Answered step by step

Verified Expert Solution

Question

1 Approved Answer

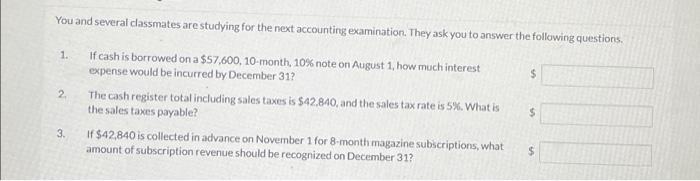

You and several classmates are studying for the next accounting examination. They ask you to answer the following questions. 1. 2. 3. If cash is

You and several classmates are studying for the next accounting examination. They ask you to answer the following questions. 1. 2. 3. If cash is borrowed on a $57,600, 10-month, 10% note on August 1, how much interest expense would be incurred by December 31? The cash register total including sales taxes is $42,840, and the sales tax rate is 5%. What is the sales taxes payable? If $42,840 is collected in advance on November 1 for 8-month magazine subscriptions, what amount of subscription revenue should be recognized on December 31? LA LA $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started