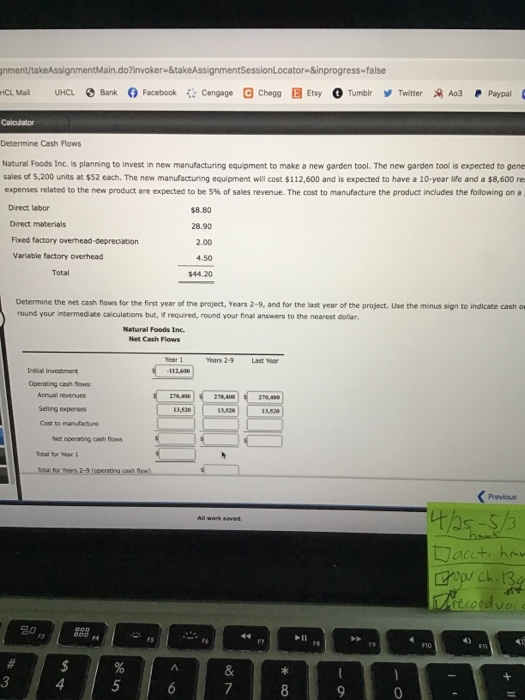

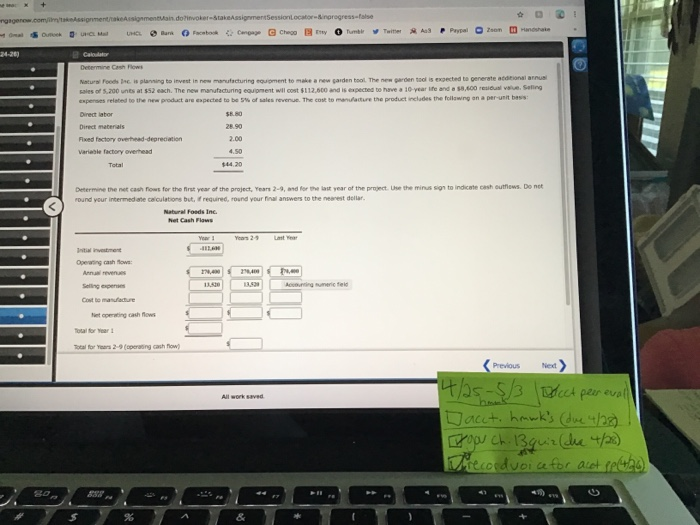

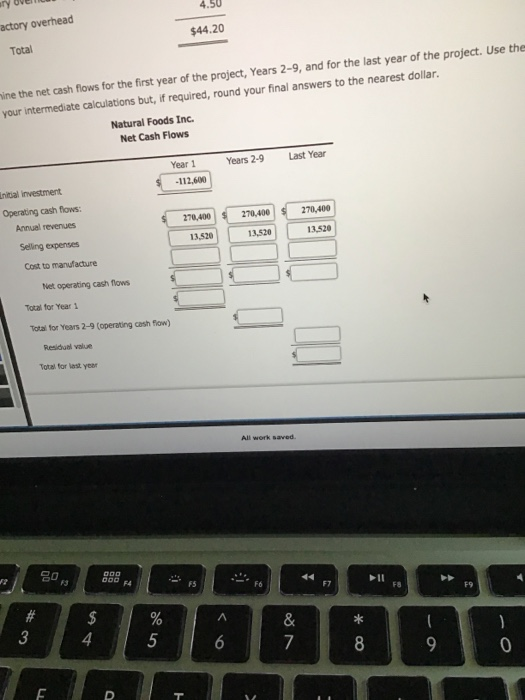

ynmenttakeAssignmentMain.doFinvoker-StakeAssignmentSessionLocator-Sinprogress-false HCL Mal UHCL Bank Facebook Cengage Chegg E Etsy Tumblr Twitter A03 Paypal Calculator Determine Cash Flows Natural Foods Inc. is planning to invest in new manufacturing equipment to make a new garden tool. The new garden tool is expected to gene sales of 5,200 units at $52 each. The new manufacturing equipment will cost $112,600 and is expected to have a 10-year life and a $8,600 re expenses related to the new product are expected to be 5% of sales revenue. The cost to manufacture the product includes the following on a Direct labor $8.80 Direct materials 28.90 2.00 Foxed factory overhead-depreciation Variable factory overhead Total $44.20 Determine the net cash flows for the first year of the project, Years 2-9, and for the last year of the project. Use the minus sign to indicate cash a round your intermediate calculations but required, round your final answers to the nearest dollar Natural Foods Inc Net Cash Flows Year 1 Years 2-9 Last year investment Operating cash flow Annual Revenues Seling expenses Cost to manufacture totoros 14/25-5/3 acct. hmm y gou Ch.134 Drecoodvoie rence.commons Ora De . or Burn Of gentes corregressie Cage @ Chege Ny Tumi LHC AAB Pro on Call N os 200 ang t i t ing met 552 each. The new mancung comes wi n andet The o is expected to generational d is expected to have a 10 years and a 3.600 Sering SO 29 Director Direct materials Fixed actory overhead depreciation Variable factory overhead Total the mission to indicate c outos. Do not Determine then chows for the und wurde u year the project. Yes, n d out year of the pret rest dolar the Che Investment how A revenues $ 400 N. Soal for 2- perating cash flow 4/25 -5/3 Dicct peer evall acct. hawk's (due 4/28) Il you ch. 13 quiz (dre 4/28) Diccord voice for acct (466) 4.50 actory overhead $44.20 Total in the net cash flows for the first year of the project, Years 2-9, and for the last year of the project. Use th your intermediate calculations but, if required, round your final answers to the nearest dollar. Natural Foods Inc. Net Cash Flows Year 1 Years 2-9 Last Year -112.600 Inicial investment Operating cash flows Annual revenues 270,400 S 270.000 270,400 Selling expenses Cost to manufacture Net operating cash flow Total for Year 1 Total for years 2-9 (operating cash flow) Residual value All work saved ynmenttakeAssignmentMain.doFinvoker-StakeAssignmentSessionLocator-Sinprogress-false HCL Mal UHCL Bank Facebook Cengage Chegg E Etsy Tumblr Twitter A03 Paypal Calculator Determine Cash Flows Natural Foods Inc. is planning to invest in new manufacturing equipment to make a new garden tool. The new garden tool is expected to gene sales of 5,200 units at $52 each. The new manufacturing equipment will cost $112,600 and is expected to have a 10-year life and a $8,600 re expenses related to the new product are expected to be 5% of sales revenue. The cost to manufacture the product includes the following on a Direct labor $8.80 Direct materials 28.90 2.00 Foxed factory overhead-depreciation Variable factory overhead Total $44.20 Determine the net cash flows for the first year of the project, Years 2-9, and for the last year of the project. Use the minus sign to indicate cash a round your intermediate calculations but required, round your final answers to the nearest dollar Natural Foods Inc Net Cash Flows Year 1 Years 2-9 Last year investment Operating cash flow Annual Revenues Seling expenses Cost to manufacture totoros 14/25-5/3 acct. hmm y gou Ch.134 Drecoodvoie rence.commons Ora De . or Burn Of gentes corregressie Cage @ Chege Ny Tumi LHC AAB Pro on Call N os 200 ang t i t ing met 552 each. The new mancung comes wi n andet The o is expected to generational d is expected to have a 10 years and a 3.600 Sering SO 29 Director Direct materials Fixed actory overhead depreciation Variable factory overhead Total the mission to indicate c outos. Do not Determine then chows for the und wurde u year the project. Yes, n d out year of the pret rest dolar the Che Investment how A revenues $ 400 N. Soal for 2- perating cash flow 4/25 -5/3 Dicct peer evall acct. hawk's (due 4/28) Il you ch. 13 quiz (dre 4/28) Diccord voice for acct (466) 4.50 actory overhead $44.20 Total in the net cash flows for the first year of the project, Years 2-9, and for the last year of the project. Use th your intermediate calculations but, if required, round your final answers to the nearest dollar. Natural Foods Inc. Net Cash Flows Year 1 Years 2-9 Last Year -112.600 Inicial investment Operating cash flows Annual revenues 270,400 S 270.000 270,400 Selling expenses Cost to manufacture Net operating cash flow Total for Year 1 Total for years 2-9 (operating cash flow) Residual value All work saved