Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Yes you can use Excel to solve the problem I just need to say the calculations please if possible. Thank you 3. The Basics of

Yes you can use Excel to solve the problem I just need to say the calculations please if possible. Thank you

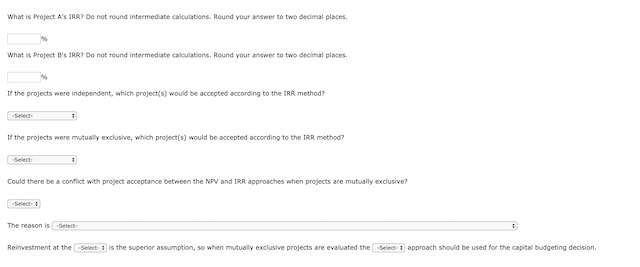

3. The Basics of capital Budgeting ERR Thesis of Capital hudge RR A projects internal of return (RR) is the that forces the PV of inflows to equals cost. The is an estimate of the project's role of return, and incomparable to the ons bond. The equation for calculating the the expected cash flow in Perind cash ows are created as negative cow s. There must be ange in shown to the TRR, The R ution is the NPV bation solved for the partir controle The calculation meat a w arenested at the end of the Select the project's cost of capital, then there would be p ower of the IRR than the project's riska cost of the the project shte t Because of the Revestment rate as when projects are subted the IRO N can lead to acting results from the method. Two Basic can lead to conflict between and IRR: S a rances (earlier cash flows in one project w ater cash flows in the other project) and project the cout of one project is larger than the other. When mutually exclusive projects are considered, then the method should be used to be project Quantitative Problem belinger tures is coming to projects for inclusion in sc valu, operating working capical requirements, and tax affects are all included in these pe e been asked to the toth projects are shows are shown on the time the below. Depreciation, selvage shows och projects have t-year lives, and they have risk characteristics similar to the average project. Bollinger'WACC Is 104 What is Project A's IRR? Do not round intermediate calculations. Round your answer to two decimal places What is Project B's IRR? Do not round Intermediate calculations. Round your answer to two decimal places If the projects were independent, which project(s) would be accepted according to the IRR method? If the projects were mutually exclusive, which project(s) would be accepted according to the IRR method? Could there be a conflict with project acceptance between the NPV and IRR approaches when projects are mutually exclusive? The reason is Select Reinvestment at the select is the superior assumption, so when mutually exclusive projects are evaluated the select approach should be used for the capital budgeting decisionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started