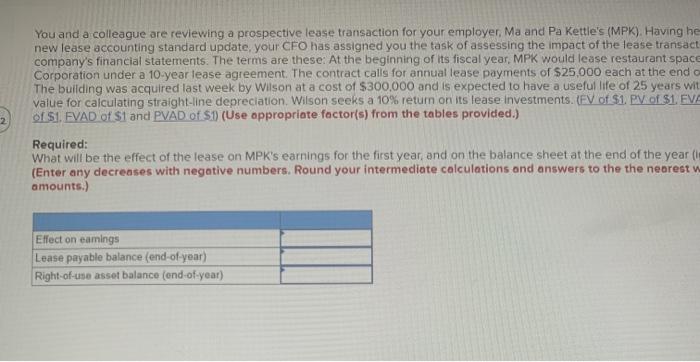

You and a colleague are reviewing a prospective lease transaction for your employer, Ma and Pa Kettle's (MPK). Having he new lease accounting standard update your CFO has assigned you the task of assessing the impact of the lease transact company's financial statements. The terms are these: At the beginning of its fiscal year, MPK would lease restaurant space Corporation under a 10-year lease agreement. The contract calls for annual lease payments of $25,000 each at the end The building was acquired last week by Wilson at a cost of $300,000 and is expected to have a useful life of 25 years wit value for calculating straight-line depreciation Wilson seeks a 10% return on its lease Investments. (FV of $1. PV of $1. EVE of $1. EVAD of S1 and PVAD of $1 (Use appropriate factor(s) from the tables provided.) Required: What will be the effect of the lease on MPK's earnings for the first year, and on the balance sheet at the end of the year ( (Enter any decreases with negative numbers. Round your intermediate calculations and answers to the the nearest amounts.) Effect on eamings Lease payable balance (end-of-year) Right-of-use asset balance (ond-of-year) You and a colleague are reviewing a prospective lease transaction for your employer, Ma and Pa Kettle's (MPK). Having he new lease accounting standard update your CFO has assigned you the task of assessing the impact of the lease transact company's financial statements. The terms are these: At the beginning of its fiscal year, MPK would lease restaurant space Corporation under a 10-year lease agreement. The contract calls for annual lease payments of $25,000 each at the end The building was acquired last week by Wilson at a cost of $300,000 and is expected to have a useful life of 25 years wit value for calculating straight-line depreciation Wilson seeks a 10% return on its lease Investments. (FV of $1. PV of $1. EVE of $1. EVAD of S1 and PVAD of $1 (Use appropriate factor(s) from the tables provided.) Required: What will be the effect of the lease on MPK's earnings for the first year, and on the balance sheet at the end of the year ( (Enter any decreases with negative numbers. Round your intermediate calculations and answers to the the nearest amounts.) Effect on eamings Lease payable balance (end-of-year) Right-of-use asset balance (ond-of-year)