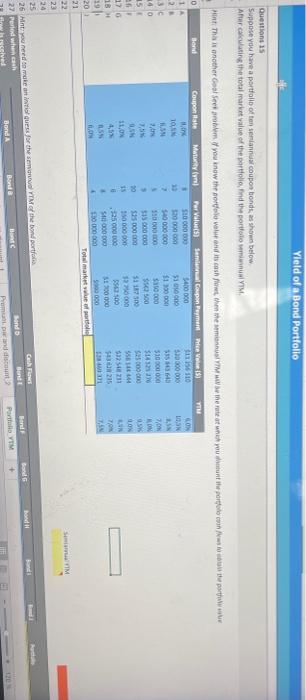

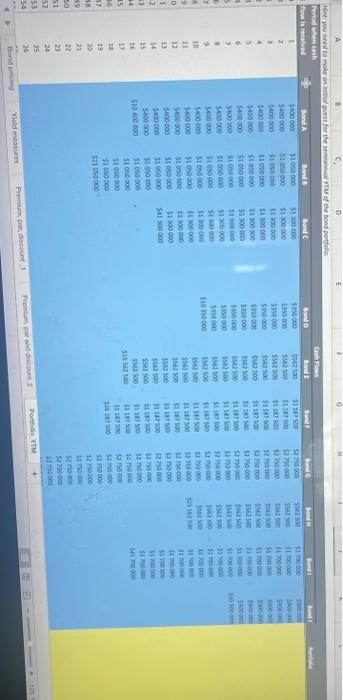

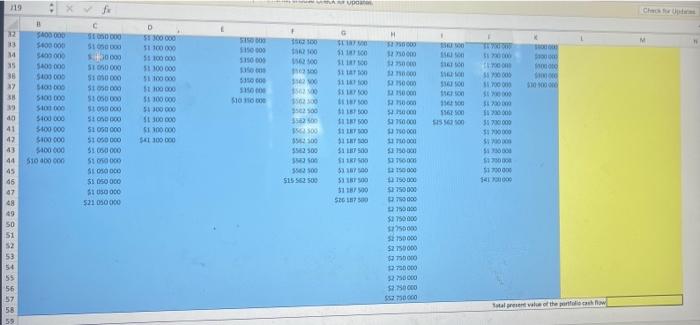

Yield of a Bond Portfolio Questions as Suppose you have a portfolio of an annus Coupon bonds, as shown below Aur calculating the total market value of the portfolio find the portfoliowy 00000 ONS 000 NEO 2 000000 000 OE IS DOO DODOS MEETS ON 000000 SES Mont Thai another Gool Seetroom you know the portfolio Wolond cash flow these the rate on youtube portfolio porte 0 Bond Coupon Rate Maturity For Values Seminal Compen Peyman Me TIM 1 5400000 1 156110 LON 28 ON 13 20000000 51000 HUN 2 55 140 9.A 550 000 000 310000 2,00 7,5 5 se 500 36 OS 5 000 000 S500 176 11,ON 15 7000 SH GON $32 19 S600 000 $1200000 20 Total man wear 22 23 SIM 06 COSTS 000 000 00100 SEE COSES w ES SECURE LE MAT NO M 0000001 000 VE 2 26 Hint you need to make an initial guess for the samad IM the bond porto 27 Perle wanach Bond A BB Cash Land Bandi Pumwandiscount Port Bond Premium par discount Valdma por and court Por YTM SC 54 25 ES DO 52750000 EZ SI 50 LES 300 C 22 NRK 20 6F SH 000 DOLLS 000 059 05 7 costes 19 13 95 000 SEES 000 TS 200 LES 000 000 SEES 000DLES SISSE (I 51 OSO 900 51 050 000 51 050 000 35 16 000 300 DE 15 Sto 0000 BOSS Ons 0055 OOSTE 15 R15 005 ans TE 15 E 000 Anance 10000 541 300 000 5400.000 550200 t 0000095 SETS 551500 2 1 D CY BOSS 005 S400000 12 DOS 005 It 2018 011 COM 00 000 OSOS 000 SO 1 0000 0000015 DOS 000 0001 00015 500 TS 000 OE IS DE 1 0001 00015 000 OE 00015 0000V Od V OV 10 51 1500 COM oss os 000 DOIS 6 DO 000 SEE 5400 000 SA 10000 OS 520000 0000011 000 20 51000 51300000 900 006 00625 COS SIV 51100 51100 $100 5110 5527500 550.000 SH10 000 SM 300 $100 OSO 000 con COCO01 000 Ort CO 0035 5 OS 53000 000 27500 00005 000 UCIS 5562500 000 OG 11 WOO DOES CODE 000 00 15 000005 5798000 000011 000 0000015 300055 DOODG1S 000 DO 15 BOSCH 15 512 500 000 USES $400 000 $20.000 520000 000 5250000 000.00 31 DOSYS CONTHS 11100 Lond Bir CF Bond Bond Honda flow is received Period wash Hint you need to use for the the bond portfolio 59 Total reserve of the follow 58 57 000ES 95 200 250000 3700000 bogo 54 53 52 COSIS 150000 IS COO OSCE $275.000 750000 52617300 49 000 SE DO005 15 000 0058 51700000 51100 511870 $117 90 SP 150.000 00000 Tes 000 DO 15 000 OSO TS 090 OSO 15 DO 000 IS 00000 s BE 510 100 000 44 005295515 005 OS COS COC OOSE $1190-001 TOOL CS ROSES todos 00000 000 OSS 000 DO 000 COTIV $100 000 EP CP SE 100 000 41 515 500 16 51 050 000 S: DOO 11 LT100 11110 $11100 BENTO 000 0015 000 nors 000 DOIS 00 00 15 000 000 15 100 ostat DOSO 15 DOS DOT DOS DOS 000 SE DOODSE S BODE BOLEH OSE 0000 LES 11 Op GE HE 150200 $100 51100002 51 050 000 5100 000 ONS ODOLO 000OOL COS DONT TE VETS 1 310000 lo 515 000 CON Bot os 2011 15 000 DOL 15 000 000 COTS 38 . DO DO SI 51 100 000 BOOTS 000005 DOS GOCES DOS 5400000 SE COLOSES SL 5100 SEIT 2100 34 OS GOOD GE H $150 000 COD DE 15 OOO OLI 000 OOIS OOL 1 SES 000005 000 cows 000 CON it SES 000 C EE LE 5 D Ch 611 Yield of a Bond Portfolio Questions as Suppose you have a portfolio of an annus Coupon bonds, as shown below Aur calculating the total market value of the portfolio find the portfoliowy 00000 ONS 000 NEO 2 000000 000 OE IS DOO DODOS MEETS ON 000000 SES Mont Thai another Gool Seetroom you know the portfolio Wolond cash flow these the rate on youtube portfolio porte 0 Bond Coupon Rate Maturity For Values Seminal Compen Peyman Me TIM 1 5400000 1 156110 LON 28 ON 13 20000000 51000 HUN 2 55 140 9.A 550 000 000 310000 2,00 7,5 5 se 500 36 OS 5 000 000 S500 176 11,ON 15 7000 SH GON $32 19 S600 000 $1200000 20 Total man wear 22 23 SIM 06 COSTS 000 000 00100 SEE COSES w ES SECURE LE MAT NO M 0000001 000 VE 2 26 Hint you need to make an initial guess for the samad IM the bond porto 27 Perle wanach Bond A BB Cash Land Bandi Pumwandiscount Port Bond Premium par discount Valdma por and court Por YTM SC 54 25 ES DO 52750000 EZ SI 50 LES 300 C 22 NRK 20 6F SH 000 DOLLS 000 059 05 7 costes 19 13 95 000 SEES 000 TS 200 LES 000 000 SEES 000DLES SISSE (I 51 OSO 900 51 050 000 51 050 000 35 16 000 300 DE 15 Sto 0000 BOSS Ons 0055 OOSTE 15 R15 005 ans TE 15 E 000 Anance 10000 541 300 000 5400.000 550200 t 0000095 SETS 551500 2 1 D CY BOSS 005 S400000 12 DOS 005 It 2018 011 COM 00 000 OSOS 000 SO 1 0000 0000015 DOS 000 0001 00015 500 TS 000 OE IS DE 1 0001 00015 000 OE 00015 0000V Od V OV 10 51 1500 COM oss os 000 DOIS 6 DO 000 SEE 5400 000 SA 10000 OS 520000 0000011 000 20 51000 51300000 900 006 00625 COS SIV 51100 51100 $100 5110 5527500 550.000 SH10 000 SM 300 $100 OSO 000 con COCO01 000 Ort CO 0035 5 OS 53000 000 27500 00005 000 UCIS 5562500 000 OG 11 WOO DOES CODE 000 00 15 000005 5798000 000011 000 0000015 300055 DOODG1S 000 DO 15 BOSCH 15 512 500 000 USES $400 000 $20.000 520000 000 5250000 000.00 31 DOSYS CONTHS 11100 Lond Bir CF Bond Bond Honda flow is received Period wash Hint you need to use for the the bond portfolio 59 Total reserve of the follow 58 57 000ES 95 200 250000 3700000 bogo 54 53 52 COSIS 150000 IS COO OSCE $275.000 750000 52617300 49 000 SE DO005 15 000 0058 51700000 51100 511870 $117 90 SP 150.000 00000 Tes 000 DO 15 000 OSO TS 090 OSO 15 DO 000 IS 00000 s BE 510 100 000 44 005295515 005 OS COS COC OOSE $1190-001 TOOL CS ROSES todos 00000 000 OSS 000 DO 000 COTIV $100 000 EP CP SE 100 000 41 515 500 16 51 050 000 S: DOO 11 LT100 11110 $11100 BENTO 000 0015 000 nors 000 DOIS 00 00 15 000 000 15 100 ostat DOSO 15 DOS DOT DOS DOS 000 SE DOODSE S BODE BOLEH OSE 0000 LES 11 Op GE HE 150200 $100 51100002 51 050 000 5100 000 ONS ODOLO 000OOL COS DONT TE VETS 1 310000 lo 515 000 CON Bot os 2011 15 000 DOL 15 000 000 COTS 38 . DO DO SI 51 100 000 BOOTS 000005 DOS GOCES DOS 5400000 SE COLOSES SL 5100 SEIT 2100 34 OS GOOD GE H $150 000 COD DE 15 OOO OLI 000 OOIS OOL 1 SES 000005 000 cows 000 CON it SES 000 C EE LE 5 D Ch 611