Answered step by step

Verified Expert Solution

Question

1 Approved Answer

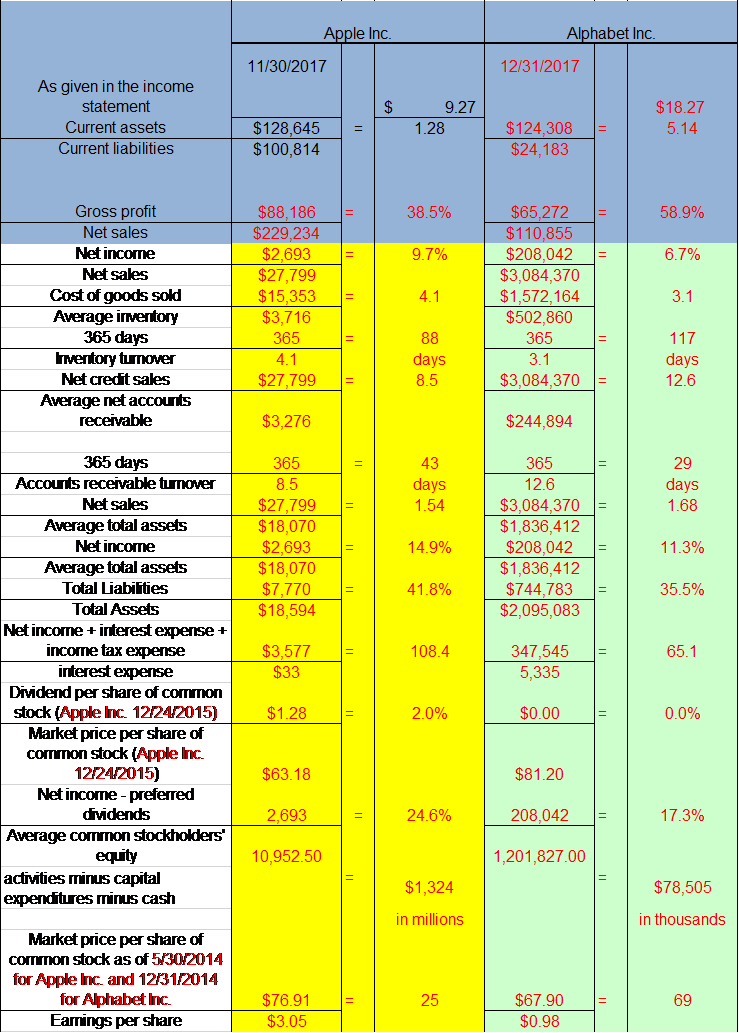

You all get the chance to play the role of financial analyst below. The summary should be a comparison of each company's performance for each

You all get the chance to play the role of financial analyst below. The summary should be a comparison of each company's performance for each major category of ratios listed below. Focus on major differences as you compare each company's performance. A nice way to conclude is to state which company you feel is the better investment and why.

Liquidity:

Solvency:

Profitability:

Conclusion:

Alphabet Inc. Apple Inc. 11/30/2017 12/31/2017 As given in the income statement Current assets Current liabilities 9.27 1.28 $18.27 5.14 = $128,645 $100,814 $124,308 $24,183 38.5% 58.9% 9.7% 6.7% $88,186 $229,234 $2,693 $27,799 $15,353 $3,716 365 4.1 $27.799 4.1 Gross profit Net sales Net income Net sales Cost of goods sold Average inventory 365 days Inventory turnover Net credit sales Average net accounts receivable $65,272 $110.855 $208,042 $3,084,370 $1,572,164 $502,860 365 3.1 $3,084,370 3.1 88 days 8.5 117 days 12.6 $3,276 $244,894 365 29 8.5 43 days 1.54 days 1.68 365 12.6 $3,084,370 $1,836,412 $208,042 $1,836,412 $744,783 $2,095,083 14.9% = $27,799 $18,070 $2.693 $18,070 $7,770 $18,594 11.3% 41.8% 35.5% $3,577 108.4 65.1 365 days Accounts receivable turnover Net sales Average total assets Net income Average total assets Total Liabilities Total Assets Net income + interest expense + income tax expense interest expense Dividend per share of common stock (Apple Inc. 12/24/2015) Market price per share of common stock (Apple Inc. 12/24/2015) Net income - preferred dividends Average common stockholders' equity activities minus capital expenditures minus cash 347,545 5,335 $33 $1.28 2.0% $0.00 0.0% $63.18 $81.20 2,693 24.6% 208.042 17.3% 10,952.50 1,201,827.00 $1,324 $78,505 in millions in thousands Market price per share of common stock as of 5/30/2014 for Apple Inc. and 12/31/2014 for Alphabet Inc. Eamings per share $76.91 $3.05 $67.90 $0.98

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started