YO

YO

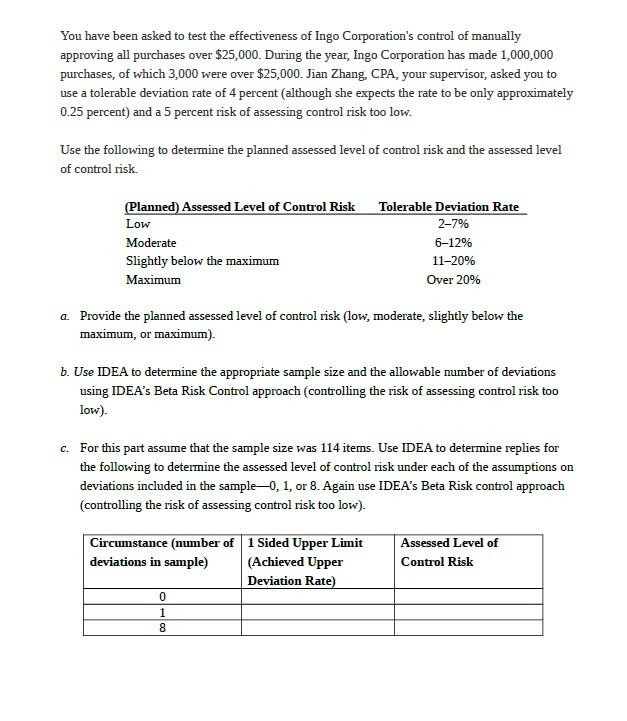

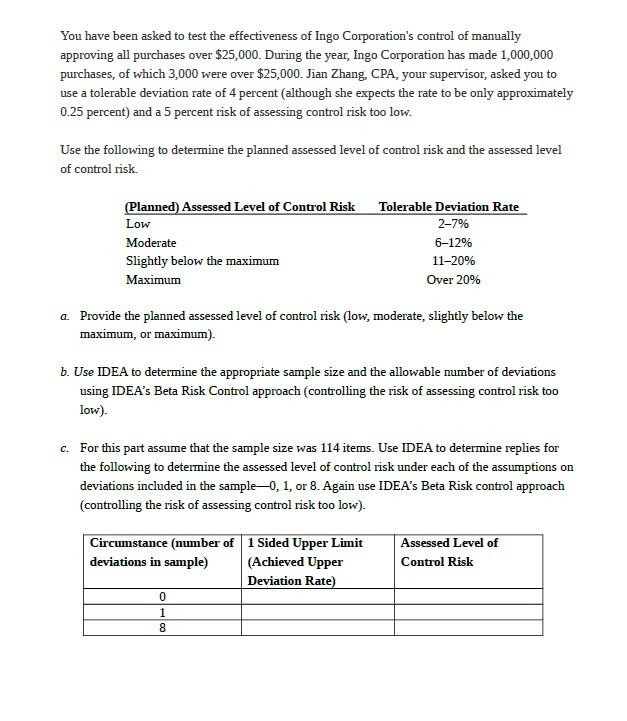

You have been asked to test the effectiveness of Ingo Corporation's control of manually approving all purchases over $25,000. During the year, Ingo Corporation has made 1,000,000 purchases, of which 3,000 were over $25,000. Jian Zhang, CPA, your supervisor, asked you to use a tolerable deviation rate of 4 percent (although she expects the rate to be only approximately 0.25 percent) and a 5 percent risk of assessing control risk too low. Use the following to determine the planned assessed level of control risk and the assessed level of control risk. (Planned) Assessed Level of Control Risk Low Moderate Slightly below the maximum Maximum Tolerable Deviation Rate 2-7% 6-12% 11-20% Over 20% a. Provide the planned assessed level of control risk (low, moderate, slightly below the maximum, or maximum). b. Use IDEA to determine the appropriate sample size and the allowable number of deviations using IDEA's Beta Risk Control approach (controlling the risk of assessing control risk too low). c. For this part assume that the sample size was 114 items. Use IDEA to determine replies for the following to determine the assessed level of control risk under each of the assumptions on deviations included in the sample-0, 1, or 8. Again use IDEA's Beta Risk control approach (controlling the risk of assessing control risk too low). Assessed Level of Control Risk Circumstance (number of 1 Sided Upper Limit deviations in sample) (Achieved Upper Deviation Rate) 0 1 8 You have been asked to test the effectiveness of Ingo Corporation's control of manually approving all purchases over $25,000. During the year, Ingo Corporation has made 1,000,000 purchases, of which 3,000 were over $25,000. Jian Zhang, CPA, your supervisor, asked you to use a tolerable deviation rate of 4 percent (although she expects the rate to be only approximately 0.25 percent) and a 5 percent risk of assessing control risk too low. Use the following to determine the planned assessed level of control risk and the assessed level of control risk. (Planned) Assessed Level of Control Risk Low Moderate Slightly below the maximum Maximum Tolerable Deviation Rate 2-7% 6-12% 11-20% Over 20% a. Provide the planned assessed level of control risk (low, moderate, slightly below the maximum, or maximum). b. Use IDEA to determine the appropriate sample size and the allowable number of deviations using IDEA's Beta Risk Control approach (controlling the risk of assessing control risk too low). c. For this part assume that the sample size was 114 items. Use IDEA to determine replies for the following to determine the assessed level of control risk under each of the assumptions on deviations included in the sample-0, 1, or 8. Again use IDEA's Beta Risk control approach (controlling the risk of assessing control risk too low). Assessed Level of Control Risk Circumstance (number of 1 Sided Upper Limit deviations in sample) (Achieved Upper Deviation Rate) 0 1 8

YO

YO