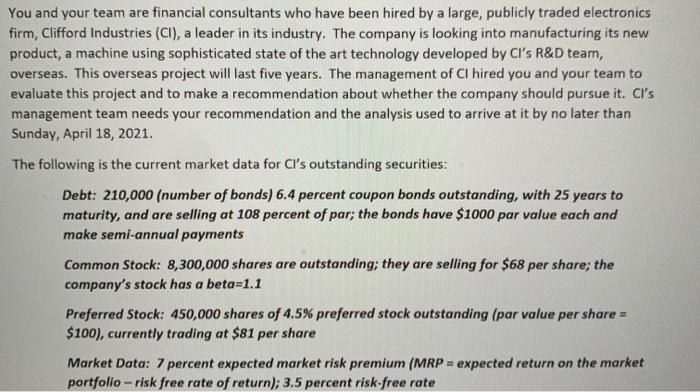

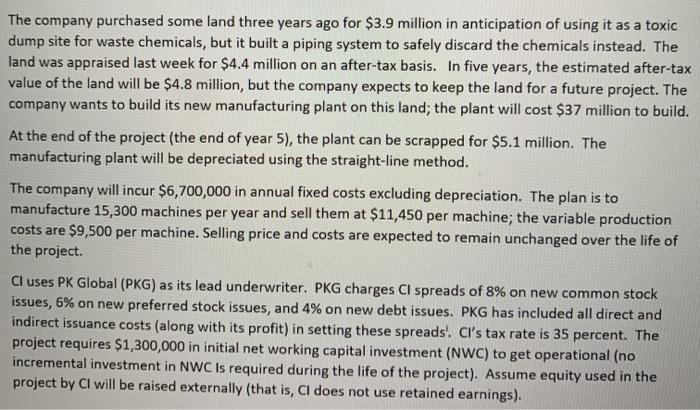

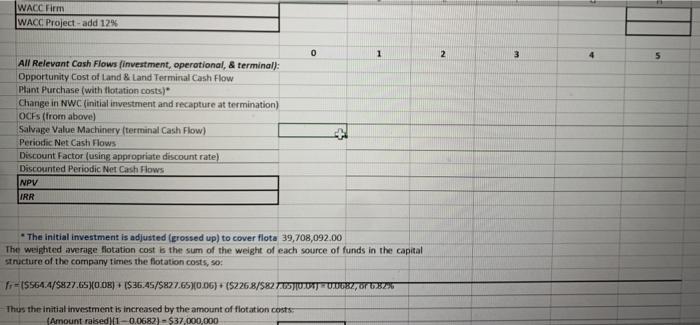

You and your team are financial consultants who have been hired by a large, publicly traded electronics firm, Clifford Industries (CI), a leader in its industry. The company is looking into manufacturing its new product, a machine using sophisticated state of the art technology developed by CI's R&D team, overseas. This overseas project will last five years. The management of CI hired you and your team to evaluate this project and to make a recommendation about whether the company should pursue it. Cl's management team needs your recommendation and the analysis used to arrive at it by no later than Sunday, April 18, 2021. The following is the current market data for Cl's outstanding securities: Debt: 210,000 (number of bonds) 6.4 percent coupon bonds outstanding, with 25 years to maturity, and are selling at 108 percent of par; the bonds have $1000 par value each and make semi-annual payments Common Stock: 8,300,000 shares are outstanding; they are selling for $68 per share; the company's stock has a beta=1.1 Preferred Stock: 450,000 shares of 4.5% preferred stock outstanding (par value per share = $100), currently trading at $81 per share Market Data: 7 percent expected market risk premium (MRP = expected return on the market portfolio -risk free rate of return); 3.5 percent risk-free rate The company purchased some land three years ago for $3.9 million in anticipation of using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. The land was appraised last week for $4.4 million on an after-tax basis. In five years, the estimated after-tax value of the land will be $4.8 million, but the company expects to keep the land for a future project. The company wants to build its new manufacturing plant on this land; the plant will cost $37 million to build. At the end of the project (the end of year 5), the plant can be scrapped for $5.1 million. The manufacturing plant will be depreciated using the straight-line method. The company will incur $6,700,000 in annual fixed costs excluding depreciation. The plan is to manufacture 15,300 machines per year and sell them at $11,450 per machine; the variable production costs are $9,500 per machine. Selling price and costs are expected to remain unchanged over the life of the project. Cl uses PK Global (PKG) as its lead underwriter. PKG charges Cl spreads of 8% on new common stock issues, 6% on new preferred stock issues, and 4% on new debt issues. PKG has included all direct and indirect issuance costs (along with its profit) in setting these spreads!. Cl's tax rate is 35 percent. The project requires $1,300,000 in initial net working capital investment (NWC) to get operational (no incremental investment in NWC is required during the life of the project). Assume equity used in the project by Ci will be raised externally (that is, Cl does not use retained earnings). WACC Firm WACC Project - add 12% 0 1 2 3 4 5 All Relevant Cash Flows (investment, operational, & terminal): Opportunity Cost of Land & Land Terminal Cash Flow Plant Purchase (with flotation costs)" Change in NWC (initial investment and recapture at termination) OCEs (from above) Salvage Value Machinery (terminal Cash Flow) Periodic Net Cash Flows Discount Factor (using appropriate discount rate) Discounted Periodic Net Cash Flows NPV IRR * The initial investment is adjusted (prossed up) to cover flota 39,708,092.00 The weighted average flotation cost is the sum of the weight of each source of funds in the capital structure of the company times the flotation costs, so: fr=15564.4/$27.65X0.05) ($36.45/5827.65*0.06) + (52268/58275UUTTUURZO 29 Thus the initial investment is increased by the amount of flotation costs Amount raised)(1-0.0682) - $37,000,000 You and your team are financial consultants who have been hired by a large, publicly traded electronics firm, Clifford Industries (CI), a leader in its industry. The company is looking into manufacturing its new product, a machine using sophisticated state of the art technology developed by CI's R&D team, overseas. This overseas project will last five years. The management of CI hired you and your team to evaluate this project and to make a recommendation about whether the company should pursue it. Cl's management team needs your recommendation and the analysis used to arrive at it by no later than Sunday, April 18, 2021. The following is the current market data for Cl's outstanding securities: Debt: 210,000 (number of bonds) 6.4 percent coupon bonds outstanding, with 25 years to maturity, and are selling at 108 percent of par; the bonds have $1000 par value each and make semi-annual payments Common Stock: 8,300,000 shares are outstanding; they are selling for $68 per share; the company's stock has a beta=1.1 Preferred Stock: 450,000 shares of 4.5% preferred stock outstanding (par value per share = $100), currently trading at $81 per share Market Data: 7 percent expected market risk premium (MRP = expected return on the market portfolio -risk free rate of return); 3.5 percent risk-free rate The company purchased some land three years ago for $3.9 million in anticipation of using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. The land was appraised last week for $4.4 million on an after-tax basis. In five years, the estimated after-tax value of the land will be $4.8 million, but the company expects to keep the land for a future project. The company wants to build its new manufacturing plant on this land; the plant will cost $37 million to build. At the end of the project (the end of year 5), the plant can be scrapped for $5.1 million. The manufacturing plant will be depreciated using the straight-line method. The company will incur $6,700,000 in annual fixed costs excluding depreciation. The plan is to manufacture 15,300 machines per year and sell them at $11,450 per machine; the variable production costs are $9,500 per machine. Selling price and costs are expected to remain unchanged over the life of the project. Cl uses PK Global (PKG) as its lead underwriter. PKG charges Cl spreads of 8% on new common stock issues, 6% on new preferred stock issues, and 4% on new debt issues. PKG has included all direct and indirect issuance costs (along with its profit) in setting these spreads!. Cl's tax rate is 35 percent. The project requires $1,300,000 in initial net working capital investment (NWC) to get operational (no incremental investment in NWC is required during the life of the project). Assume equity used in the project by Ci will be raised externally (that is, Cl does not use retained earnings). WACC Firm WACC Project - add 12% 0 1 2 3 4 5 All Relevant Cash Flows (investment, operational, & terminal): Opportunity Cost of Land & Land Terminal Cash Flow Plant Purchase (with flotation costs)" Change in NWC (initial investment and recapture at termination) OCEs (from above) Salvage Value Machinery (terminal Cash Flow) Periodic Net Cash Flows Discount Factor (using appropriate discount rate) Discounted Periodic Net Cash Flows NPV IRR * The initial investment is adjusted (prossed up) to cover flota 39,708,092.00 The weighted average flotation cost is the sum of the weight of each source of funds in the capital structure of the company times the flotation costs, so: fr=15564.4/$27.65X0.05) ($36.45/5827.65*0.06) + (52268/58275UUTTUURZO 29 Thus the initial investment is increased by the amount of flotation costs Amount raised)(1-0.0682) - $37,000,000