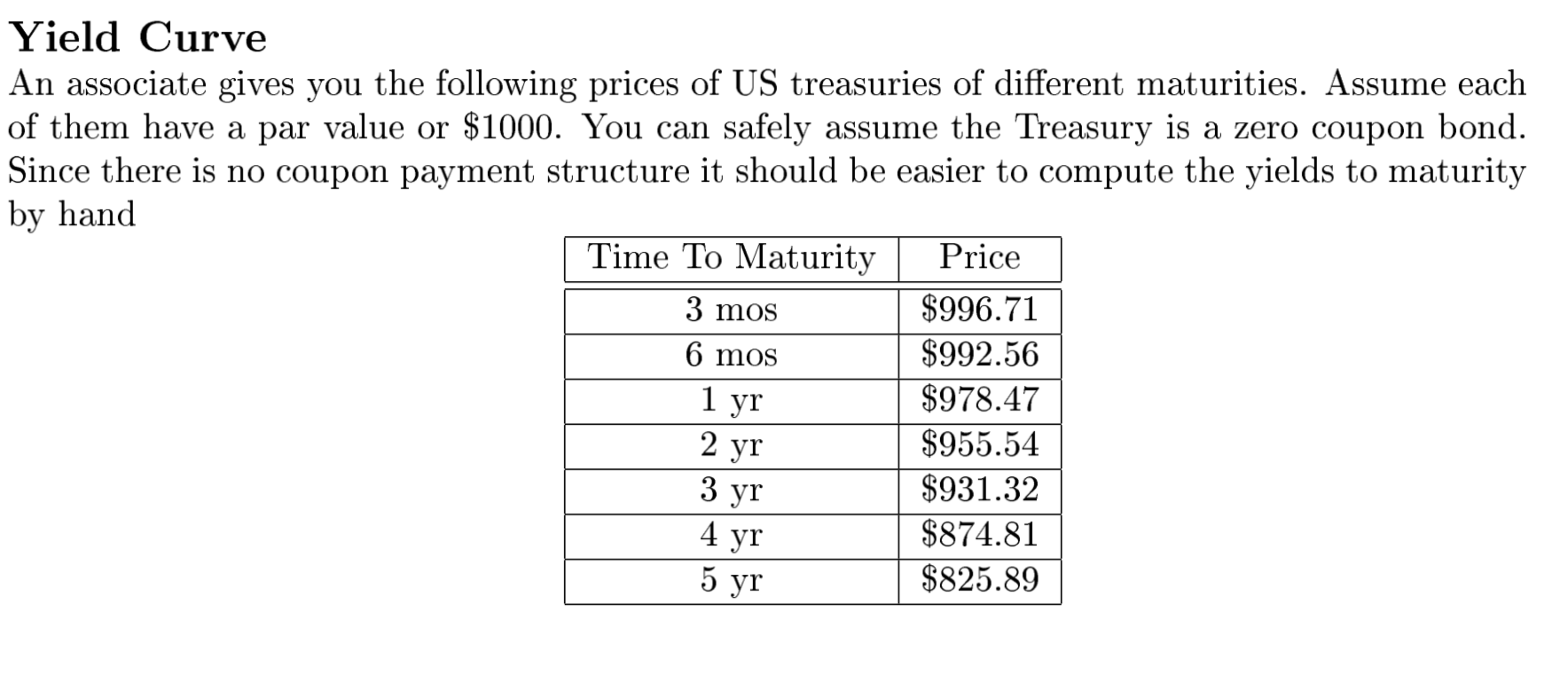

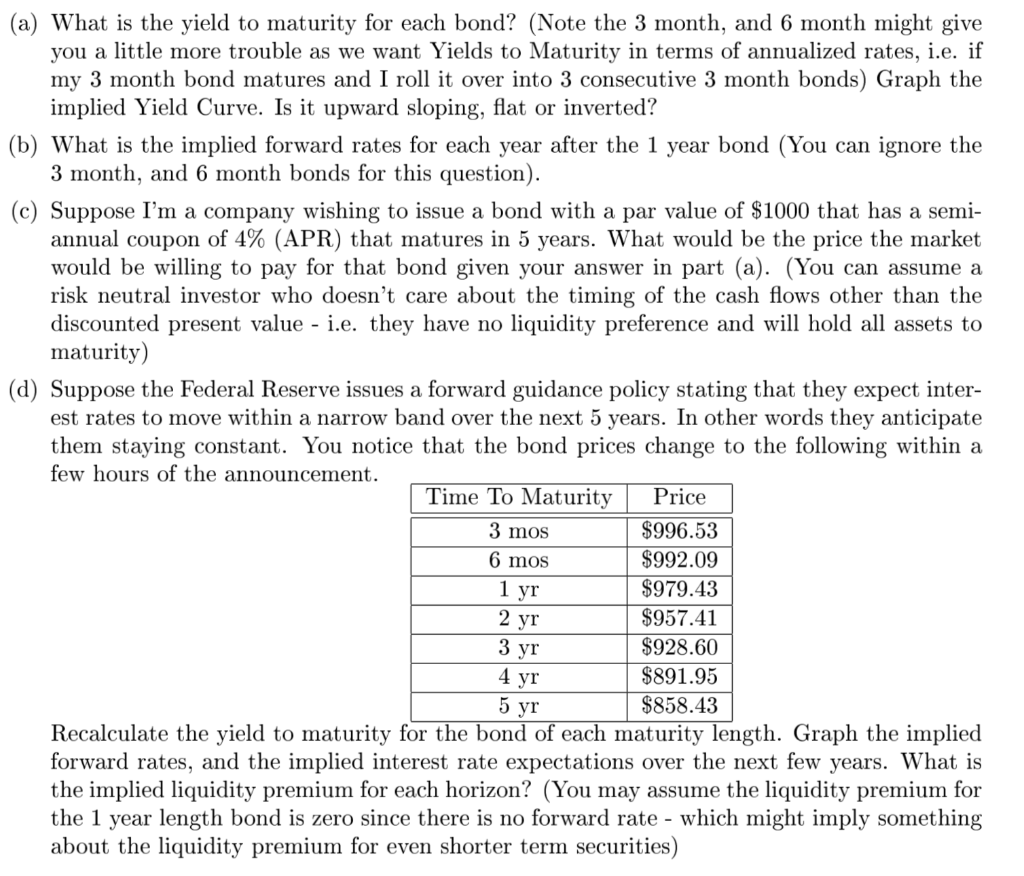

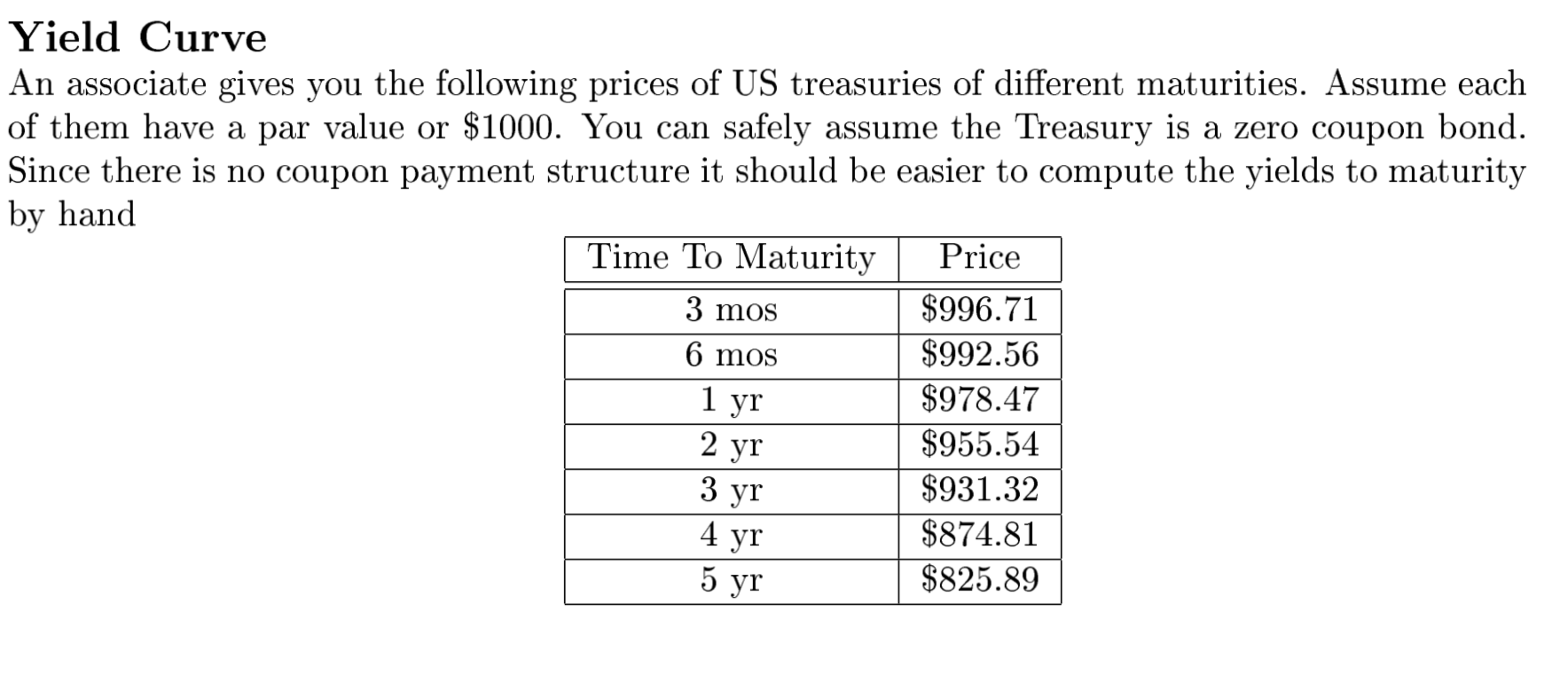

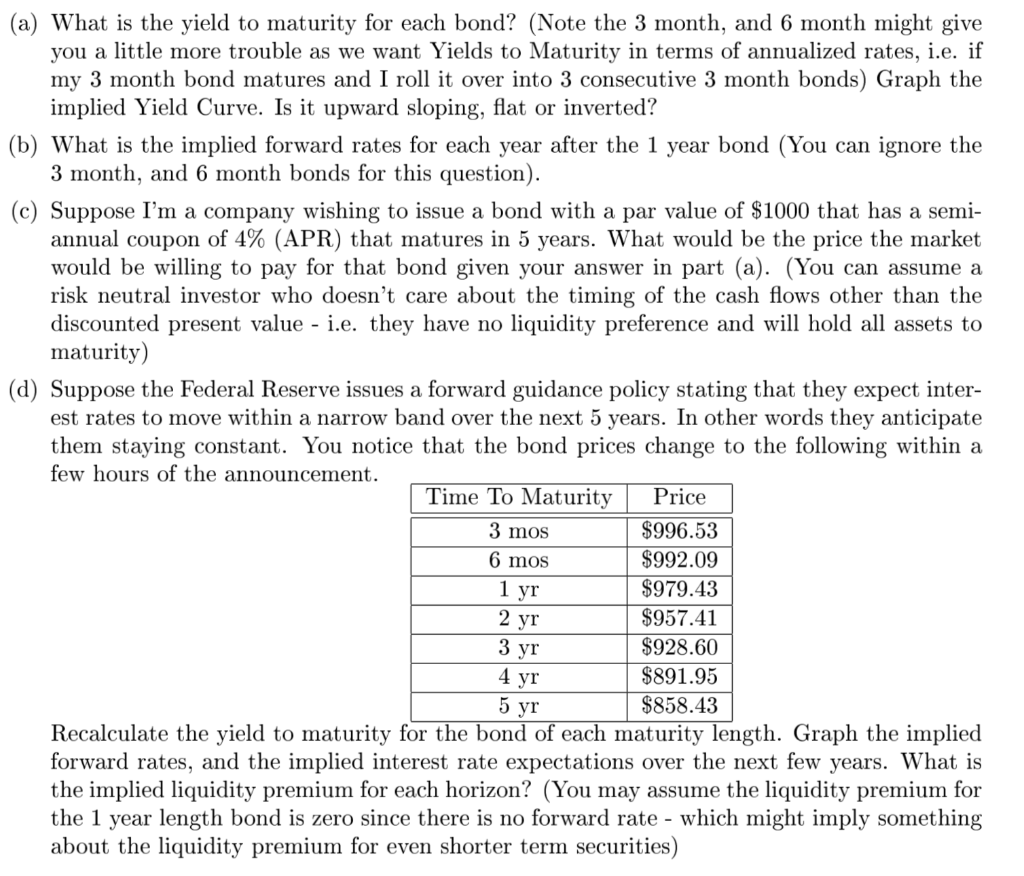

Yield Curve An associate gives you the following prices of US treasuries of different maturities. Assume each of them have a par value or $1000. You can safely assume the Treasury is a zero coupon bond. Since there is no coupon payment structure it should be easier to compute the yields to maturity by hand Time To Maturity Price $996.71 3 mos $992.56 6 mos $978.47 1 yr 2 yr 3 yr 4 yr 5 $955.54 $931.32 $874.81 $825.89 (a) What is the yield to maturity for each bond? (Note the 3 month, and 6 month might give you a little more trouble as we want Yields to Maturity in terms of annualized rates, i.e. if my 3 month bond matures and I roll it over into 3 consecutive 3 month bonds) Graph the implied Yield Curve. Is it upward sloping, flat or inverted? (b) What is the implied forward rates for each year after the 1 year bond (You can ignore the 3 month, and 6 month bonds for this question). (c) Suppose I'm a company wishing to issue a bond with a par value of $1000 that has a semi- annual coupon of 4% (APR) that matures in 5 years. What would be the price the market would be willing to pay for that bond given your answer in part (a). (You can assume a risk neutral investor who doesn't care about the timing of the cash flows other than the discounted present value - i.e. they have no liquidity preference and will hold all assets to maturity) (d) Suppose the Federal Reserve issues a forward guidance policy stating that they expect inter- est rates to move within a narrow band over the next 5 years. In other words they anticipate them staying constant. You notice that the bond prices change to the following within a few hours of the announcement. Time To Maturity Price $996.53 3 mos $992.09 6 mos 1 y 2 yr 3 yr 4 yr 5 yr Recalculate the yield to maturity for the bond of each maturity length. Graph the implied forward rates, and the implied interest rate expectations over the next few years. What is the implied liquidity premium for each horizon? (You may assume the liquidity premium for the 1 year length bond is zero since there is no forward rate - which might imply something $979.43 $957.41 $928.60 $891.95 $858.43 about the liquidity premium for even shorter term securities) Yield Curve An associate gives you the following prices of US treasuries of different maturities. Assume each of them have a par value or $1000. You can safely assume the Treasury is a zero coupon bond. Since there is no coupon payment structure it should be easier to compute the yields to maturity by hand Time To Maturity Price $996.71 3 mos $992.56 6 mos $978.47 1 yr 2 yr 3 yr 4 yr 5 $955.54 $931.32 $874.81 $825.89 (a) What is the yield to maturity for each bond? (Note the 3 month, and 6 month might give you a little more trouble as we want Yields to Maturity in terms of annualized rates, i.e. if my 3 month bond matures and I roll it over into 3 consecutive 3 month bonds) Graph the implied Yield Curve. Is it upward sloping, flat or inverted? (b) What is the implied forward rates for each year after the 1 year bond (You can ignore the 3 month, and 6 month bonds for this question). (c) Suppose I'm a company wishing to issue a bond with a par value of $1000 that has a semi- annual coupon of 4% (APR) that matures in 5 years. What would be the price the market would be willing to pay for that bond given your answer in part (a). (You can assume a risk neutral investor who doesn't care about the timing of the cash flows other than the discounted present value - i.e. they have no liquidity preference and will hold all assets to maturity) (d) Suppose the Federal Reserve issues a forward guidance policy stating that they expect inter- est rates to move within a narrow band over the next 5 years. In other words they anticipate them staying constant. You notice that the bond prices change to the following within a few hours of the announcement. Time To Maturity Price $996.53 3 mos $992.09 6 mos 1 y 2 yr 3 yr 4 yr 5 yr Recalculate the yield to maturity for the bond of each maturity length. Graph the implied forward rates, and the implied interest rate expectations over the next few years. What is the implied liquidity premium for each horizon? (You may assume the liquidity premium for the 1 year length bond is zero since there is no forward rate - which might imply something $979.43 $957.41 $928.60 $891.95 $858.43 about the liquidity premium for even shorter term securities)