabilities Accounts Payable Interest Payable Total Current Liabilities Long-Term Liabilities Note Payable Total Liabilities $294.000 33,000 $327,000 $55,000 $382,000 PPE Buildin $175,000 Equip 80,000 Less: 0 Total $255,000 Total As $1.375.000 Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity $700,000 293,000 $993,000 S1375.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started