Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Yogi expects total sales of $365,000 in January and $400,000 in February. Assume that Yogi's sales are collected as follows: (Click the icon to view

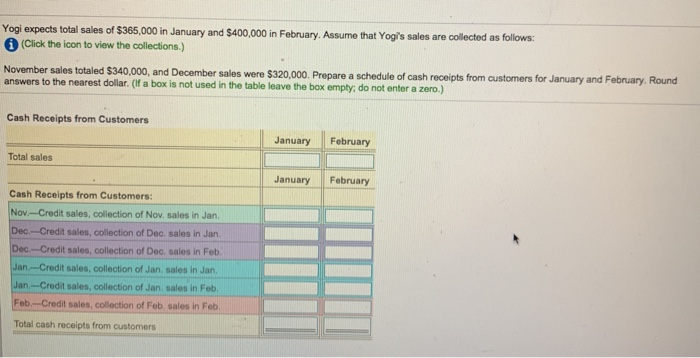

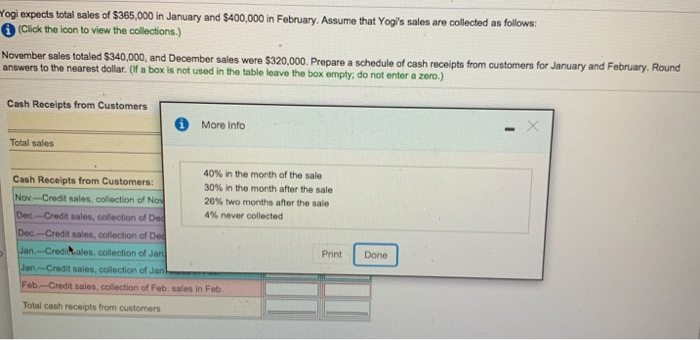

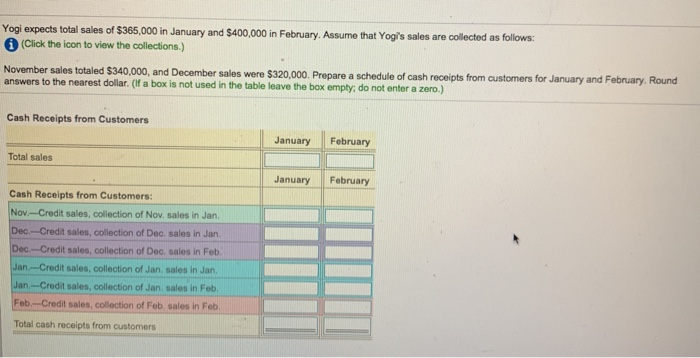

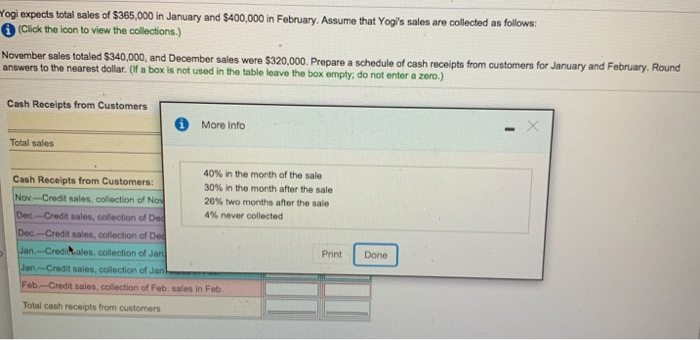

"Yogi expects total sales of $365,000 in January and $400,000 in February. Assume that Yogi's sales are collected as follows: (Click the icon to view the collections.) November sales totaled $340,000, and December sales were $320,000. Prepare a schedule of cash receipts from customers for January and February. Round answers to the nearest dollar. (If a box is not used in the table leave the box empty, do not enter a zero.) Cash Receipts from Customers January February Total sales January February Cash Receipts from Customers: Nov--Credit sales, collection of Nov, sales in Jan. Dec.-Credit sales, collection of Dec sales in Jan Dec.-Credit sales, collection of Dec. sales in Feb. Jan-Credit sales, collection of Jan. sales in Jan Jan ---Credit sales, collection of Jan. sales in Feb. Feb.-Credit sales, collection of Feb, sales in Feb. Total cash receipts from customers "ogi expects total sales of $365,000 in January and $400,000 in February. Assume that Yogi's sales are collected as follows: (Click the icon to view the collections.) November sales totaled $340,000, and December sales were $320,000. Prepare a schedule of cash receipts from customers for January and February. Round answers to the nearest dollar. (If a box is not used in the table leave the box empty, do not enter a zero) Cash Receipts from Customers More Info Total sales 40% in the month of the sale Cash Receipts from Customers: 30% in the month after the sale Nov-Credit sales, collection of Now 26% two months after the sale Deo Credit sales, collection of Dec 4% never collected Dec-Credit sales, collection of De Jan -- Credikales, collection of Jan Print Jan-Credit sales, collection of JanL Feb.--Credit sales, collection of Feb. sales in Feb Done Total cash receipts from customers

"Yogi expects total sales of $365,000 in January and $400,000 in February. Assume that Yogi's sales are collected as follows: (Click the icon to view the collections.) November sales totaled $340,000, and December sales were $320,000. Prepare a schedule of cash receipts from customers for January and February. Round answers to the nearest dollar. (If a box is not used in the table leave the box empty, do not enter a zero.) Cash Receipts from Customers January February Total sales January February Cash Receipts from Customers: Nov--Credit sales, collection of Nov, sales in Jan. Dec.-Credit sales, collection of Dec sales in Jan Dec.-Credit sales, collection of Dec. sales in Feb. Jan-Credit sales, collection of Jan. sales in Jan Jan ---Credit sales, collection of Jan. sales in Feb. Feb.-Credit sales, collection of Feb, sales in Feb. Total cash receipts from customers "ogi expects total sales of $365,000 in January and $400,000 in February. Assume that Yogi's sales are collected as follows: (Click the icon to view the collections.) November sales totaled $340,000, and December sales were $320,000. Prepare a schedule of cash receipts from customers for January and February. Round answers to the nearest dollar. (If a box is not used in the table leave the box empty, do not enter a zero) Cash Receipts from Customers More Info Total sales 40% in the month of the sale Cash Receipts from Customers: 30% in the month after the sale Nov-Credit sales, collection of Now 26% two months after the sale Deo Credit sales, collection of Dec 4% never collected Dec-Credit sales, collection of De Jan -- Credikales, collection of Jan Print Jan-Credit sales, collection of JanL Feb.--Credit sales, collection of Feb. sales in Feb Done Total cash receipts from customers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started